Compare Seshasayee Paper with Similar Stocks

Dashboard

Poor long term growth as Operating profit has grown by an annual rate -25.78% of over the last 5 years

The company has declared Negative results for the last 10 consecutive quarters

With ROE of 4, it has a Very Expensive valuation with a 0.7 Price to Book Value

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Paper, Forest & Jute Products

INR 1,385 Cr (Small Cap)

17.00

17

0.00%

-0.23

4.04%

0.71

Total Returns (Price + Dividend)

Latest dividend: 5 per share ex-dividend date: May-22-2024

Risk Adjusted Returns v/s

Returns Beta

News

Seshasayee Paper & Boards Ltd: Valuation Shifts Signal Heightened Price Risk

Seshasayee Paper & Boards Ltd has seen a marked shift in its valuation parameters, moving from an expensive to a very expensive rating, raising concerns about its price attractiveness amid subdued financial returns and challenging sector dynamics.

Read full news articleAre Seshasayee Paper & Boards Ltd latest results good or bad?

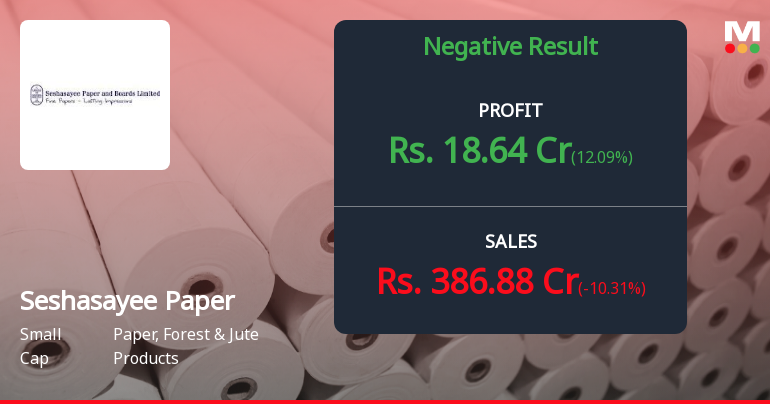

The latest financial results for Seshasayee Paper & Boards Ltd indicate a complex operational landscape characterized by both challenges and modest recoveries. For the quarter ending December 2025, the company reported consolidated net profit of ₹18.64 crores, reflecting a year-on-year growth of 12.09%, contrasting with a significant decline in the previous year. However, this recovery is set against a backdrop of declining net sales, which totaled ₹386.88 crores, down 10.31% from the same quarter last year. The operating margin, excluding other income, was reported at 6.39%, which shows a notable decline from the previous quarter, highlighting ongoing pressures from rising costs and competitive market conditions. The profit before tax also experienced a sequential decline of 15.60%, although it marked a year-on-year improvement from a low base in the prior year. The financial performance reveals that whi...

Read full news article

Seshasayee Paper Q3 FY26: Profit Rebound Masks Deeper Operational Concerns

Seshasayee Paper & Boards Ltd., a Tamil Nadu-based paper manufacturer with ₹1,353 crore market capitalisation, delivered a mixed Q3 FY26 performance that highlights the persistent challenges facing India's paper industry. The company reported consolidated net profit of ₹18.64 crores for the quarter ended December 2025, marking a 12.09% year-on-year increase but an alarming 16.82% sequential decline from Q2 FY26's ₹22.41 crores. The stock surged 5.17% to ₹226.00 following the results announcement, though it remains deeply entrenched in bearish territory, trading 30.20% below its 52-week high of ₹323.80.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Credit Rating

30-Jan-2026 | Source : BSEWe wish to inform you that ICRA Limited vide its letter dated 30.01.2026 has assigned the Credit Rating for the Credit Facilities availed by the Company from Bankers.

Board Meeting Intimation for To Consider And Approve The Standalone And Consolidated Un-Audited Financial Results Of The Company For The Quarter And Nine Months Ended December 31 2025.

14-Jan-2026 | Source : BSESeshasayee Paper And Boards Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 31/01/2026 inter alia to consider and approve the Standalone and Consolidated Un-audited Financial Results of the Company for the quarter and nine months ended December 31 2025 the Standalone and Consolidated Un-audited Financial Results of the Company for the quarter and nine months ended December 31 2025

Board Meeting Intimation for To Consider And Approve The Standalone And Consolidated Un-Audited Financial Results Of The Company For The Quarter And Nine Months Ended December 31 2025

14-Jan-2026 | Source : BSESeshasayee Paper And Boards Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 31/01/2026 inter alia to consider and approve the Standalone and Consolidated Un-audited Financial Results of the Company for the quarter and nine months ended December 31 2025

Corporate Actions

No Upcoming Board Meetings

Seshasayee Paper & Boards Ltd has declared 125% dividend, ex-date: 04 Jun 25

Seshasayee Paper & Boards Ltd has announced 2:10 stock split, ex-date: 19 Aug 19

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 1 Schemes (0.0%)

Held by 46 FIIs (12.99%)

Ponni Sugars (erode) Limited (14.02%)

The Tamil Nadu Industrial Investment Corpn Ltd (14.27%)

20.11%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is -10.31% vs -8.90% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 12.09% vs -75.89% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -10.84% vs 4.03% in Sep 2024

Growth in half year ended Sep 2025 is -42.20% vs -54.83% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is -10.66% vs -0.82% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -31.21% vs -61.62% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -2.63% vs -13.49% in Mar 2024

YoY Growth in year ended Mar 2025 is -59.68% vs -31.59% in Mar 2024