Compare Rajshree Sugars with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Operating profit has grown by an annual rate -249.91% of over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 13.31 times

- The company has been able to generate a Return on Equity (avg) of 3.09% signifying low profitability per unit of shareholders funds

The company has declared Negative results for the last 3 consecutive quarters

Risky - Negative Operating Profits

99.86% of Promoter Shares are Pledged

Below par performance in long term as well as near term

Stock DNA

Sugar

INR 95 Cr (Micro Cap)

NA (Loss Making)

20

0.00%

1.35

-7.03%

0.40

Total Returns (Price + Dividend)

Latest dividend: 1.0000 per share ex-dividend date: Aug-16-2017

Risk Adjusted Returns v/s

Returns Beta

News

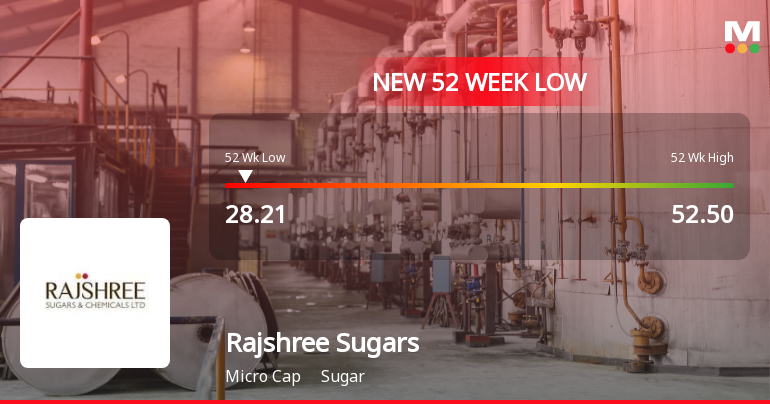

Rajshree Sugars & Chemicals Ltd Falls to 52-Week Low of Rs.28.21

Rajshree Sugars & Chemicals Ltd has touched a new 52-week low of Rs.28.21 today, marking a significant decline amid ongoing pressures in the sugar sector. The stock’s recent performance reflects a continuation of downward momentum, with the share price falling below all key moving averages and underperforming the broader market indices.

Read full news articleAre Rajshree Sugars & Chemicals Ltd latest results good or bad?

The latest financial results for Rajshree Sugars & Chemicals Ltd indicate a challenging operational environment. In Q3 FY26, the company reported a net loss of ₹9.19 crores, marking the third consecutive quarter of losses. Revenue for the quarter was ₹97.99 crores, reflecting a year-on-year growth of 20.69% from a weak base in Q3 FY24, but a sequential decline of 16.13% from the previous quarter, suggesting deteriorating business momentum. The operating margin stood at a negative 11.04%, indicating deep operational losses, while the return on equity was negative at -12.31%, highlighting significant shareholder wealth destruction. The company has accumulated losses of ₹28.92 crores over the nine-month period ending December 2025, which is a decline in profitability compared to the prior year. The financial trajectory shows a sharp contraction in revenue, down 43.86% from the peak achieved in Q4 FY25. This ...

Read full news article

Rajshree Sugars & Chemicals Ltd Falls to 52-Week Low of Rs.29

Rajshree Sugars & Chemicals Ltd has declined to a fresh 52-week low of Rs.29, marking a significant drop in its share price amid broader market fluctuations and company-specific pressures. This new low reflects a continuation of the stock’s downward trajectory over the past year, underperforming both its sector and the broader market indices.

Read full news article Announcements

Unaudited Financial Results For The Quarter And Nine Months Ended 31.12.2025

11-Feb-2026 | Source : BSEUn-audited financial results for the quarter and nine months ended 31.12.2025 along with the limited review report issued by the Auditors.

Board Meeting Outcome for Un-Audited Financial Results For The Quarter And Nine Months Ended 31.12.2025

11-Feb-2026 | Source : BSEUn-audited financial results for the quarter and nine months ended 31.12.2025 along with the limited review report issued by the Auditors.

Announcement under Regulation 30 (LODR)-Change in Management

11-Feb-2026 | Source : BSEAppointment Reappointment and Tenure Completion of the Internal Auditors

Corporate Actions

No Upcoming Board Meetings

Rajshree Sugars & Chemicals Ltd has declared 30% dividend, ex-date: 15 Sep 10

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

99.8636

Held by 4 Schemes (0.01%)

Held by 1 FIIs (0.0%)

Rajshree Pathy (34.21%)

Pethinaidu Surulinarayanasami (3.41%)

41.7%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -16.13% vs -17.10% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -27.99% vs 49.22% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -33.24% vs -12.43% in Sep 2024

Growth in half year ended Sep 2025 is -227.89% vs -35.16% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -23.87% vs -19.11% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -709.28% vs -84.80% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -15.95% vs -0.43% in Mar 2024

YoY Growth in year ended Mar 2025 is -41.21% vs 253.40% in Mar 2024