Compare Sawaca Enterpri. with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -0.89

- The company has reported losses. Due to this company has reported negative ROCE

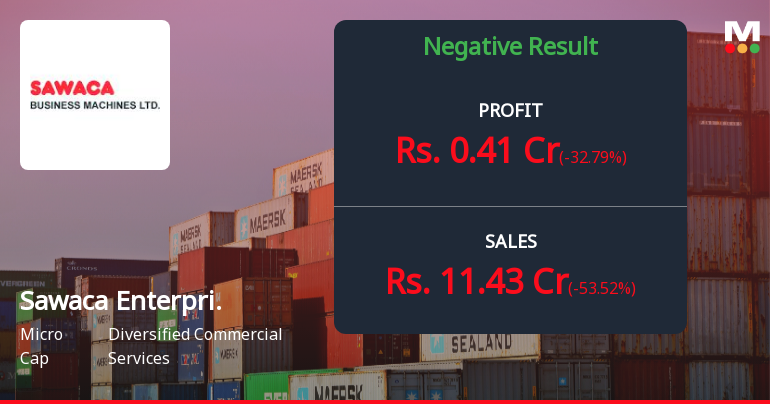

Negative results in Sep 25

Risky - Negative EBITDA

Stock DNA

Diversified Commercial Services

INR 20 Cr (Micro Cap)

NA (Loss Making)

26

0.00%

0.04

-1.55%

0.35

Total Returns (Price + Dividend)

Sawaca Enterpri. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Sawaca Enterprises Q3 FY26: Operational Struggles Persist Despite Sequential Profit Recovery

Sawaca Enterprises Ltd., a micro-cap diversified commercial services company with a market capitalisation of ₹20.00 crores, posted a net profit of ₹0.41 crores in Q3 FY26 (October-December 2025), marking a significant sequential recovery of 115.79% from Q2 FY26's ₹0.19 crores. However, the year-on-year performance tells a starkly different story, with profits plunging 32.79% from ₹0.61 crores in Q3 FY25. The stock has been under severe pressure, declining 5.71% to ₹0.33 on February 13, 2026, and trading near its 52-week low of ₹0.32.

Read full news articleAre Sawaca Enterprises Ltd latest results good or bad?

Sawaca Enterprises Ltd's latest financial results for Q2 FY26 reveal significant operational challenges. The company reported a net profit of ₹0.19 crores, which reflects a year-on-year decline of 62.00%. This is accompanied by a drastic drop in revenue, which fell to ₹5.70 crores, marking an 81.58% decrease compared to the same quarter last year. This revenue figure represents the lowest quarterly sales recorded in the available data series, indicating a severe breakdown in the company's business model. The operating margin for the quarter was reported at -13.86%, a deterioration from the previous quarter, highlighting ongoing operational losses. Furthermore, the company's return on equity averaged just 2.58%, suggesting a lack of value creation for shareholders. The financial performance is characterized by a heavy reliance on non-operating income, which accounted for a significant portion of profit befo...

Read full news article

Sawaca Enterprises Ltd Stock Falls to 52-Week Low of Rs.0.32

Shares of Sawaca Enterprises Ltd, a player in the Diversified Commercial Services sector, declined sharply to a new 52-week low of Rs.0.32 on 13 Feb 2026, marking a significant downturn in the stock’s performance over the past year.

Read full news article Announcements

Board Meeting Intimation for Meeting To Be Held On 13Th February 2026

04-Feb-2026 | Source : BSESawaca Enterprises Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 13/02/2026 inter alia to consider and approve 1. Unaudited Financial Results of the Company for the quarter and nine months ended on December 31 2025 together with Limited Review Report thereon by the statutory auditor of the Company as per Regulation 33 of the SEBI (LODR) Reg. 2015; 2. To consider and transit any other businesses if any which may be placed before the Board with the permission of the Chairman.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

06-Jan-2026 | Source : BSEThe Certificate Under Reg. 74(5) of SEBI (DP) Regulation 2018 is enclosed.

Closure of Trading Window

26-Dec-2025 | Source : BSEThe intimation for trading window closure is enclosed.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Sawaca Enterprises Ltd has announced 1:10 stock split, ex-date: 27 May 22

Sawaca Enterprises Ltd has announced 10:100 bonus issue, ex-date: 27 May 22

Sawaca Enterprises Ltd has announced 4:1 rights issue, ex-date: 07 Mar 24

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Jyotsana Satishkumar Shah (0.37%)

None

94.86%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is -53.52% vs 0.00% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -32.79% vs 510.00% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -70.48% vs 9,311.76% in Sep 2024

Growth in half year ended Sep 2025 is -69.23% vs 122.86% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -64.73% vs 14,133.33% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -53.24% vs 208.89% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 1,157.65% vs 144.03% in Mar 2024

YoY Growth in year ended Mar 2025 is -176.09% vs -16.36% in Mar 2024