Compare SoftBank Group Corp. with Similar Stocks

Dashboard

- OPERATING CASH FLOW(Y) Highest at JPY 760,399 MM

- PRE-TAX PROFIT(Q) Highest at JPY 1,449,203 MM

- NET PROFIT(Q) Highest at JPY 1,037,075.64 MM

With ROCE of 2.80%, it has a attractive valuation with a 0.98 Enterprise value to Capital Employed

Majority shareholders : Non Institution

Market Beating Performance

Stock DNA

Telecom - Equipment & Accessories

JPY 22,904,511 Million (Large Cap)

5.00

NA

0.00%

0.91

25.81%

1.62

Total Returns (Price + Dividend)

SoftBank Group Corp. for the last several years.

Risk Adjusted Returns v/s

News

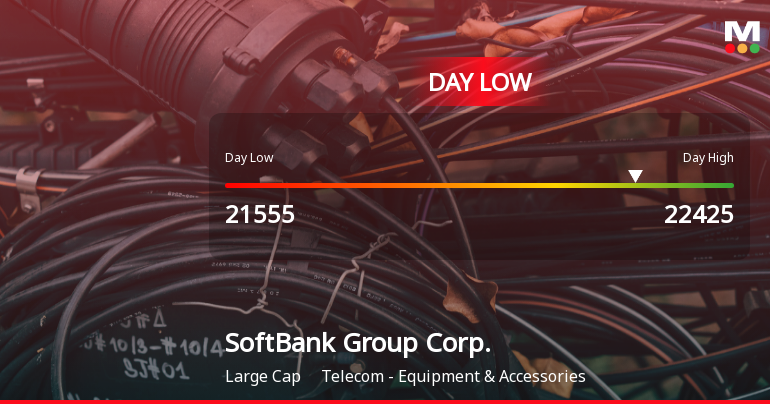

SoftBank Group Corp. Hits Day Low at JPY 21,555 Amid Price Pressure

SoftBank Group Corp. saw a significant decline in its stock today, contrasting with the broader market's performance. Despite recent downturns, the company has demonstrated strong long-term growth, with substantial increases over the past year and three years. Financial metrics reveal a solid market capitalization and operating cash flow, alongside notable debt levels.

Read full news article

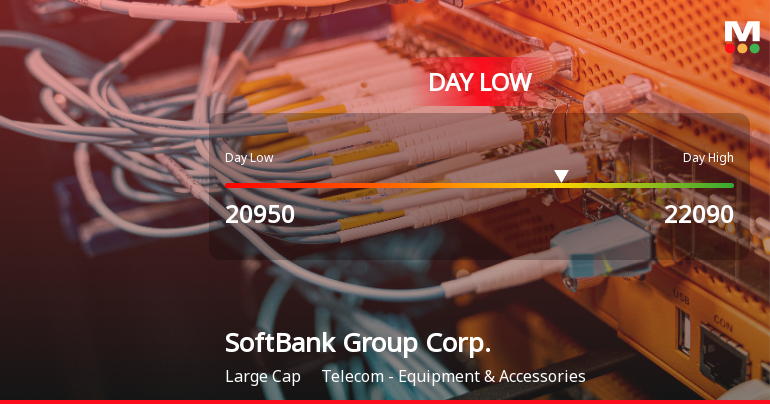

SoftBank Group Corp. Hits Day Low of JPY 20,950 Amid Price Pressure

SoftBank Group Corp. saw a notable decline in its stock today, contrasting with the Japan Nikkei 225's performance. Despite recent challenges, the company has delivered impressive annual returns and maintains a strong market capitalization, reflecting its significant position in the telecom equipment and accessories sector.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Foreign Institutions

Held in 0 Schemes (0%)

Held by 2 Foreign Institutions (0.0%)

Quarterly Results Snapshot (Consolidated) - Jun'25 - QoQ

QoQ Growth in quarter ended Jun 2025 is -6.22% vs 5.92% in Mar 2025

QoQ Growth in quarter ended Jun 2025 is 3.49% vs 392.73% in Mar 2025

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 7.21% vs 2.83% in Mar 2024

YoY Growth in year ended Mar 2025 is 750.08% vs 122.57% in Mar 2024