Compare Sunil Healthcare with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 5.21%

- Poor long term growth as Net Sales has grown by an annual rate of 1.98% over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 5.63 times

Below par performance in long term as well as near term

Stock DNA

Pharmaceuticals & Biotechnology

INR 71 Cr (Micro Cap)

41.00

32

0.00%

0.84

2.55%

1.05

Total Returns (Price + Dividend)

Sunil Healthcare for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Are Sunil Healthcare Ltd latest results good or bad?

Sunil Healthcare Ltd has reported its financial results for Q2 FY26, showing a return to profitability with a net profit of ₹1.00 crore, which reflects a quarter-on-quarter increase of 9.89%. The company also achieved net sales of ₹23.52 crores, marking a year-on-year growth of 16.09% and a sequential increase of 3.89%. This marks the third consecutive quarter of revenue growth, indicating a potential stabilization in demand for its gelatin capsule products. The operating margin improved to 16.67%, up from 14.49% in the previous quarter, suggesting enhanced operational efficiency. However, the return on equity (ROE) remains low at 2.55%, indicating challenges in capital efficiency. The company is still facing elevated debt levels, with a debt-to-EBITDA ratio averaging 6.68 times, which raises concerns about its ability to manage financial obligations effectively. Despite these positive indicators, the com...

Read full news article

Sunil Healthcare Q2 FY26: Return to Profitability Masks Underlying Concerns

Sunil Healthcare Limited, India's second-largest manufacturer of empty hard gelatin capsule shells, reported a return to profitability in Q2 FY26 with net profit of ₹1.00 crores, marking a significant turnaround from losses in the previous year. However, the micro-cap pharmaceutical company's stock has struggled, trading at ₹69.61 and down 16.13% over the past year, reflecting investor scepticism about the sustainability of this recovery.

Read full news article

Sunil Healthcare Ltd is Rated Sell

Sunil Healthcare Ltd is rated Sell by MarketsMOJO, with this rating last updated on 14 Oct 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 30 January 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article Announcements

Unaudited Financial Results (Both Standalone And Consolidated) For The Quarter And Nine Months Ended 31.12.2025 Of FY 2025-26

06-Feb-2026 | Source : BSEBoard at its meeting held today interalia approved Unaudited Financial Results (both standalone and consolidated) for the quarter and nine months ended 31.12.2025 of FY 2025-26

Board Meeting Outcome for Outcome Of The Board Meeting Held On 06.02.2026

06-Feb-2026 | Source : BSEPursuant to Regulation 30 of the SEBI (LODR) Regulations 2015 we are pleased to inform that the Board of Directors of the Company at their Board Meeting held on Friday February 06 2026 interalia approved Un-Audited Financial Results (standalone and consolidated) for the 3rd quarter/ nine months ended December 31 2025 of the FY 2025-26.

Board Meeting Intimation for Intimation Of Board Meeting Pursuant To Regulation 29 Of SEBI (LODR) Regulations 2015

28-Jan-2026 | Source : BSESunil Healthcare Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 06/02/2026 inter alia to consider and approve Intimation of Board Meeting scheduled to be held on 6th February 2026 to consider interalia un-audited financial results (standalone and consolidated) for the 3rd quarter/9 months ended 31.12.2025 of FY 2025-26

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Anil Kumar Khaitan (57.95%)

Shailesh Kumar (6.18%)

17.85%

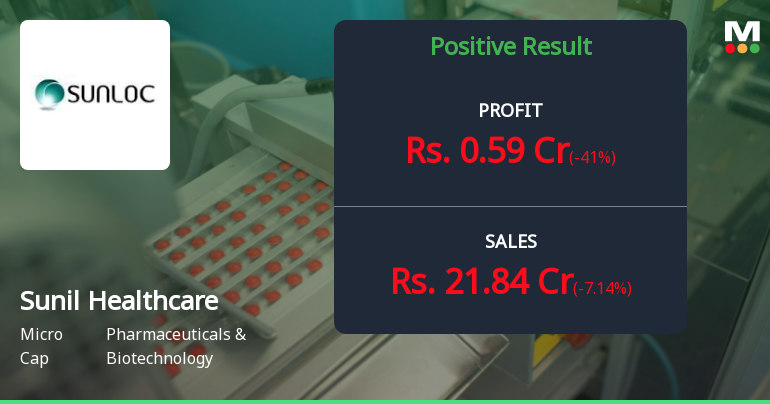

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -7.14% vs 3.89% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -41.00% vs 9.89% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 10.56% vs -9.65% in Sep 2024

Growth in half year ended Sep 2025 is 253.23% vs 28.74% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 9.31% vs -9.68% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 239.89% vs 8.25% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -7.51% vs -18.37% in Mar 2024

YoY Growth in year ended Mar 2025 is 20.67% vs -126.80% in Mar 2024