Compare Uravi Defence & with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -12.62% CAGR growth in Operating Profits over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.22 times

- The company has been able to generate a Return on Equity (avg) of 4.60% signifying low profitability per unit of shareholders funds

Flat results in Sep 25

With ROCE of 3.6, it has a Very Expensive valuation with a 3.5 Enterprise value to Capital Employed

Reducing Promoter Confidence

Below par performance in long term as well as near term

Stock DNA

Auto Components & Equipments

INR 230 Cr (Micro Cap)

137.00

38

0.00%

0.45

3.34%

4.58

Total Returns (Price + Dividend)

Uravi Defence & for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

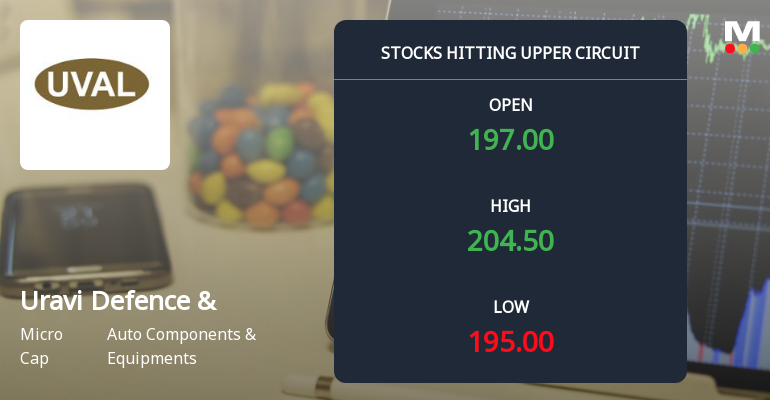

Uravi Defence & Technology Ltd Hits Upper Circuit Amid Strong Buying Pressure

Uravi Defence & Technology Ltd, a micro-cap player in the Auto Components & Equipments sector, surged to hit its upper circuit price limit on 8 January 2026, reflecting robust buying interest and a maximum daily gain of 5.0%. This notable price action comes despite a broader market downturn, underscoring the stock’s outperformance and renewed investor focus.

Read full news article

Uravi Defence & Technology Ltd is Rated Strong Sell

Uravi Defence & Technology Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 13 Aug 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 05 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

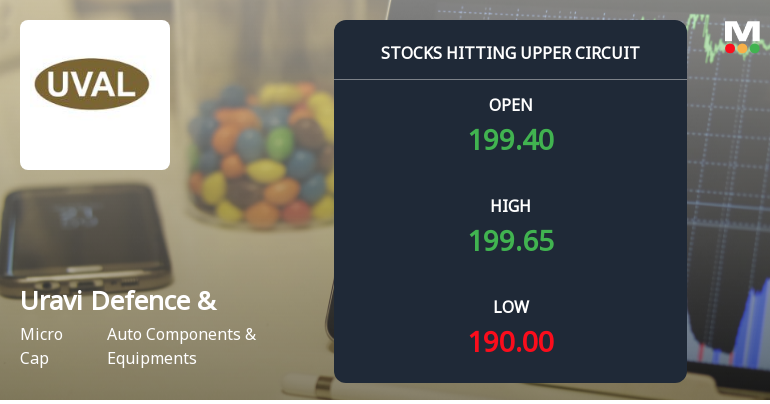

Uravi Defence & Technology Ltd Surges to Upper Circuit Amid Strong Buying Pressure

Shares of Uravi Defence & Technology Ltd surged to hit the upper circuit limit on 5 January 2026, propelled by robust buying interest and a maximum daily gain of 4.99%. The stock’s performance notably outpaced its sector and benchmark indices, reflecting heightened investor enthusiasm despite a prevailing strong sell rating from MarketsMOJO.

Read full news article Announcements

Uravi T and Wedge Lamps Limited - Clarification - Financial Results

03-Dec-2019 | Source : NSEUravi T and Wedge Lamps Limitedge Lamps Limited for the quarter ended 30-Sep-2019 with respect to Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

Uravi T and Wedge Lamps Limited - Updates

16-Oct-2019 | Source : NSEUravi T and Wedge Lamps Limited has informed the Exchange regarding 'Certificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations, 2018 for the Quarter ended September 30, 2019'.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

Uravi Defence & Technology Ltd has announced 1:1 bonus issue, ex-date: 11 Jul 22

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

6.7002

Held by 0 Schemes

Held by 6 FIIs (8.24%)

Viney Corporation Limited (18.26%)

Sangita Pravinkumar Tundiya (6.03%)

26.16%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -8.27% vs 4.71% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 33.33% vs -48.28% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -16.47% vs 14.65% in Sep 2024

Growth in half year ended Sep 2025 is 2.67% vs -36.97% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 4.30% vs 16.42% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -34.39% vs 27.64% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -1.52% vs 23.83% in Mar 2024

YoY Growth in year ended Mar 2025 is -15.96% vs 144.83% in Mar 2024