Compare Tahmar Enterp. with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Operating profit has grown by an annual rate -243.57% of over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -2.40

Flat results in Dec 25

Risky - Negative EBITDA

Below par performance in long term as well as near term

Stock DNA

Beverages

INR 100 Cr (Micro Cap)

NA (Loss Making)

8

0.00%

0.46

-4.67%

1.14

Total Returns (Price + Dividend)

Tahmar Enterp. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Tahmar Enterprises Ltd Falls to 52-Week Low of Rs.6 Amidst Weak Financial Metrics

Tahmar Enterprises Ltd, a player in the beverages sector, has reached a new 52-week low of Rs.6, marking a significant decline in its stock price amid a challenging market environment. This fresh low reflects ongoing pressures on the company’s financial performance and valuation metrics.

Read full news article

Tahmar Enterprises Ltd Stock Falls to 52-Week Low of Rs.6.41

Tahmar Enterprises Ltd, a player in the beverages sector, recorded a new 52-week low of Rs.6.41 today, marking a significant decline in its stock price amid broader market pressures and company-specific performance concerns.

Read full news article

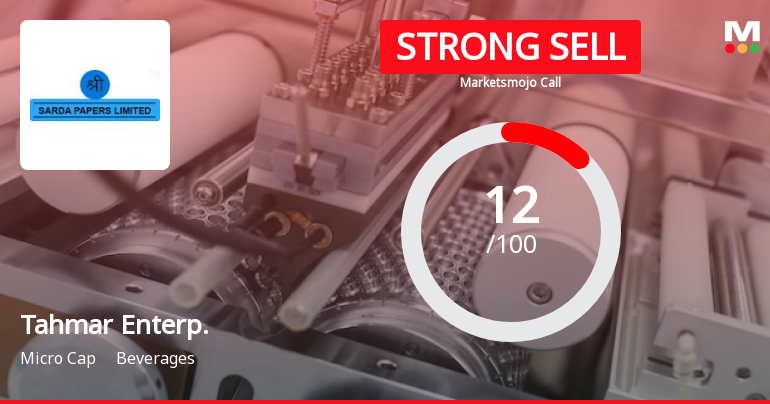

Tahmar Enterprises Ltd is Rated Strong Sell

Tahmar Enterprises Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 17 Feb 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 02 March 2026, providing investors with an up-to-date view of the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

16-Feb-2026 | Source : BSENewspaper Publication of Quarterly Financial result .

Board Meeting Outcome for Outcome Of Board Meeting

14-Feb-2026 | Source : BSEOutcome of Board meeting

Un-Audited Financial Results (Standalone) For The Quarter And Nine Months Ended December 31St 2025

14-Feb-2026 | Source : BSEUnaudited Financial Result for the Quarter ended 31/12/2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Sarita Alice Sequeira (45.95%)

Mastermind Jpin Sme Growth Fund (10.4%)

23.34%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is -98.97% vs -36.18% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -325.00% vs -84.00% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -12.74% vs 62.89% in Sep 2024

Growth in half year ended Sep 2025 is -159.46% vs 36.21% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -36.24% vs 14.47% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -187.14% vs 23.08% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -28.99% vs 112.89% in Mar 2024

YoY Growth in year ended Mar 2025 is -5,320.00% vs 0.00% in Mar 2024