Compare Starlineps Enter with Similar Stocks

Stock DNA

Non - Ferrous Metals

INR 314 Cr (Micro Cap)

107.00

60

0.00%

-0.14

8.30%

8.90

Total Returns (Price + Dividend)

Latest dividend: 0 per share ex-dividend date: Feb-23-2022

Risk Adjusted Returns v/s

Returns Beta

News

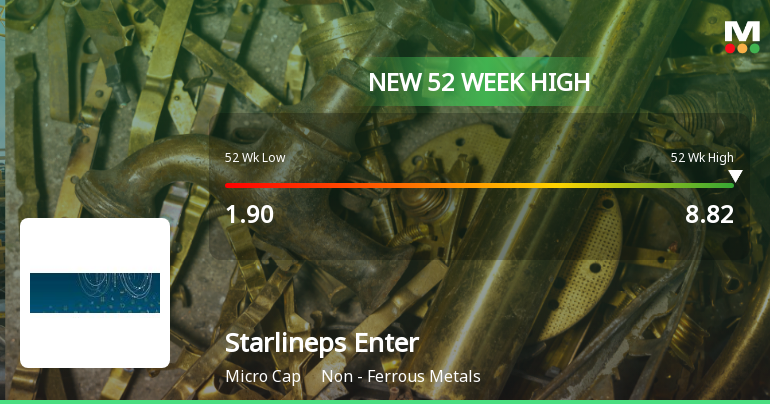

Starlineps Enterprises Ltd Hits New 52-Week High at Rs.8.82

Starlineps Enterprises Ltd, a key player in the Non-Ferrous Metals sector, reached a significant milestone today by hitting a new 52-week high of Rs.8.82. This achievement marks a continuation of the stock’s robust upward momentum, reflecting sustained gains over the past several weeks amid a broadly positive market environment.

Read full news article

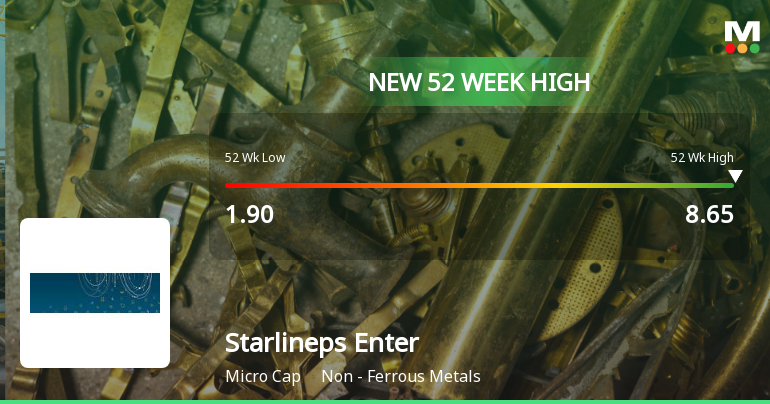

Starlineps Enterprises Ltd Hits New 52-Week High at Rs.8.65

Starlineps Enterprises Ltd, a player in the Non - Ferrous Metals sector, reached a significant milestone today by hitting a new 52-week high of Rs.8.65. This achievement marks a continuation of the stock’s strong upward momentum, reflecting sustained gains over the past three weeks amid a broadly positive market environment.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Acquisition

06-Feb-2026 | Source : BSEWe wish to inform that Management of the Company has decided to make an investment of Rs. 6 Crore by subscribing new equity shares of Stone Sapphire (India) Private Limited.

Board Meeting Intimation for Consider And Approve The Unaudited Standalone & Consolidated Financial Results Of The Company For The Quarter And Nine Month Ended 31St December 2025.

04-Feb-2026 | Source : BSEStarlineps Enterprises Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 12/02/2026 inter alia to consider and approve the Unaudited Standalone & Consolidated Financial Results of the Company for the quarter and nine month ended 31st December 2025.

Announcement under Regulation 30 (LODR)-Newspaper Publication

31-Jan-2026 | Source : BSEWe enclosed herewith copy of the newspaper publication of Notice of the Extra Ordinary General Meeting of the Company.

Corporate Actions

12 Feb 2026

Starlineps Enterprises Ltd has announced 1:5 stock split, ex-date: 25 Sep 24

Starlineps Enterprises Ltd has announced 1:5 bonus issue, ex-date: 25 Sep 24

Starlineps Enterprises Ltd has announced 2:5 rights issue, ex-date: 08 Sep 25

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Dhirajbhai Vaghjibhai Koradiya (23.3%)

Maheshji Chothaji Thakor (5.23%)

52.61%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 50.88% vs 169.35% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -51.69% vs 166.39% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 18.91% vs 223.50% in Sep 2024

Growth in half year ended Sep 2025 is -59.90% vs 296.75% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 226.95% vs 20.64% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 273.50% vs 354.55% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 146.47% vs 48.87% in Mar 2024

YoY Growth in year ended Mar 2025 is 267.60% vs 193.44% in Mar 2024