Compare UVS Hospitality with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 351 Cr (Micro Cap)

22.00

21

0.00%

0.02

8.47%

1.94

Total Returns (Price + Dividend)

UVS Hospitality for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

UVS Hospitality & Services Ltd is Rated Strong Sell

UVS Hospitality & Services Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 19 Feb 2026, reflecting a reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed below are current as of 03 March 2026, providing investors with the latest perspective on the company’s position.

Read full news article

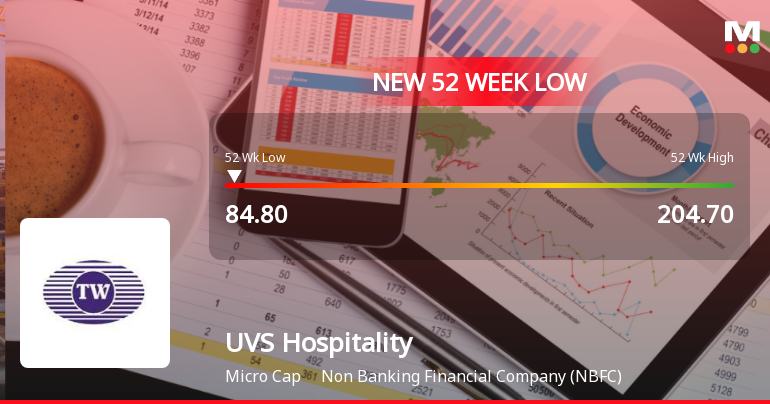

UVS Hospitality & Services Ltd Falls to 52-Week Low of Rs.83.05

Shares of UVS Hospitality & Services Ltd, a Non Banking Financial Company (NBFC), touched a fresh 52-week low of Rs.83.05 today, marking a significant decline amid a broader market rally. This new low reflects ongoing pressures on the stock, which has underperformed its sector and the broader market over the past year.

Read full news article

UVS Hospitality & Services Ltd Falls to 52-Week Low of Rs.84.8 Amid Market Downturn

UVS Hospitality & Services Ltd has touched a new 52-week low of Rs.84.8 today, marking a significant decline amid a turbulent market environment. The stock’s recent performance highlights ongoing pressures within the Non Banking Financial Company (NBFC) sector, with the share price falling sharply over the past week and underperforming its sector peers and broader market indices.

Read full news article Announcements

Change In The Email Address Of The Company.

28-Feb-2026 | Source : BSEThe Stock Exchange and the stakeholders are kindly requested to take on record the intimation pertaining to the change in the email address of the company.

Announcement under Regulation 30 (LODR)-Newspaper Publication

27-Feb-2026 | Source : BSEStock -Exchange and Stakeholders are requested to take on record Intimation with respect to the dispatch of Notice of Extra- Ordinary General Meeting.

Announcement under Regulation 30 (LODR)-Newspaper Publication

26-Feb-2026 | Source : BSEStock Exchange and Stakeholders are requested to take on record intimation with respect to the pre-newspaper publication pertaining to EGM schedule to be held on 20th March 2026

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Utkarsh Chandrakant Vartak (36.45%)

Sachin Dilip Nanche (16.02%)

27.19%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 8.49% vs 39.72% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -2.51% vs 444.44% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 39.35% vs 0.00% in Sep 2024

Growth in half year ended Sep 2025 is 7.11% vs 7,711.11% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 31.97% vs 0.00% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 13.65% vs 7,456.25% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 34.96% vs -10.22% in Mar 2024

YoY Growth in year ended Mar 2025 is -14,200.00% vs 144.44% in Mar 2024