Compare Royale Manor with Similar Stocks

Total Returns (Price + Dividend)

Royale Manor for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

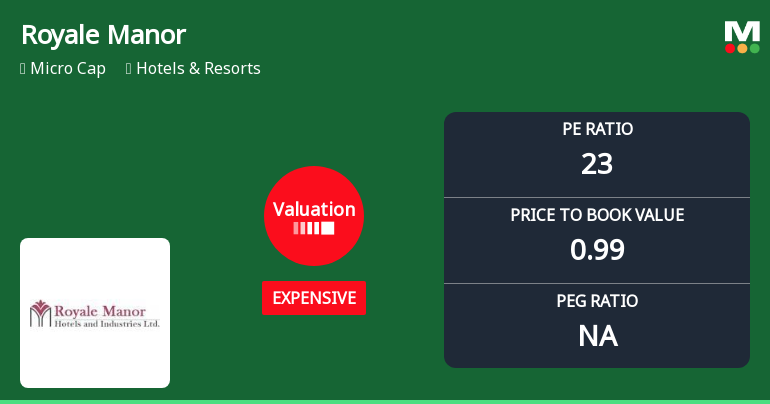

Royale Manor Hotels & Industries Ltd: Valuation Shifts Signal Price Attractiveness Concerns

Royale Manor Hotels & Industries Ltd has experienced a notable shift in its valuation parameters, moving from a fair to an expensive rating, which has impacted its price attractiveness. Despite a modest day gain of 2.43%, the company’s price-to-earnings (P/E) ratio and other valuation metrics suggest a deteriorating investment appeal relative to its historical averages and peer group within the Hotels & Resorts sector.

Read full news article

Royale Manor Hotels & Industries Ltd is Rated Strong Sell

Royale Manor Hotels & Industries Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 18 Aug 2025, reflecting a shift from the previous 'Sell' grade. However, the analysis and financial metrics discussed here represent the stock's current position as of 04 March 2026, providing investors with an up-to-date view of its fundamentals, returns, and technical outlook.

Read full news article

Royale Manor Hotels & Industries Ltd Falls to 52-Week Low of Rs.29.78

Royale Manor Hotels & Industries Ltd has touched a fresh 52-week low of Rs.29.78 today, marking a significant decline in its share price amid broader sectoral and market pressures. The stock’s performance continues to lag behind key benchmarks, reflecting ongoing concerns about its financial metrics and valuation.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

13-Feb-2026 | Source : BSEIntimation of Newspaper Publication of Unaudited Financial Results for the Third Quarter and Nine Months ended on December 31 2025

Board Meeting Outcome for Un-Audited Financial Results (UFR) For The Third Quarter And Nine Months Ended December 31 2025 Along With The Statutory Auditors Limited Review Report

12-Feb-2026 | Source : BSEUn-Audited Financial Results (UFR) for the Third quarter and Nine Months ended December 31 2025 along with the Statutory Auditors Limited Review Report

Un-Audited Financial Results (UFR) For The Third Quarter And Nine Months Ended December 31 2025 Along With The Statutory Auditors Limited Review Report

12-Feb-2026 | Source : BSEUn-Audited Financial Results for the Third quarter and Nine months ended December 31 2025 along with the Statutory Auditors Limited review report

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Shree Bala Finvest Private Limited. (15.31%)

Kailash Ramavatar Goenka (11.23%)

38.87%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 8.22% vs -17.39% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 18.18% vs -68.57% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -9.14% vs 6.06% in Sep 2024

Growth in half year ended Sep 2025 is -90.48% vs 6.78% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -2.42% vs -4.44% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -34.88% vs -52.04% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -0.98% vs 5.78% in Mar 2024

YoY Growth in year ended Mar 2025 is -26.54% vs 11.35% in Mar 2024