Compare Symbiox Investme with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 6 Cr (Micro Cap)

NA (Loss Making)

22

0.00%

0.00

-0.03%

0.20

Total Returns (Price + Dividend)

Symbiox Investme for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Are Symbiox Investment & Trading Co Ltd latest results good or bad?

Symbiox Investment & Trading Co Ltd's latest financial results indicate a challenging operational environment. For the fiscal year 2025, the company reported annual sales of ₹2.00 crores, reflecting a year-on-year decline of 33.3% from ₹3.00 crores in FY24. This trend of fluctuating sales has persisted over the past six years, with annual revenues remaining largely stagnant and no significant growth momentum observed. The company's profitability remains a critical concern, as it has reported zero net profit across recent fiscal years, indicating that operational costs fully consume revenues. The average return on equity (ROE) stands at a low 0.85%, which is significantly below industry standards, suggesting weak capital efficiency. Furthermore, the latest quarterly results for December 2025 show a substantial decline in net sales and net profit compared to the previous quarter, with net sales decreasing by...

Read full news article

Symbiox Investment & Trading Co Ltd: A Micro-Cap NBFC Struggling with Minimal Operations and Persistent Losses

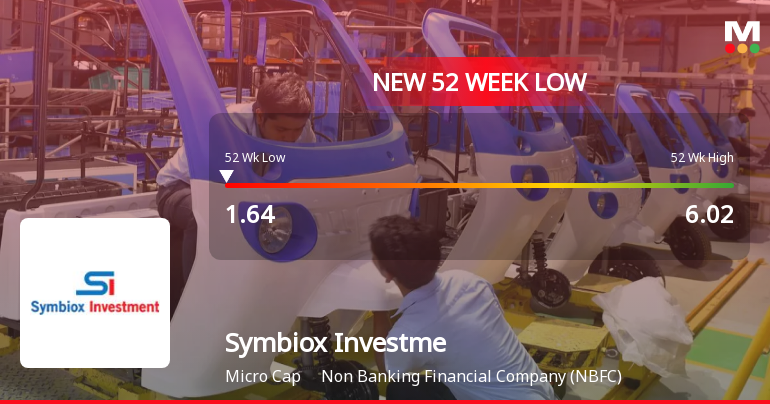

Symbiox Investment & Trading Company Limited, a micro-cap non-banking financial company with a market capitalisation of just ₹6.00 crores, continues to grapple with negligible operational scale and virtually non-existent profitability. The company's stock price closed at ₹2.03 on February 06, 2026, reflecting a 6.84% single-day gain but masking a deeper malaise—the stock has plummeted 52.79% over the past year and remains 66.56% below its three-year high, signalling profound investor disillusionment.

Read full news article Announcements

Announcement Under Reg 30.

07-Feb-2026 | Source : BSERevision of Outcome of Board Meeting held on 7th February2026.

Board Meeting Outcome for Outcome Of Board Meeting Held On 07Th February 2026.

07-Feb-2026 | Source : BSEOutcome of Board Meeting held on 07th February 2026.

Board Meeting Intimation for Meeting To Be Held On 7Th February 2026.

31-Jan-2026 | Source : BSESymbiox Investment & Trading Company Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 07/02/2026 inter alia to consider and approve Unaudited Financial Results for Quarter ended on 31st December 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Tyro Commercial Private Limited (3.2%)

Sushanta Naskar (2.06%)

81.6%

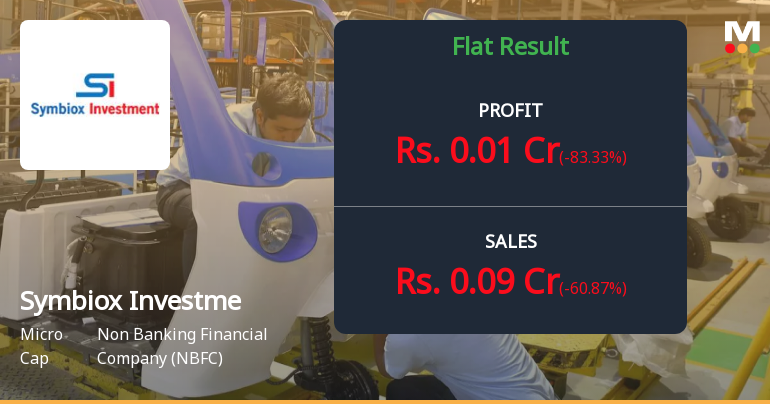

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -60.87% vs -50.00% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -83.33% vs -14.29% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -34.91% vs -59.07% in Sep 2024

Growth in half year ended Sep 2025 is -60.61% vs 37.50% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -48.34% vs -45.49% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -71.43% vs 113.04% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -29.23% vs -2.01% in Mar 2024

YoY Growth in year ended Mar 2025 is -9.52% vs 31.25% in Mar 2024