Compare Supreme Engg. with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -27.37% and Operating profit at -366.31% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 2.27 times

- The company has been able to generate a Return on Equity (avg) of 7.63% signifying low profitability per unit of shareholders funds

Risky - Negative EBITDA

Stock DNA

Iron & Steel Products

INR 24 Cr (Micro Cap)

NA (Loss Making)

27

0.00%

-1.02

10.54%

-0.27

Total Returns (Price + Dividend)

Supreme Engg. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

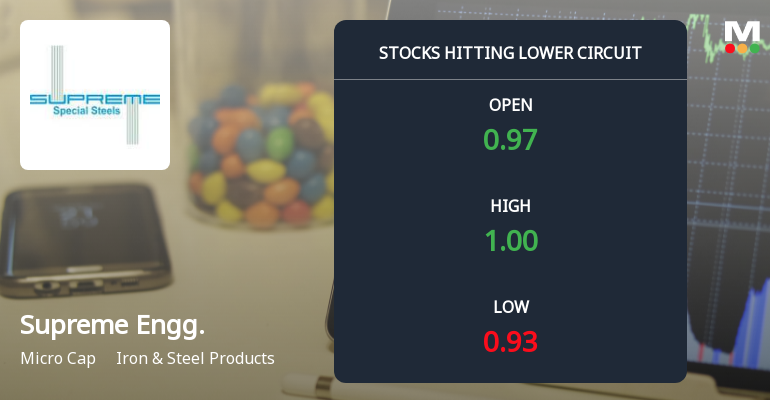

Supreme Engineering Ltd Hits Lower Circuit Amid Heavy Selling Pressure

Supreme Engineering Ltd, a micro-cap player in the Iron & Steel Products sector, witnessed intense selling pressure on 6 Mar 2026, culminating in the stock hitting its lower circuit limit. The share price declined sharply by 3.09%, closing at ₹1.00, reflecting a day marked by panic selling and unfilled supply, signalling investor concerns amid a challenging market environment.

Read full news article

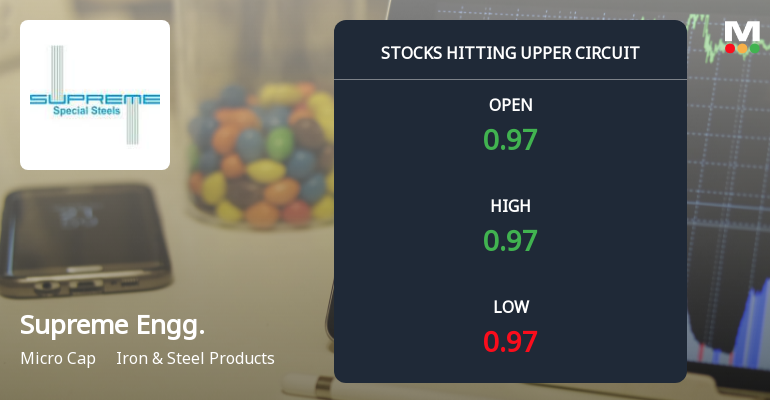

Supreme Engineering Ltd Surges to Upper Circuit on Robust Buying Pressure

Supreme Engineering Ltd, a micro-cap player in the Iron & Steel Products sector, surged to hit its upper circuit limit on 5 March 2026, registering a maximum daily gain of 4.3%. This sharp price movement was driven by robust buying interest, resulting in a regulatory freeze on further transactions and signalling unfilled demand among investors.

Read full news article

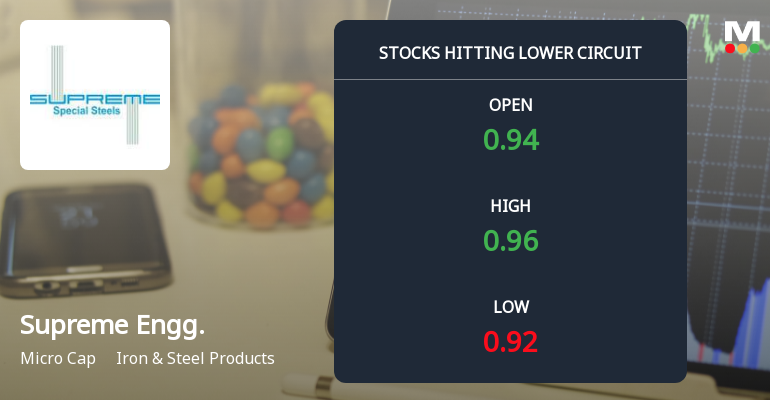

Supreme Engineering Ltd Hits Lower Circuit Amid Heavy Selling Pressure

Supreme Engineering Ltd, a micro-cap player in the Iron & Steel Products sector, witnessed a sharp decline on 4 Mar 2026, hitting its lower circuit limit of ₹0.92 per share. The stock endured intense selling pressure, culminating in a maximum daily loss of 4.17%, as panic selling gripped investors amid unfilled supply and weak technical indicators.

Read full news article Announcements

Supreme Engineering Limited - Investor Presentation

21-Nov-2019 | Source : NSESupreme Engineering Limited has informed the Exchange regarding Investor Presentation

Supreme Engineering Limited - Statement of deviation(s) or variation(s) under Reg. 32

15-Nov-2019 | Source : NSESupreme Engineering Limited has informed the Exchange regarding Statement of deviation(s) or variation(s) under Reg. 32 of SEBI (LODR) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Supreme Engineering Ltd has declared 5% dividend, ex-date: 18 Sep 19

Supreme Engineering Ltd has announced 1:10 stock split, ex-date: 03 Mar 22

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

18.4186

Held by 0 Schemes

Held by 0 FIIs

Sanjay Chowdhri (22.64%)

Anil Vishanji Dedhia (4%)

52.63%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 33.85% vs -38.81% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 110.77% vs -1,028.57% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 74.94% vs -50.03% in Sep 2024

Growth in half year ended Sep 2025 is 75.42% vs -76.12% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 63.62% vs -40.91% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 82.71% vs -44.61% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -32.99% vs 36.41% in Mar 2024

YoY Growth in year ended Mar 2025 is -6.97% vs 89.50% in Mar 2024