Compare Sainik Finance with Similar Stocks

Stock DNA

Cement & Cement Products

INR 46 Cr (Micro Cap)

8.00

23

0.00%

2.47

12.54%

0.95

Total Returns (Price + Dividend)

Sainik Finance for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Sainik Finance & Industries Ltd Upgraded to Sell on Technical Improvements

Sainik Finance & Industries Ltd has seen its investment rating upgraded from Strong Sell to Sell, reflecting a nuanced shift in its technical outlook despite persistent fundamental challenges. The change, effective from 12 Feb 2026, is primarily driven by improvements in technical indicators, while valuation and financial trends remain mixed. This article analyses the four key parameters—Quality, Valuation, Financial Trend, and Technicals—that influenced this rating revision.

Read full news articleAre Sainik Finance & Industries Ltd latest results good or bad?

The latest financial results for Sainik Finance & Industries Ltd reveal significant challenges, particularly in Q3 FY26. The company reported net sales of negative ₹1.29 crores, indicating that it is experiencing more sales returns, discounts, or reversals than actual sales. This marks a stark contrast to the positive net sales of ₹5.82 crores reported in Q2 FY26. The operational performance has deteriorated sharply, with a net loss of ₹8.87 crores in Q3 FY26, a drastic swing from a small profit of ₹0.18 crores in the previous quarter. The operating margin, although reported at 465.89%, is distorted due to the negative sales figure, rendering it largely meaningless. The company’s interest burden remains high at ₹4.40 crores, further straining its profitability amidst collapsing operational performance. The profit before tax also reflects this trend, showing a substantial loss of ₹10.23 crores compared to a...

Read full news article

Sainik Finance & Industries Q3 FY26: Micro-Cap Cement Player Struggles with Negative Revenue and Mounting Losses

Sainik Finance & Industries Ltd., a micro-cap player in the cement and cement products sector, reported deeply troubling quarterly results for Q3 FY26 (December 2025 quarter), with net sales of negative ₹1.29 crores and a consolidated net loss of ₹8.87 crores. The company, with a market capitalisation of just ₹42.00 crores, continues to struggle with operational viability, posting its second consecutive quarter of negative revenue. Following the results, the stock traded at ₹39.91 on February 12, 2026, down 37.64% from its 52-week high of ₹64.00, though it has gained 3.69% in the most recent trading session.

Read full news article Announcements

Submission Of Unaudited Financial Results Of The Company For The Quarter Ended 31.12.2025

12-Feb-2026 | Source : BSESubmission of Unaudited Financial Results of the Company for the quarter ended 31.12.2025

Board Meeting Outcome for Submission Of Unaudited Financial Results Of The Company For The Quarter Ended 31.12.2025

12-Feb-2026 | Source : BSESubmission of Unaudited Financial Results of the Company for the Quarter ended 31.12.2025

Board Meeting Intimation for Approval Of Unaudited Financial Results Of The Company For The Quarter Ended 31St December 2025

04-Feb-2026 | Source : BSESainik Finance & Industries Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 12/02/2026 inter alia to consider and approve Pursuant to Regulation 29 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 it is hereby informed that the Meeting of the Board of Directors of the Company will be held on Thursday 12th day of February 2026 inter-alia to consider & approve the Unaudited Financial Results of the Company for the quarter ended on 31st December 2025 to place before the Board the Limited Review Report given by the statutory auditors on the Unaudited Financial Results of the Company for the quarter ended on 31st December 2025 and to discuss & approve all other matters with the permission of the Chair as may be deemed fit for the business of the Company.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Kuldeep Singh Solanki (23.01%)

Manak Vanijya Private Limited (3.14%)

21.95%

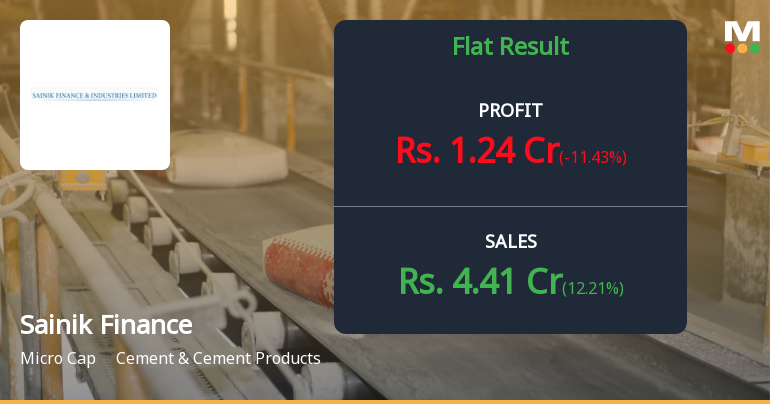

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 12.21% vs 6.22% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -11.43% vs 450.00% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 2.94% vs -4.71% in Sep 2024

Growth in half year ended Sep 2025 is -20.00% vs 9.95% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 6.13% vs -1.21% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -16.57% vs 131.79% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 9.31% vs -15.37% in Mar 2024

YoY Growth in year ended Mar 2025 is 209.00% vs 2,322.22% in Mar 2024