Compare unerry, Inc. with Similar Stocks

Dashboard

Poor Management Efficiency with a low ROE of 6.67%

- The company has been able to generate a Return on Equity (avg) of 6.67% signifying low profitability per unit of shareholders funds

Company has a low Debt to Equity ratio (avg) at times

Healthy long term growth as Net Sales has grown by an annual rate of 48.90% and Operating profit at 35.13%

The company has declared Positive results for the last 6 consecutive quarters

With ROE of 7.32%, it has a attractive valuation with a 4.90 Price to Book Value

Underperformed the market in the last 1 year

Stock DNA

Computers - Software & Consulting

JPY 10,843 Million (Small Cap)

67.00

NA

0.00%

-0.88

14.90%

5.39

Total Returns (Price + Dividend)

unerry, Inc. for the last several years.

Risk Adjusted Returns v/s

News

Unerry, Inc. Adjusts Evaluation to Hold Amid Mixed Technical Indicators and Strong Growth

Unerry, Inc. has recently transitioned from an unassigned status to a Hold following a comprehensive evaluation of its market position and technical indicators. The company has shown strong long-term growth, with impressive profit increases and a solid financial foundation, including a low debt-to-equity ratio and consistent positive quarterly results.

Read full news article

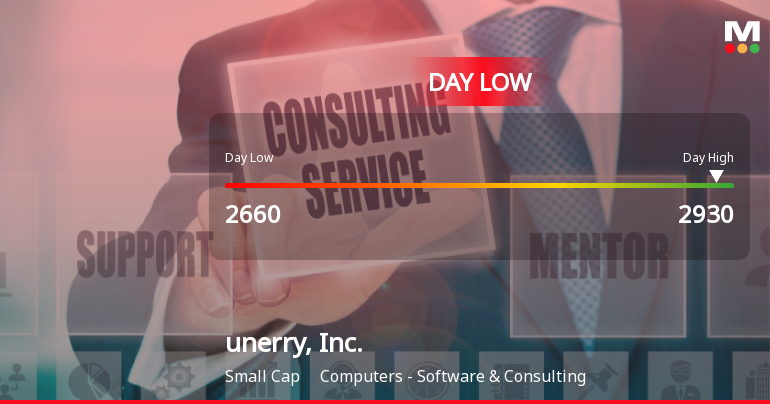

Unerry, Inc. Hits Day Low of JPY 2,660 Amid Price Pressure

Unerry, Inc., a small-cap company in the Computers - Software & Consulting sector, saw its stock decline significantly today, contrasting with the Japan Nikkei 225. Despite recent short-term challenges, the company has strong long-term fundamentals, including impressive profit growth and a solid return on equity.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot

Shareholding Compare (%holding)

Quarterly Results Snapshot (Consolidated) - Jun'25 - YoY

YoY Growth in quarter ended Jun 2025 is 30.91% vs 56.09% in Jun 2024

YoY Growth in quarter ended Jun 2025 is 407.52% vs -211.04% in Jun 2024

Annual Results Snapshot (Consolidated) - Jun'25

YoY Growth in year ended Jun 2025 is 31.44% vs 36.51% in Jun 2024

YoY Growth in year ended Jun 2025 is 385.94% vs 626.60% in Jun 2024