Compare SMT Engineering with Similar Stocks

Dashboard

Poor Management Efficiency with a low ROCE of 2.40%

- The company has been able to generate a Return on Capital Employed (avg) of 2.40% signifying low profitability per unit of total capital (equity and debt)

Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 1.39

Healthy long term growth as Net Sales has grown by an annual rate of 200.71% and Operating profit at 103.44%

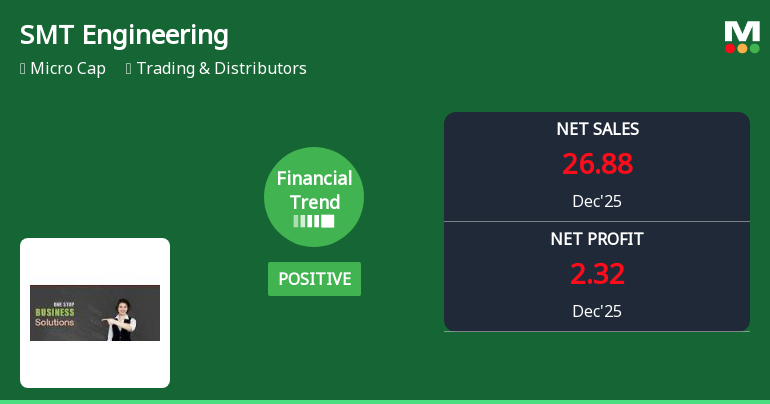

The company has declared Positive results for the last 4 consecutive quarters

With ROCE of 12, it has a Very Expensive valuation with a 4.8 Enterprise value to Capital Employed

Stock DNA

Trading & Distributors

INR 562 Cr (Micro Cap)

44.00

26

0.00%

0.84

15.19%

7.85

Total Returns (Price + Dividend)

SMT Engineering for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

SMT Engineering Ltd Reports Mixed Quarterly Results Amid Strong Revenue Growth

SMT Engineering Ltd, a player in the Trading & Distributors sector, has posted a mixed set of financial results for the quarter ended December 2025, reflecting a shift from its previously outstanding financial trend to a more positive yet cautious outlook. While revenue growth remains robust, margin pressures and rising interest costs have tempered net profitability, prompting a downgrade in its Mojo Grade from Buy to Hold.

Read full news article

SMT Engineering Ltd Hits New 52-Week High at Rs.346.8

SMT Engineering Ltd, a key player in the Trading & Distributors sector, reached a significant milestone today by hitting a new 52-week and all-time high of Rs.346.8. This achievement marks a continuation of the stock’s robust momentum, reflecting sustained gains over the past week and a remarkable performance relative to its sector and broader market indices.

Read full news article

SMT Engineering Ltd Stock Hits All-Time High at Rs.346.8

SMT Engineering Ltd, a key player in the Trading & Distributors sector, reached a new all-time high of Rs.346.8 on 13 Feb 2026, underscoring a sustained period of robust performance and market confidence. The stock’s impressive ascent reflects a significant achievement in its trading history, supported by strong momentum and consistent gains over recent weeks.

Read full news article Announcements

Board Meeting Outcome for Outcome Of Board Meeting Held On 12Th February 2026

12-Feb-2026 | Source : BSEOutcome under regulations 30 and 33 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015

Financial Results For The Quarter Ended December 31 2025

12-Feb-2026 | Source : BSEOutcome of Board Meeting on approval of Financial Results for the Quarter Ended December 31 2025

Announcement under Regulation 30 (LODR)-Allotment

10-Feb-2026 | Source : BSEBoard Meeting outcome for allottment of 1550000 Equity Shares on Preferential Basis

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Ajay Jaiswal (21.8%)

Jitendra Rasiklal Sanghavi (3.03%)

25.32%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -21.24% vs 25.80% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -63.46% vs 170.21% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 10,647.37% vs 5,600.00% in Sep 2024

Growth in half year ended Sep 2025 is 3,380.00% vs -90.27% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 9,276.60% vs 9,300.00% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 3,700.00% vs -90.24% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 721.09% vs 884.62% in Mar 2024

YoY Growth in year ended Mar 2025 is 247.02% vs -500.00% in Mar 2024