Compare Rajputana Invest with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 11 Cr (Micro Cap)

90.00

NA

0.00%

0.00

2.96%

2.66

Total Returns (Price + Dividend)

Rajputana Invest for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

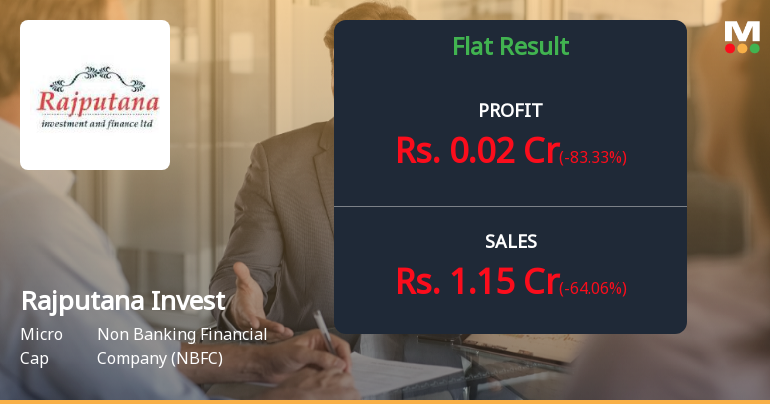

Are Rajputana Investment & Finance Ltd latest results good or bad?

Rajputana Investment & Finance Ltd's latest financial results indicate significant challenges in its operational performance. The company reported a substantial decline in net sales for the quarter ended December 2025, with a year-over-year decrease of 64.06%. This follows a previous quarter where the company had experienced an impressive growth rate of 310.26% in December 2024, highlighting a stark reversal in revenue generation. The standalone net profit also reflected a negative trend, with an 83.33% decline compared to the same quarter last year, further compounding concerns about the company's profitability. The operating profit margin, which was already negative at -4.35% in December 2024, worsened, indicating ongoing difficulties in achieving operational efficiency. Overall, Rajputana Investment's financial profile continues to show signs of distress, characterized by low profitability and erratic ...

Read full news article

Rajputana Investment & Finance Q3 FY26: Micro-Cap NBFC Struggles with Negligible Profits and Stagnant Operations

Rajputana Investment & Finance Ltd., a micro-cap non-banking financial company with a market capitalisation of just ₹11.00 crores, continues to grapple with minimal operational scale and negligible profitability as it navigates through FY2026. The company's stock price surged 8.43% on February 11, 2026, closing at ₹37.95, though this movement appears disconnected from fundamental performance given the company's extremely thin trading volumes and lack of institutional interest. With net sales of merely ₹1.84 crores in Q4 FY17 (the latest quarterly data available) and near-zero profit margins, Rajputana Investment represents a high-risk proposition for investors seeking exposure to the NBFC sector.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

12-Feb-2026 | Source : BSENewspaper Publication of unaudited financial result for the quarter ended 31.12.2025.

Unaudited Financial Result 31.12.2025

11-Feb-2026 | Source : BSEUnaudited financial result with LRR for the quarter ended 31.12.2025.

Board Meeting Outcome for Outcome Of Board Meeting

11-Feb-2026 | Source : BSEOutcome of Board Meeting held on 11.02.2026

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

Rajputana Investment & Finance Ltd has announced 9:5 bonus issue, ex-date: 28 Aug 17

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

B R D Developers And Builders Limited (60.77%)

Srinandan Agarwala (4.78%)

23.66%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is -64.06% vs 310.26% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -83.33% vs -29.41% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 253.49% vs -38.57% in Sep 2024

Growth in half year ended Sep 2025 is -73.68% vs -47.22% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 3.20% vs 86.24% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -77.42% vs -41.51% in Dec 2024