Total Returns (Price + Dividend)

Vaghani Techno for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

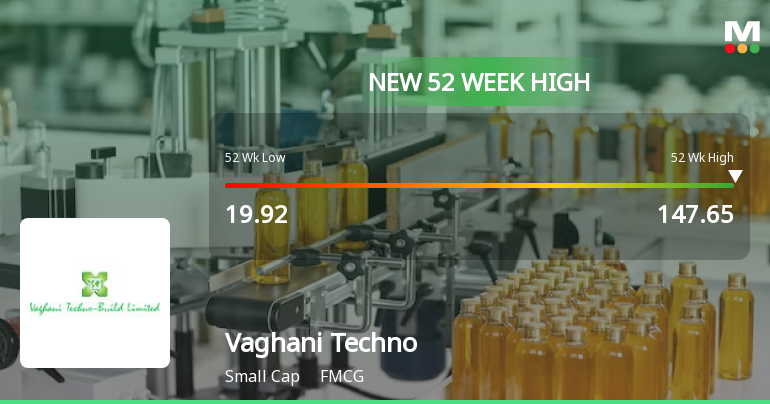

Vaghani Techno-Build Hits New 52-Week High of Rs.147.65, Marking Significant Rally

Vaghani Techno-Build has reached a new 52-week high of Rs.147.65 today, reflecting a strong upward momentum that has seen the stock gain nearly 50% over the past 21 trading sessions. This milestone underscores the stock’s robust performance within the FMCG sector amid a broadly positive market environment.

Read More

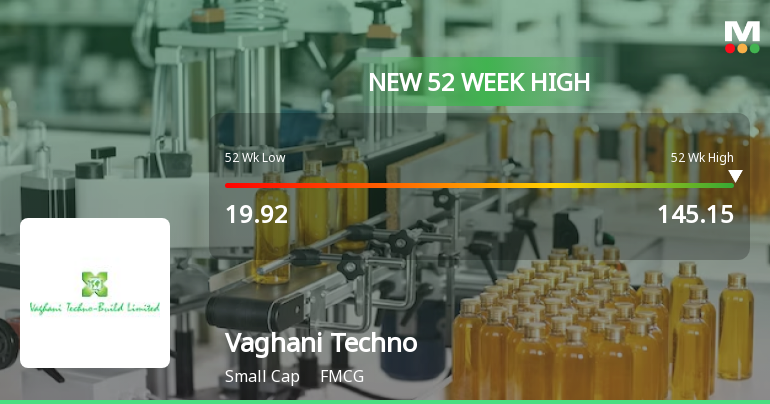

Vaghani Techno-Build Hits New 52-Week High at Rs.145.15

Vaghani Techno-Build, a key player in the FMCG sector, reached a fresh 52-week high of Rs.145.15 today, marking a significant milestone in its stock performance. This new peak reflects sustained momentum as the stock continues to trade above all major moving averages, underscoring its recent strength in the market.

Read More

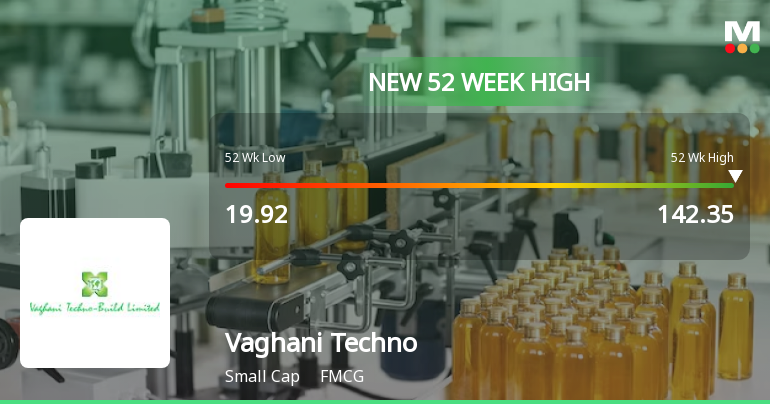

Vaghani Techno-Build Hits New 52-Week High at Rs.142.35

Vaghani Techno-Build, a player in the FMCG sector, reached a significant milestone today by touching a new 52-week high of Rs.142.35. This achievement marks a notable phase of momentum for the stock, reflecting sustained gains over the past month and a half.

Read More Announcements

Announcement under Regulation 30 (LODR)-Conversion of Securities

11-Dec-2025 | Source : BSECONVERSION OF 5600000 WARRANT INTO EQUITY SHARES TO PROMOTER AND PROMOTER GROUP.

Announcement under Regulation 30 (LODR)-Change of Company Name

02-Dec-2025 | Source : BSEAs pre Captioned subject we hereby informed you that Central Processing Centre has approved the change of name from Vaghani Techno-build Limited to Emrock Corporation Limited with effect from December 1 2025 Kindly take on the record.

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

21-Nov-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Meet Govind Vaghani

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

None

Pragnesh Manikantbhai Joshi (3.25%)

21.63%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 200.00% vs -70.00% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 150.00% vs -37.50% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 0.00% vs 0.00% in Sep 2024

Growth in half year ended Sep 2025 is 3,300.00% vs 107.14% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 0.00% vs 0.00% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 116.67% vs -400.00% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 0.00% vs 0.00% in Mar 2024

YoY Growth in year ended Mar 2025 is 270.00% vs -266.67% in Mar 2024