Compare Sumeet Industrie with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 2.62%

- Poor long term growth as Operating profit has grown by an annual rate 16.49% of over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -21.48

With ROCE of 7.9, it has a Very Expensive valuation with a 5.6 Enterprise value to Capital Employed

Despite the size of the company, domestic mutual funds hold only 0% of the company

Stock DNA

Garments & Apparels

INR 1,462 Cr (Micro Cap)

77.00

20

0.00%

0.31

9.11%

6.82

Total Returns (Price + Dividend)

Latest dividend: 0.4 per share ex-dividend date: Sep-20-2012

Risk Adjusted Returns v/s

Returns Beta

News

When is the next results date for Sumeet Industries Ltd?

The next results date for Sumeet Industries Ltd is scheduled for 12 February 2026....

Read full news article

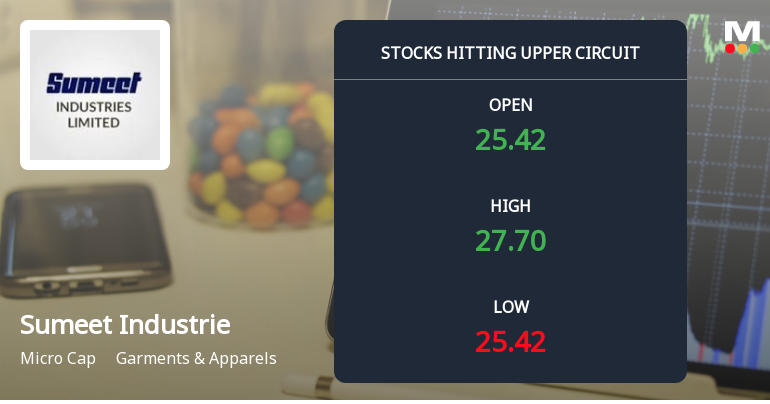

Sumeet Industries Ltd Surges to Upper Circuit on Strong Buying Momentum

Sumeet Industries Ltd, a micro-cap player in the Garments & Apparels sector, surged to hit its upper circuit price limit on 28 Jan 2026, registering a maximum daily gain of 4.98%. The stock closed at ₹27.61, reflecting robust buying interest and a notable outperformance relative to its sector and benchmark indices.

Read full news article

Sumeet Industries Ltd Surges to Upper Circuit Amid Strong Buying Pressure

Sumeet Industries Ltd, a micro-cap player in the Garments & Apparels sector, witnessed a robust rally on 22 Jan 2026, hitting its upper circuit limit with a 4.19% gain. The stock’s surge was driven by intense buying pressure amid a backdrop of falling investor participation and a regulatory freeze on further trades, signalling strong unfilled demand and renewed investor interest after a brief correction phase.

Read full news article Announcements

Board Meeting Intimation for Approval Of Un-Audited Financial Result For Quarter Ended On 31.12.2025 And Draft Letter Of Offer For Right Issue

30-Jan-2026 | Source : BSESumeet Industries Ltd-has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 12/02/2026 inter alia to consider and approve Approval of Un-audited Financial Result for Quarter ended on 31.12.2025 and Draft Letter of Offer for Right Issue

Receipt Of Approval For Reclassification Application Of Promoters Under Regulation 31A(9) Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 From BSE.

29-Jan-2026 | Source : BSEReceipt of approval for Reclassification of Erstwhile Promoters from Promoter group to Public

Receipt Of Approval For Reclassification Of Erstwhile Promoters Under Regulation 31A(9) Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015.

29-Jan-2026 | Source : BSEReceipt of approval for Re-classification of Erstwhile Promoter and Promoter Group from NSE

Corporate Actions

12 Feb 2026

Sumeet Industries Ltd has declared 4% dividend, ex-date: 20 Sep 12

Sumeet Industries Ltd has announced 2:10 stock split, ex-date: 03 Oct 25

Sumeet Industries Ltd has announced 1:4 bonus issue, ex-date: 02 Aug 18

Sumeet Industries Ltd has announced 3:7 rights issue, ex-date: 15 Dec 17

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 1 FIIs (0.0%)

Padmini Polytex Private Limited (33.49%)

Kapil Birla (1.9%)

8.99%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 8.38% vs 2.24% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 23.56% vs -88.21% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 1.81% vs 4.49% in Sep 2024

Growth in half year ended Sep 2025 is 230.37% vs 115.55% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 6.52% vs -10.32% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 300.12% vs 19.67% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 1.88% vs -4.67% in Mar 2024

YoY Growth in year ended Mar 2025 is 388.53% vs -0.49% in Mar 2024