Compare Sindhu Trade with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Operating profit has grown by an annual rate of -16.52%

With a fall in Net Profit of -37.17%, the company declared Very Negative results in Sep 25

With ROE of -2.3, it has a Very Expensive valuation with a 2 Price to Book Value

Despite the size of the company, domestic mutual funds hold only 0% of the company

Stock DNA

Diversified

INR 3,181 Cr (Small Cap)

NA (Loss Making)

66

0.00%

0.27

-2.25%

1.93

Total Returns (Price + Dividend)

Sindhu Trade for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

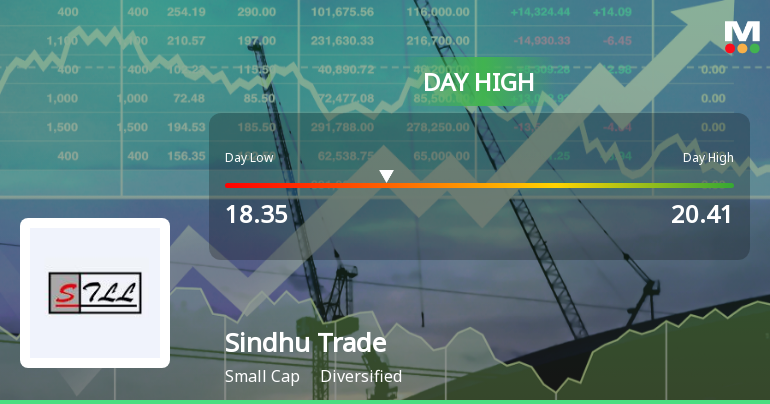

Sindhu Trade Links Ltd Hits Intraday High with 7.15% Surge on 29 Jan 2026

Sindhu Trade Links Ltd demonstrated robust intraday strength on 29 Jan 2026, surging to an intraday high of Rs 21.95, marking a 7.49% gain from the previous close. This performance outpaced its sector and broader market indices, reflecting notable trading momentum despite an initial gap down at the open.

Read full news article

Sindhu Trade Links Ltd Hits Intraday High with 7.93% Surge on 28 Jan 2026

Sindhu Trade Links Ltd recorded a robust intraday performance on 28 Jan 2026, surging to an intraday high of Rs 20.2, marking an 8.25% increase and closing the day with a notable 7.93% gain. This strong upward movement outpaced the Diversified sector and broader market indices, reflecting heightened trading activity and volatility.

Read full news article

Sindhu Trade Links Ltd is Rated Strong Sell

Sindhu Trade Links Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 17 Nov 2025, reflecting a significant reassessment of the stock’s outlook. However, the analysis and financial metrics discussed here represent the company’s current position as of 27 January 2026, providing investors with the latest insights into its performance and prospects.

Read full news article Announcements

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Sindhu Trade Links Ltd has announced 1:10 stock split, ex-date: 03 Feb 22

Sindhu Trade Links Ltd has announced 2:1 bonus issue, ex-date: 19 May 22

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

0.2761

Held by 1 Schemes (0.0%)

Held by 14 FIIs (3.18%)

Paramitra Holdings Private Limited (14.79%)

Fine Grow Buildcon Private Limited (2.25%)

13.88%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -24.80% vs -44.40% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -42.42% vs 131.86% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -68.64% vs 12.08% in Sep 2024

Growth in half year ended Sep 2025 is -84.25% vs 136.23% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 15.65% vs 55.89% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 4.53% vs 594.96% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 2.67% vs 43.29% in Mar 2024

YoY Growth in year ended Mar 2025 is 71.81% vs 2,133.62% in Mar 2024