Compare Victoria's Secret & Co. with Similar Stocks

Total Returns (Price + Dividend)

Victoria's Secret & Co. for the last several years.

Risk Adjusted Returns v/s

News

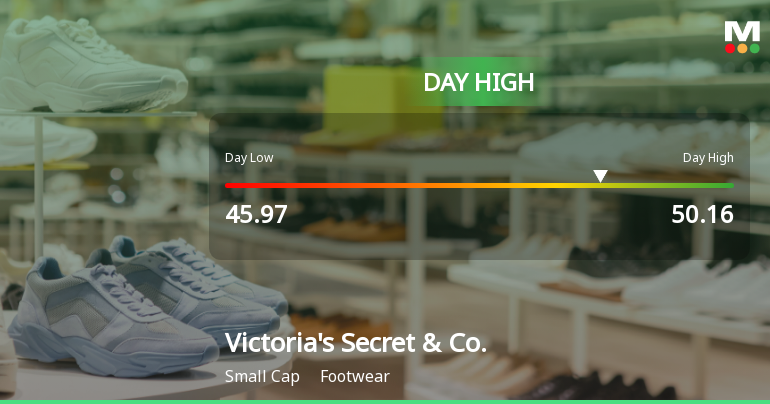

Victoria's Secret Hits Day High with 17.99% Surge in Stock Price

Victoria's Secret & Co. saw a notable increase in stock performance on December 5, 2025, reaching an intraday high. The company has outperformed the S&P 500 in various time frames, but faces long-term challenges, including declining net profit and a negative growth rate in operating profits over the past five years.

Read full news article

Victoria's Secret & Co. Hits New 52-Week High of $50.16

Victoria's Secret & Co. achieved a new 52-week high, reflecting a significant performance increase over the past year. With a market capitalization of USD 2,056 million, a P/E ratio of 9.00, and a return on equity of 26.37%, the company showcases strong financial health despite a higher debt-to-equity ratio.

Read full news article

Victoria's Secret & Co. Experiences Evaluation Revision Amid Mixed Performance Indicators

Victoria's Secret & Co. has recently revised its evaluation amid fluctuating market conditions. The stock, priced at $41.33, has shown significant volatility over the past year. Performance indicators present a mixed outlook, with short-term returns surpassing the S&P 500, while longer-term results indicate a decline relative to the index.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Oct 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 81 Schemes (57.07%)

Held by 147 Foreign Institutions (12.47%)

Quarterly Results Snapshot (Consolidated) - Oct'25 - YoY

YoY Growth in quarter ended Oct 2025 is 9.28% vs 6.48% in Oct 2024

YoY Growth in quarter ended Oct 2025 is 43.64% vs 22.54% in Oct 2024

Annual Results Snapshot (Consolidated) - Jan'25

YoY Growth in year ended Jan 2025 is 0.78% vs -2.55% in Jan 2024

YoY Growth in year ended Jan 2025 is 45.69% vs -65.68% in Jan 2024