Compare Unick Fix-A-Form with Similar Stocks

Total Returns (Price + Dividend)

Unick Fix-A-Form for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

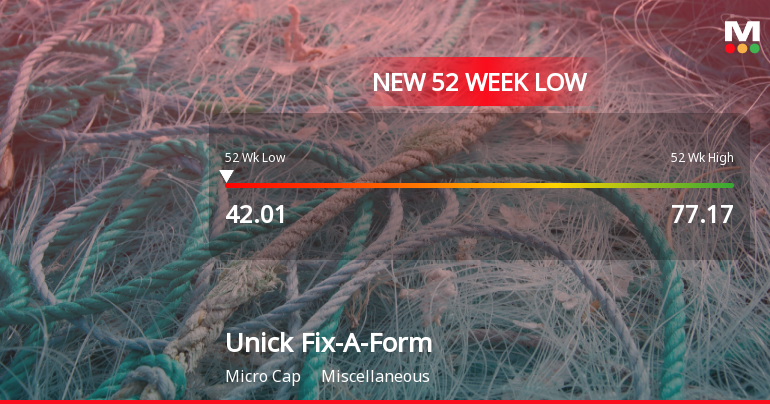

Unick Fix-A-Form And Printers Ltd Falls to 52-Week Low of Rs 42.01

Unick Fix-A-Form And Printers Ltd has reached a new 52-week low of Rs.42.01 today, marking a significant decline in its share price amid a sustained period of underperformance relative to its sector and broader market indices.

Read full news articleAre Unick Fix-A-Form And Printers Ltd latest results good or bad?

Unick Fix-A-Form And Printers Ltd's latest financial results for Q3 FY26 reflect significant operational challenges. The company reported a net loss of ₹0.56 crores, marking a stark decline from a profit of ₹0.50 crores in the previous quarter. This represents a notable shift in profitability, as the company had previously maintained a positive net profit in the first half of the fiscal year. Revenue for the quarter was ₹12.40 crores, which is a 16.10% decrease from ₹14.78 crores in Q2 FY26. This sequential decline indicates a concerning trend in sales momentum, despite a marginal year-on-year decline of just 0.16%. The operating margin also experienced substantial compression, falling to 4.76% from 11.91% in the previous quarter, reflecting severe pressure on profitability due to rising operational costs that the company struggled to pass on to customers. The financial performance indicates that Unick Fi...

Read full news articleAre Unick Fix-A-Form And Printers Ltd latest results good or bad?

Unick Fix-A-Form And Printers Ltd's latest financial results indicate significant operational challenges. In the quarter ending September 2025, the company reported net sales of ₹14.78 crores, reflecting a sequential decline of 13.82% from ₹17.15 crores in the previous quarter. This marked the weakest quarterly revenue performance since December 2024. The operating profit margins also experienced notable compression, falling sharply to 11.91% from 18.19% in the prior quarter, suggesting difficulties in maintaining profitability amidst rising costs or operational inefficiencies. Year-on-year comparisons revealed a slight revenue growth of 0.68%, but net profit decreased by 19.35% from ₹0.62 crores in Q2 FY25 to ₹0.50 crores in Q2 FY26. The company's operating profit, excluding other income, dropped significantly to ₹1.76 crores from ₹3.12 crores sequentially, indicating a decline of 43.59%. This trend of ma...

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

03-Feb-2026 | Source : BSENewspaper Publication Unaudited Result 31st December 2025

Board Meeting Outcome for Outcome Of Board Meeting

31-Jan-2026 | Source : BSEOutcome of Board Meeting

Unaudited Financial Result For Quarter Ended 31St December 2025

31-Jan-2026 | Source : BSEUnaudited Financial Result for quarter ended 31st December 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Kamini Bhupen Vasa (27.16%)

Sushila Naileshkumar Shah (1.54%)

27.14%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -16.10% vs -13.82% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -212.00% vs -55.36% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 5.52% vs 7.30% in Sep 2024

Growth in half year ended Sep 2025 is -6.86% vs 86.17% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 3.87% vs 3.84% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -31.85% vs 93.83% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 0.18% vs -15.55% in Mar 2024

YoY Growth in year ended Mar 2025 is 33.16% vs -12.50% in Mar 2024