Compare Shopify, Inc. with Similar Stocks

Dashboard

Poor Management Efficiency with a low ROE of 5.87%

- The company has been able to generate a Return on Equity (avg) of 5.87% signifying low profitability per unit of shareholders funds

Company has a low Debt to Equity ratio (avg) at times

Healthy long term growth as Net Sales has grown by an annual rate of 37.88%

The company has declared Positive results for the last 6 consecutive quarters

With ROE of 14.55%, it has a fair valuation with a 14.87 Price to Book Value

High Institutional Holdings at 73.85%

Consistent Returns over the last 3 years

Stock DNA

Software Products

CAD 284,157 Million (Large Cap)

111.00

NA

0.00%

-0.43

14.47%

16.32

Total Returns (Price + Dividend)

Shopify, Inc. for the last several years.

Risk Adjusted Returns v/s

News

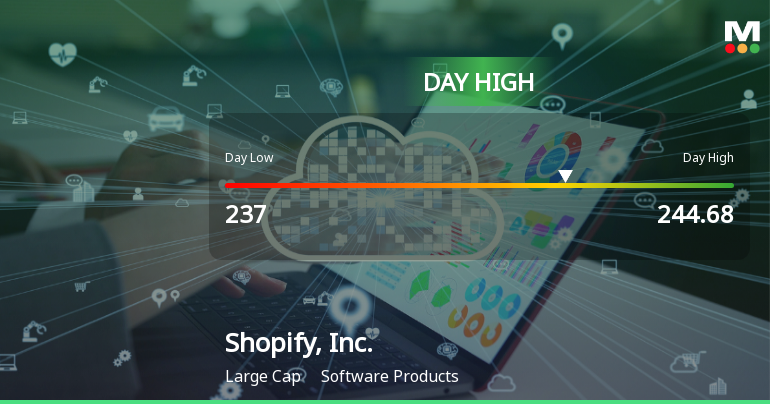

Shopify Stock Hits Day High with Strong 3.69% Intraday Surge

Shopify, Inc. has shown strong stock performance, gaining 3.69% on October 24, 2025, and achieving a 9.59% increase over the past week. The company has reported impressive annual growth of 118.97% and consistent positive results for six quarters, highlighting its significant role in the software industry.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Mar 2025

Shareholding Compare (%holding)

Foreign Institutions

Held in 57 Schemes (7.06%)

Held by 2193 Foreign Institutions (58.9%)

Quarterly Results Snapshot (Consolidated) - Jun'25 - YoY

YoY Growth in quarter ended Jun 2025 is 32.55% vs 22.99% in Jun 2024

YoY Growth in quarter ended Jun 2025 is 435.81% vs 113.29% in Jun 2024

Annual Results Snapshot (Consolidated) - Dec'24

YoY Growth in year ended Dec 2024 is 27.67% vs 30.71% in Dec 2023

YoY Growth in year ended Dec 2024 is 1,440.95% vs 103.98% in Dec 2023