Compare Shukra Bullions with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -3.70% CAGR growth in Net Sales over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 0.11

- The company has been able to generate a Return on Equity (avg) of 5.43% signifying low profitability per unit of shareholders funds

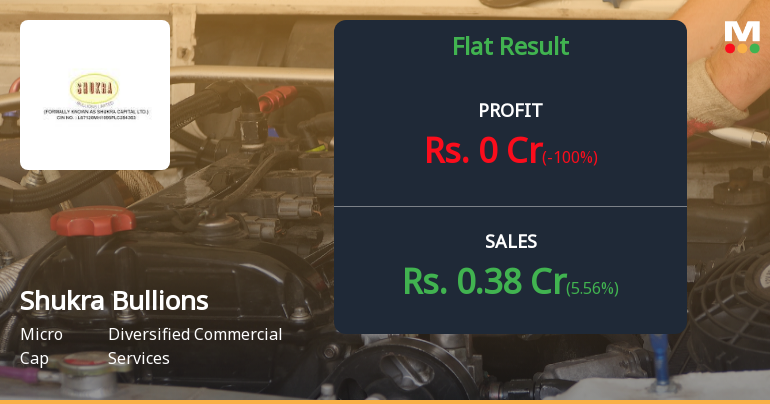

Flat results in Dec 25

With ROE of 1.6, it has a Very Expensive valuation with a 10.9 Price to Book Value

Stock DNA

Diversified Commercial Services

INR 22 Cr (Micro Cap)

687.00

54

0.00%

-0.08

1.58%

11.42

Total Returns (Price + Dividend)

Shukra Bullions for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Are Shukra Bullions Ltd latest results good or bad?

Shukra Bullions Ltd's latest financial results for Q3 FY26 present a complex picture of the company's operational performance. The company reported net sales of ₹0.38 crores, reflecting a quarter-on-quarter growth of 5.56% from ₹0.36 crores in Q2 FY26. This represents a significant year-on-year increase of 153.33% compared to ₹0.15 crores in Q3 FY25. However, despite this revenue growth, the company reported a net profit of ₹0.00 crores, indicating a complete erosion of profitability from ₹0.07 crores in the previous quarter. The operating margin collapsed from 19.44% in Q2 FY26 to 0.00% in Q3 FY26, highlighting severe challenges in cost management or pricing pressures that the company has not effectively addressed. The return on equity (ROE) for the latest period stands at 2.11%, which, while an improvement from the five-year average of 0.71%, remains inadequate for justifying equity investment. On a cum...

Read full news article

Shukra Bullions Q3 FY26: Marginal Profit Recovery Masks Fundamental Weakness

Shukra Bullions Limited, a micro-cap diversified commercial services company with a market capitalisation of ₹22.00 crores, reported breakeven financial performance for Q3 FY26 (October-December 2025), marking a technical recovery from the previous quarter's modest profit but revealing persistent operational challenges that continue to plague the Mumbai-based firm.

Read full news article Announcements

Non- Applicablity Of Statment Of Deviation And Variation Under Regulation 32(1) Of The SEBI (LODR)Regulation2015 For The Quarter Ended 31.12.2025

09-Feb-2026 | Source : BSEThe Statment of Deviation and Variation under Regulation 32 of SEBI (LODR) Regulation2015 is not applicable to the company.

Board Meeting Outcome for Board Meeting Outcome For Outcome Of Board Meeting

09-Feb-2026 | Source : BSEThe Board of Directors Meeting Held on 09.02.2026 has approved Unaudited Financial Results for the quarted ended 31.12.2025. As per Regulation 33 of Listing Regulation the Financial results and Limited review Report are enclosed herewith for your records.Meeting commenced at 03:00PM and conclued at 04:10 PM.Kindly take the same on your recoreds.

Financial Results For The Quarted Ended 31.12.2025

09-Feb-2026 | Source : BSEFinancial Results for the Quarted Ended 31.12.2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 1 Schemes (4.98%)

Held by 0 FIIs

Shukra Jewellery Limited (23.83%)

Gaurav Chandrakant Shah (17.95%)

37.79%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 5.56% vs 0.00% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -100.00% vs 275.00% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 12.50% vs 0.00% in Sep 2024

Growth in half year ended Sep 2025 is -62.50% vs 172.73% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 57.45% vs 0.00% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -57.14% vs 158.33% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 164.41% vs -3.28% in Mar 2024

YoY Growth in year ended Mar 2025 is 100.00% vs 100.00% in Mar 2024