Compare Shreyas Interm. with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Operating profit has grown by an annual rate 2.20% of over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of -1.00 times

Flat results in Dec 25

Risky - Negative EBITDA

Below par performance in long term as well as near term

Stock DNA

Commodity Chemicals

INR 52 Cr (Micro Cap)

NA (Loss Making)

21

0.00%

0.49

-8.03%

3.21

Total Returns (Price + Dividend)

Shreyas Interm. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

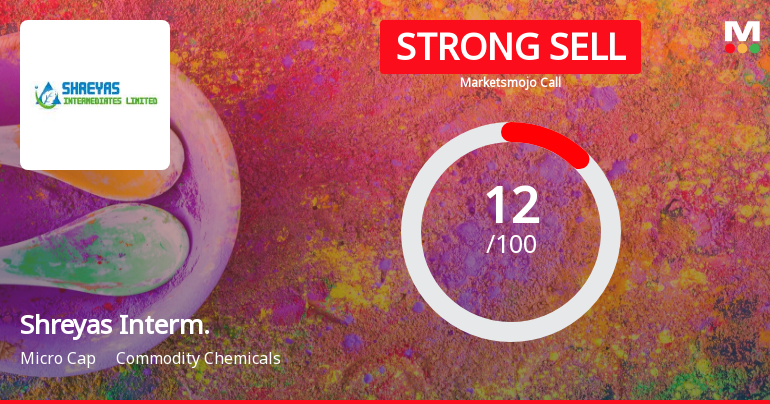

Shreyas Intermediates Ltd is Rated Strong Sell

Shreyas Intermediates Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 09 January 2026. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 05 March 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Shreyas Intermediates Ltd is Rated Strong Sell

Shreyas Intermediates Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 09 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 17 February 2026, providing investors with the most up-to-date view of the company’s performance and outlook.

Read full news articleAre Shreyas Intermediates Ltd latest results good or bad?

Shreyas Intermediates Ltd's latest financial results for Q3 FY26 reveal significant operational challenges, with net sales dropping to zero from ₹10.37 crores in the previous quarter, indicating a complete halt in revenue generation. This marks a 100% sequential decline and highlights the company's ongoing struggle to maintain consistent production and sales. The company reported a net loss of ₹0.39 crores in Q3 FY26, which is a deterioration from a loss of ₹0.24 crores in Q2 FY26, reflecting a 62.50% decline in profitability. The operating profit before depreciation and other income also shifted from a marginal profit of ₹0.07 crores in Q2 FY26 to an operating loss of ₹0.08 crores in Q3 FY26. The only income during this quarter came from other sources, amounting to ₹0.12 crores, which was insufficient to offset the operational losses. The data indicates that the company's operational paralysis is deepeni...

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

17-Feb-2026 | Source : BSENewspaper cuttings in connection with the UFR for the quarter ended 31.12.2025 in terms of Regulation 30 & 47 of SEBI (LODR) Regulations 2015.

Board Meeting Outcome for Board Meeting Outcome For Outcome Of Board Meeting For Meeting Held On 13.02.2026

13-Feb-2026 | Source : BSEIn terms of Regulations 30 and 33(3) of SEBI (LODR) Regulations 2015 this is to inform that the Meeting of the Board of Directors of the Company was held today on 13th February 2026 Friday at the registered office of the Company at 4:00 p.m. and concluded at around 05.00 p.m. The Board inter-alia considered and approved the following matters. 1.The Unaudited Standalone Financial Results for the quarter and nine months ended 31st December 2025 along with Limited Review Report thereon pursuant to Regulation 33 of SEBI (LODR) Regulations 2015. 2.Took note on Compliances made under SEBI (LODR) Regulation 2015 for the quarter and nine months ended 31st December 2025.

Standalone Unaudited Financial Result For Quarter And Nine Months Ended 31.12..2025

13-Feb-2026 | Source : BSEPursuant to provision of Regulation 30 raed with Regulation 33 of SEBI (LODR) Regulations 2015 it is hereby informed that the Board of Directors in its meeting held on 13.02.2026 at 04.00 p.m. and concluded at 05.00 p.m. inter-alia considered and approved the Standalone and approved the Standalone UFR for the quarter ended 31.12.2025 along with LRR thereon.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

10.028

Held by 3 Schemes (0.0%)

Held by 1 FIIs (8.39%)

Kesar Petroproducts Limited (27.59%)

Krish Pharma Speciality Private Limited- Escrow Demat Accoun (24.7%)

7.82%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -100.00% vs 64.08% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -62.50% vs 29.41% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 0.00% vs 0.00% in Sep 2024

Growth in half year ended Sep 2025 is 36.26% vs -8.33% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 0.00% vs 0.00% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 23.62% vs 11.81% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 0.00% vs 0.00% in Mar 2024

YoY Growth in year ended Mar 2025 is -0.63% vs -0.64% in Mar 2024