Compare Sri Adhik. Bros. with Similar Stocks

Dashboard

With HIgh Debt (Debt-Equity Ratio at 10.91 times)- the company has a Weak Long Term Fundamental Strength

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -6.09

- The company has reported losses. Due to this company has reported negative ROE

Flat results in Sep 25

With ROCE of 3.4, it has a Very Expensive valuation with a 409.8 Enterprise value to Capital Employed

Falling Participation by Institutional Investors

Stock DNA

Media & Entertainment

INR 5,045 Cr (Small Cap)

10,757.00

18

0.00%

10.91

47.00%

4,796.02

Total Returns (Price + Dividend)

Latest dividend: 0.6 per share ex-dividend date: Sep-15-2017

Risk Adjusted Returns v/s

Returns Beta

News

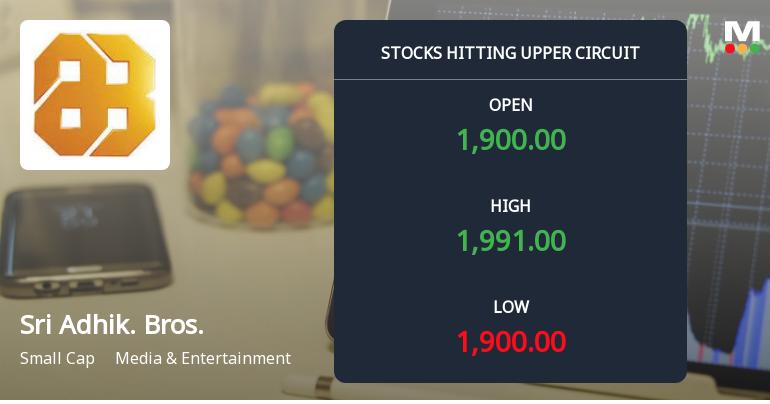

Sri Adhikari Brothers Television Network Ltd Hits Upper Circuit Amid Strong Buying Momentum

Sri Adhikari Brothers Television Network Ltd (SABTN) surged to hit its upper circuit limit on 6 Feb 2026, propelled by robust buying interest and sustained positive momentum. The stock closed at ₹1,985.3, marking a 5.0% gain on the day, significantly outperforming its sector and the broader market indices.

Read full news article

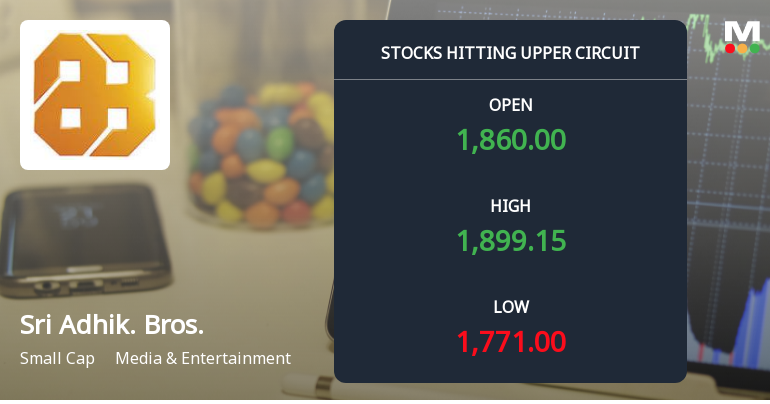

Sri Adhikari Brothers Television Network Ltd Hits Upper Circuit Amid Strong Buying Momentum

Sri Adhikari Brothers Television Network Ltd (SABTN) surged to hit its upper circuit limit on 5 Feb 2026, registering a maximum daily gain of 5.0% to close at ₹1,890.8. The stock demonstrated robust buying interest, outperforming its sector and broader market indices despite a relatively modest trading volume, signalling strong investor conviction amid a regulatory freeze on further price movement.

Read full news article

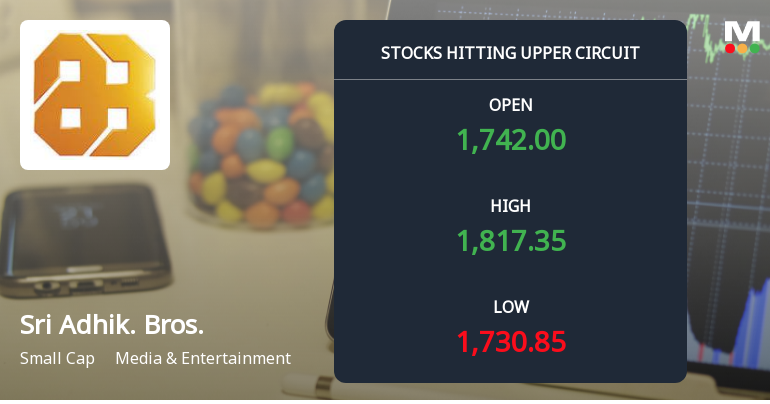

Sri Adhikari Brothers Television Network Ltd Hits Upper Circuit Amid Strong Buying Pressure

Sri Adhikari Brothers Television Network Ltd (SABTN) surged to hit its upper circuit limit on 4 Feb 2026, propelled by robust buying interest and sustained investor enthusiasm. The stock closed at ₹1,800, marking a maximum daily gain of 5.00%, significantly outperforming its sector and benchmark indices amid heightened market activity and regulatory trading restrictions.

Read full news article Announcements

Disclosure Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 - Execution Of Memorandum Of Understanding (Mou) With Mbuzz Technologies Middle East For AI & Hyperscale Data Centre Opportunities

03-Feb-2026 | Source : BSEMOU with MBuzz Technologies Middle East for AI & Hyperscale Data Centre Opportunities

Update On Website Of The Company

02-Feb-2026 | Source : BSEUpdate on website of the Company

Board Meeting Intimation for Approve The Un-Audited Financial Results (Standalone) Of The Company For The Quarter Ended December 31 2025

02-Feb-2026 | Source : BSESri Adhikari Brothers Television Network Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 11/02/2026 inter alia to consider and approve the Un-audited Financial Results (Standalone) of the Company for the quarter ended December 31 2025

Corporate Actions

11 Feb 2026

Sri Adhikari Brothers Television Network Ltd has declared 6% dividend, ex-date: 15 Sep 17

Sri Adhikari Brothers Television Network Ltd has announced 10:2 stock split, ex-date: 25 Oct 07

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

16.6664

Held by 2 Schemes (0.0%)

Held by 4 FIIs (0.71%)

Kurjibhai Premjibhai Rupareliya (59.12%)

Sera Investments & Finance India Ltd. (18.9%)

4.74%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 14,366.67% vs -97.84% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 866.85% vs -1,633.33% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 92.95% vs 0.00% in Sep 2024

Growth in half year ended Sep 2025 is 5,012.50% vs 102.25% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 1,375.00% vs 0.00% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -43.49% vs -0.44% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 121.38% vs 0.00% in Mar 2024

YoY Growth in year ended Mar 2025 is -5.22% vs 0.00% in Mar 2024