Stock DNA

Commodity Chemicals

INR 615 Cr (Micro Cap)

20.00

41

0.00%

0.59

19.68%

3.73

Total Returns (Price + Dividend)

Tuticorin Alkali for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

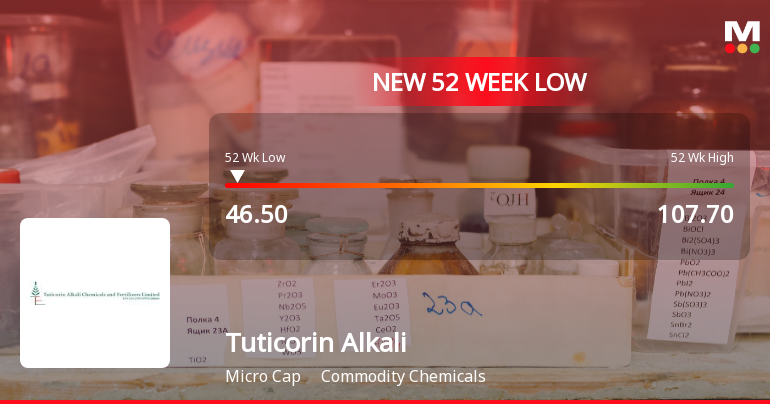

Tuticorin Alkali Chemicals & Fertilizers Stock Hits 52-Week Low at Rs.46.5

Tuticorin Alkali Chemicals & Fertilizers has reached a new 52-week low of Rs.46.5, marking a significant price level for the commodity chemicals company amid a challenging market environment. This fresh low comes after a sustained period of decline, reflecting a complex interplay of financial and market factors.

Read More

Tuticorin Alkali Sees Revision in Market Evaluation Amid Challenging Performance

Tuticorin Alkali has undergone a revision in its market evaluation, reflecting changes in its fundamental and technical outlook. Despite persistent challenges in financial trends and stock performance, certain valuation aspects have drawn renewed attention, prompting a shift in analytical perspective.

Read More

Tuticorin Alkali Chemicals & Fertilizers Falls to 52-Week Low of Rs.47.5

Tuticorin Alkali Chemicals & Fertilizers has reached a new 52-week low of Rs.47.5, marking a significant decline in its stock price amid a broader market environment where the Sensex continues to advance towards its own yearly highs.

Read More Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

13-Nov-2025 | Source : BSENewspaper publication - Q-II unaudited results

Financial Results For The Half Year Ended 30Th September2025

12-Nov-2025 | Source : BSEAdoption of unaudited financial results for the half year and quarter ended 30th September 2025

Board Meeting Outcome for Adoption Of Unaudited Financial Results For The Half Year Ended 30.09.2025

12-Nov-2025 | Source : BSEOutcome of the Board Meeting held on 12.11.2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 5 Schemes (0.0%)

Held by 3 FIIs (1.37%)

Ami Holdings Private Limited (46.61%)

Mercantile Ventures Limited (11.3%)

6.63%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 5.04% vs -5.87% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -3.24% vs 36.46% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 6.41% vs -22.03% in Sep 2024

Growth in half year ended Sep 2025 is -61.17% vs 30.06% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is -13.52% vs -30.29% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -4.68% vs 9.41% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -3.39% vs -37.54% in Mar 2024

YoY Growth in year ended Mar 2025 is -10.66% vs -31.20% in Mar 2024