Compare Thyrocare Tech. with Similar Stocks

Stock DNA

Healthcare Services

INR 7,040 Cr (Small Cap)

47.00

56

2.03%

-0.31

23.91%

13.68

Total Returns (Price + Dividend)

Latest dividend: 7 per share ex-dividend date: Oct-24-2025

Risk Adjusted Returns v/s

Returns Beta

News

Are Thyrocare Technologies Ltd latest results good or bad?

Thyrocare Technologies Ltd's latest financial results for Q3 FY26 indicate a notable performance, characterized by significant operational growth and efficiency. The company reported a net profit of ₹47.99 crores, reflecting a substantial year-on-year increase of 79.94%. This growth was supported by a revenue increase of 22.09%, reaching ₹216.53 crores, which also demonstrated robust sequential momentum with a 12.17% rise compared to the previous quarter. The operational metrics highlight an operating margin of 32.95%, which is a marked improvement from the prior year's 27.23%, showcasing effective cost management and enhanced asset utilization. Additionally, the profit after tax margin improved significantly to 22.08%, up from 14.90% in the same quarter last year, indicating better earnings quality driven by operational efficiency and a normalized tax rate. On a half-yearly basis, Thyrocare's consolidate...

Read full news article

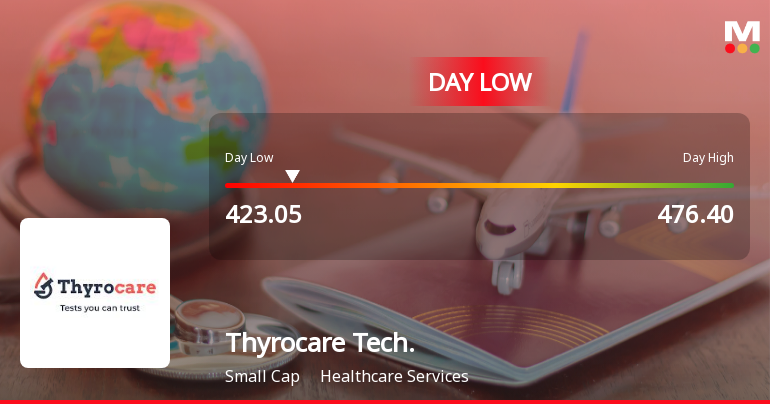

Thyrocare Technologies Ltd Hits Intraday Low Amid Price Pressure

Thyrocare Technologies Ltd experienced a notable decline today, hitting an intraday low of Rs 428, down 6.79% from its previous close, reflecting significant price pressure amid a broadly negative market environment.

Read full news article

Thyrocare Technologies Q3 FY26: Stellar Profit Surge Masks Premium Valuation Concerns

Thyrocare Technologies Ltd., the Mumbai-based diagnostic services provider, delivered a blockbuster performance in Q3 FY26, with consolidated net profit surging 79.94% year-on-year to ₹47.99 crores, substantially outpacing market expectations. The company's shares, trading at ₹459.00 with a market capitalisation of ₹7,197 crores, have gained 81.97% over the past year, dramatically outperforming both the Sensex and the broader healthcare services sector. However, this stellar operational momentum comes at a steep price, with the stock commanding a premium valuation of 57 times trailing earnings and trading at 13.68 times book value, raising questions about whether current levels adequately factor in future growth prospects.

Read full news article Announcements

Thyrocare Technologies Limited - Analysts/Institutional Investor Meet/Con. Call Updates

09-Dec-2019 | Source : NSEThyrocare Technologies Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates.

Thyrocare Technologies Limited - Analysts/Institutional Investor Meet/Con. Call Updates

03-Dec-2019 | Source : NSEThyrocare Technologies Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates

Thyrocare Technologies Limited - Other General Purpose

21-Nov-2019 | Source : NSEThyrocare Technologies Limited has informed the Exchange that Pursuant to Regulation 23 (9) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended the Company has submitted to the Exchange a copy of Disclosure of Related Party Transactions during the half year ended on September 30, 2019 on a consolidated basis.

Corporate Actions

No Upcoming Board Meetings

Thyrocare Technologies Ltd has declared 70% dividend, ex-date: 24 Oct 25

No Splits history available

Thyrocare Technologies Ltd has announced 2:1 bonus issue, ex-date: 28 Nov 25

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

100

Held by 15 Schemes (18.35%)

Held by 100 FIIs (5.32%)

Docon Technologies Private Limited (60.93%)

Nippon Life India Trustee Ltd-a/c Nippon India Small Cap Fund (6.01%)

10.79%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 17.85% vs 23.14% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 51.81% vs 24.50% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 22.52% vs 18.16% in Sep 2024

Growth in half year ended Sep 2025 is 70.97% vs 35.07% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 20.97% vs 19.77% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 65.73% vs 32.01% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 20.19% vs 8.58% in Mar 2024

YoY Growth in year ended Mar 2025 is 29.32% vs 9.72% in Mar 2024