Compare ROHM Co., Ltd. with Similar Stocks

Dashboard

Poor Management Efficiency with a low ROE of 5.50%

- The company has been able to generate a Return on Equity (avg) of 5.50% signifying low profitability per unit of shareholders funds

Company has very low debt and has enough cash to service the debt requirements

Weak Long Term Fundamental Strength with an average Return on Equity (ROE) of 5.50%

The company has declared Negative results for the last 10 consecutive quarters

Risky - Negative Operating Profits

Majority shareholders : Non Institution

Market Beating Performance

Stock DNA

Other Electrical Equipment

JPY 1,010,813 Million (Mid Cap)

NA (Loss Making)

NA

0.00%

0.10

-0.98%

1.12

Total Returns (Price + Dividend)

ROHM Co., Ltd. for the last several years.

Risk Adjusted Returns v/s

News

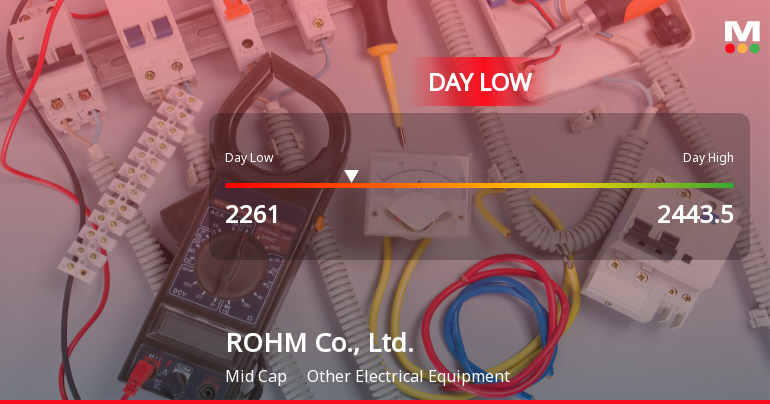

ROHM Co., Ltd. Hits Day Low Amid Price Pressure, Stock at JPY 2,261.00

ROHM Co., Ltd. saw a notable stock price decline amid a challenging market, contrasting with the Japan Nikkei 225's smaller drop. Despite a positive monthly performance, the company has struggled with negative net profits and a low return on equity, reflecting ongoing financial difficulties over the past ten quarters.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Strategic Entities

Held in 0 Schemes (0%)

Held by 1 Foreign Institutions (0.0%)

Quarterly Results Snapshot (Consolidated) - Jun'25 - QoQ

QoQ Growth in quarter ended Jun 2025 is 11.92% vs -7.81% in Mar 2025

QoQ Growth in quarter ended Jun 2025 is 105.91% vs -2,633.82% in Mar 2025

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -4.13% vs -7.90% in Mar 2024

YoY Growth in year ended Mar 2025 is -192.65% vs -32.83% in Mar 2024