Compare Tanaken KK with Similar Stocks

Dashboard

1

High Management Efficiency with a high ROE of 18.12%

2

Company has very low debt and has enough cash to service the debt requirements

3

Healthy long term growth as Net Sales has grown by an annual rate of 13.02%

4

Flat results in Jun 25

5

With ROE of 19.18%, it has a very attractive valuation with a 1.40 Price to Book Value

6

Underperformed the market in the last 1 year

Total Returns (Price + Dividend)

TimePeriod

Price Return

Dividend Return

Total Return

3 Months

4.32%

0%

4.32%

6 Months

0.68%

0%

0.68%

1 Year

13.56%

0%

13.56%

2 Years

31.2%

0%

31.2%

3 Years

-36.05%

0%

-36.05%

4 Years

-21.6%

0%

-21.6%

5 Years

-39.47%

0%

-39.47%

Tanaken KK for the last several years.

Risk Adjusted Returns v/s

News

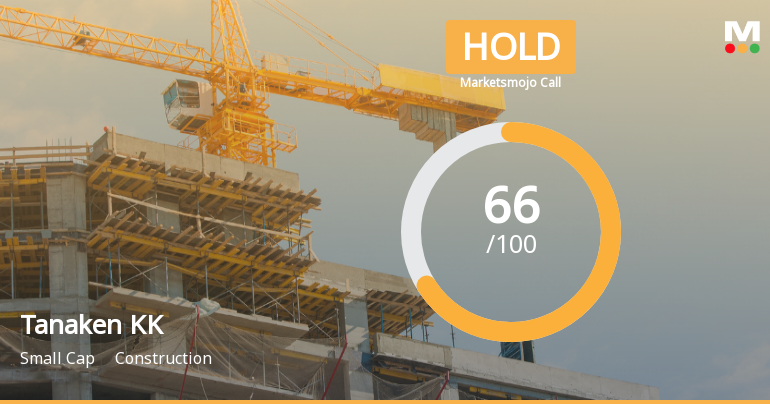

Tanaken KK Adjusts Evaluation to Hold Amid Mixed Technical and Fundamental Signals

Tanaken KK, a small-cap construction firm, has recently been assigned a Hold rating, reflecting a detailed evaluation of its technical indicators and financial metrics. The company shows solid long-term performance, despite facing recent challenges with rising raw material costs and declining profit margins.

Read full news article Announcements

No announcement available

Corporate Actions

No corporate action available

Quality key factors

Factor

Value

Sales Growth (5y)

13.02%

EBIT Growth (5y)

23.56%

EBIT to Interest (avg)

100.00

Debt to EBITDA (avg)

0

Net Debt to Equity (avg)

-0.50

Sales to Capital Employed (avg)

1.57

Tax Ratio

32.56%

Dividend Payout Ratio

30.35%

Pledged Shares

0

Institutional Holding

0

ROCE (avg)

46.31%

ROE (avg)

18.12%

Valuation key factors

Factor

Value

P/E Ratio

7

Industry P/E

Price to Book Value

1.40

EV to EBIT

3.24

EV to EBITDA

3.16

EV to Capital Employed

1.81

EV to Sales

0.60

PEG Ratio

NA

Dividend Yield

NA

ROCE (Latest)

55.83%

ROE (Latest)

19.18%

Technicals key factors

Indicator

Weekly

Monthly

MACD

Bullish

Mildly Bullish

RSI

No Signal

No Signal

Bollinger Bands

Bullish

Bullish

Moving Averages

Bullish (Daily)

KST

Bullish

Bullish

Dow Theory

Mildly Bullish

Mildly Bullish

OBV

Mildly Bullish

No Trend

Shareholding Snapshot

No data for shareholding present.

Shareholding Compare (%holding)

No data for shareholding present.

Quarterly Results Snapshot (Consolidated) - Jun'25 - QoQ

Jun'25

Mar'25

Change(%)

Net Sales

3,379.50

3,506.10

-3.61%

Operating Profit (PBDIT) excl Other Income

506.90

616.90

-17.83%

Interest

0.00

0.00

Exceptional Items

0.00

0.00

Consolidate Net Profit

311.60

496.10

-37.19%

Operating Profit Margin (Excl OI)

146.20%

172.10%

-2.59%

USD in Million.

Net Sales

QoQ Growth in quarter ended Jun 2025 is -3.61% vs 11.66% in Mar 2025

Consolidated Net Profit

QoQ Growth in quarter ended Jun 2025 is -37.19% vs 24.34% in Mar 2025

Annual Results Snapshot (Consolidated) - Mar'25

Mar'25

Mar'24

Change(%)

Net Sales

12,286.10

10,676.40

15.08%

Operating Profit (PBDIT) excl Other Income

2,379.70

1,660.80

43.29%

Interest

1.10

1.30

-15.38%

Exceptional Items

-1.20

0.00

Consolidate Net Profit

1,576.30

1,090.20

44.59%

Operating Profit Margin (Excl OI)

189.50%

150.60%

3.89%

USD in Million.

Net Sales

YoY Growth in year ended Mar 2025 is 15.08% vs -5.07% in Mar 2024

Consolidated Net Profit

YoY Growth in year ended Mar 2025 is 44.59% vs 0.31% in Mar 2024

About Tanaken KK

Tanaken KK

Construction

No Details Available.

Company Coordinates

No Company Details Available