Compare Stelrad Group Plc with Similar Stocks

Dashboard

High Debt Company with a Debt to Equity ratio (avg) at times

- High Debt Company with a Debt to Equity ratio (avg) at times

- The company has been able to generate a Return on Equity (avg) of 23.23% signifying low profitability per unit of shareholders funds

Negative results in Jun 25

With ROE of 30.71%, it has a very expensive valuation with a 4.03 Price to Book Value

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Stelrad Group Plc for the last several years.

Risk Adjusted Returns v/s

News

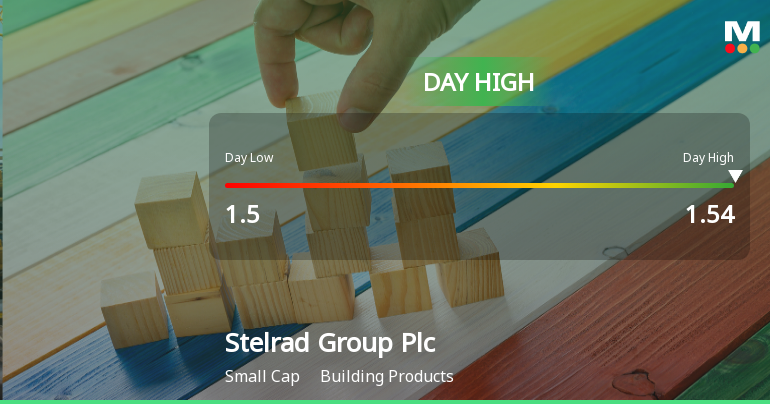

Stelrad Group Plc Hits Day High with Strong 7.32% Intraday Surge

Stelrad Group Plc, a small-cap in the building products sector, saw a significant rise today, contrasting with the modest gains of the FTSE 100. While the company has shown strong weekly and monthly performance, it has underperformed over the past year, facing challenges related to high debt and valuation metrics.

Read full news article

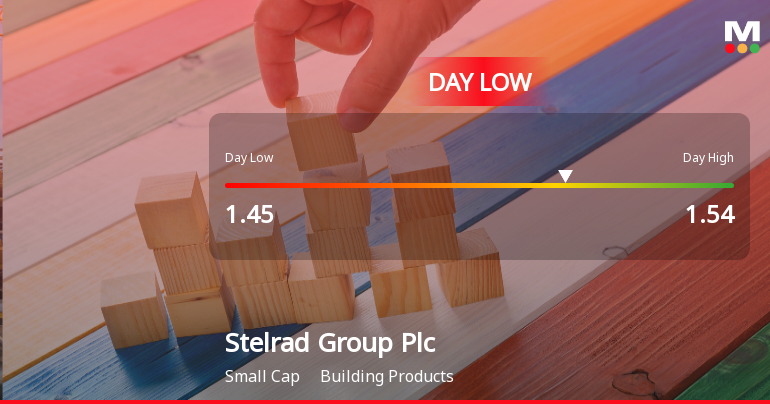

Stelrad Group Plc Hits Day Low of GBP 1.45 Amid Price Pressure

Stelrad Group Plc, a small-cap in the building products sector, faced notable volatility with a significant stock decline today. Over the past week and month, the company has underperformed compared to the FTSE 100, highlighting challenges in the market. Financial metrics indicate a high debt level and premium valuation.

Read full news article

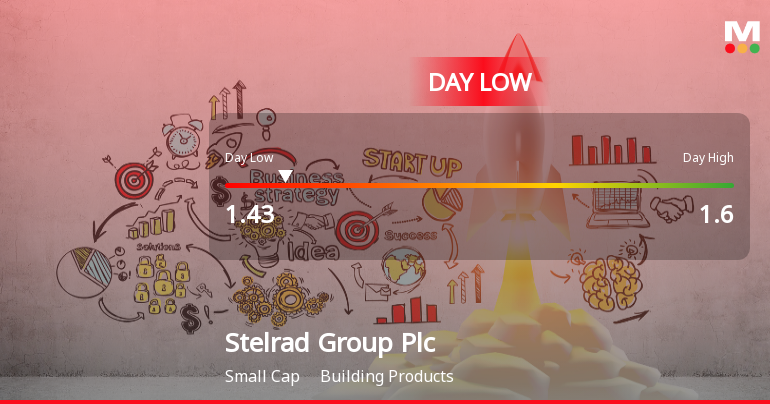

Stelrad Group Plc Hits Day Low of GBP 1.43 Amid Price Pressure

Stelrad Group Plc has faced notable volatility, with significant declines in its stock price over various timeframes, contrasting with the performance of the FTSE 100. The company reports a high debt-to-equity ratio and a recent drop in profits, complicating its financial outlook amid challenging market conditions.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot

Shareholding Compare (%holding)

Annual Results Snapshot (Consolidated) - Dec'23

YoY Growth in year ended Dec 2023 is -2.56% vs 16.16% in Dec 2022

YoY Growth in year ended Dec 2023 is 258.14% vs -70.75% in Dec 2022