Compare Vidhi Specialty with Similar Stocks

Dashboard

Poor long term growth as Net Sales has grown by an annual rate of 9.44% and Operating profit at 7.41% over the last 5 years

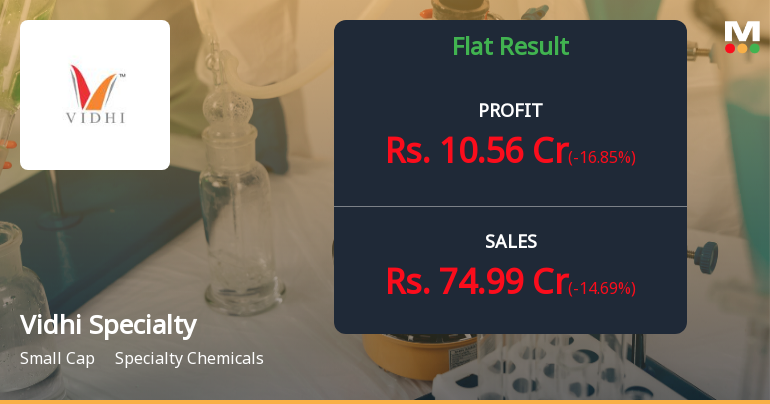

Flat results in Dec 25

With ROE of 15.5, it has a Very Expensive valuation with a 5 Price to Book Value

Despite the size of the company, domestic mutual funds hold only 0% of the company

Below par performance in long term as well as near term

Stock DNA

Specialty Chemicals

INR 1,595 Cr (Small Cap)

32.00

32

1.42%

0.08

15.48%

5.11

Total Returns (Price + Dividend)

Latest dividend: 1.5 per share ex-dividend date: Nov-14-2025

Risk Adjusted Returns v/s

Returns Beta

News

Are Vidhi Specialty Food Ingredients Ltd latest results good or bad?

Vidhi Specialty Food Ingredients Ltd's latest financial results for Q2 FY26 reflect a complex operational landscape. The company reported a net profit of ₹10.56 crores, which represents a sequential decline of 16.85% from the previous quarter but shows a modest year-on-year increase of 2.33%. Revenue for the same period was ₹74.99 crores, indicating a significant sequential decrease of 14.69% and a year-on-year decline of 17.86%. This marks the second consecutive quarter of revenue contraction, raising concerns about demand in the food colours segment. Despite the revenue pressures, Vidhi Specialty managed to maintain an operating margin of 23.58%, which is a slight improvement from the previous quarter and a substantial increase compared to the same quarter last year. This resilience in margins suggests effective cost management and operational efficiency, even as absolute operating profit declined. The ...

Read full news article

Vidhi Specialty Food Ingredients Q2 FY26: Margin Strength Masks Revenue Decline as Profitability Holds Firm

Vidhi Specialty Food Ingredients Limited, a Mumbai-based manufacturer of synthetic food colours and specialty chemicals, reported mixed results for Q2 FY26, with net profit declining 16.85% quarter-on-quarter to ₹10.56 crores despite maintaining robust operating margins above 23%. The ₹1,603 crore market capitalisation company witnessed its stock trade at ₹321.00 on February 02, 2026, down 32.42% over the past year, significantly underperforming both the Sensex and its specialty chemicals peer group.

Read full news article

Vidhi Specialty Food Ingredients Ltd is Rated Sell

Vidhi Specialty Food Ingredients Ltd is rated Sell by MarketsMOJO. This rating was last updated on 24 March 2025, reflecting a significant reassessment of the stock’s outlook. However, the analysis and financial metrics discussed here represent the company’s current position as of 02 February 2026, providing investors with the latest insights into its performance and valuation.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

03-Feb-2026 | Source : BSEAs per Reg. 47 and Reg.30 of LODR read with Schedule III (A)(12) of SEBI LODR we hereby enclose copy of newspaper Notice to the shareholders published on 03.02.2026 in Business Standard [English] and Mumbai Lakshadweep [Marathi] pursuant to Rule 6 (3)(a) of IEPF [Accounting Audit Transfer and Refund) Rules 2016 and amendments thereof This information is also being made available on the website of the company www.vidhifoodcolors.com

Announcement under Regulation 30 (LODR)-Newspaper Publication

03-Feb-2026 | Source : BSEAs per Reg. 47 of LODR the company has to published unaudited financial statements [standalone and Consolidated] for the quarter and nine month ended on 31.12.2026. approved in its board meeting held on 02.02.2026 and published on 03.02.2026 in Business Standard [English] and Mumbai Lakshadweep ][Marathi] edition. please find enclosed copies and kindly take on record.

Announcement under Regulation 30 (LODR)-Investor Presentation

03-Feb-2026 | Source : BSEAs per Reg.30 SEBI-LODR as amendment from time to time our company has announced its Unaudited Financial Result [Standalone and Consolidated] for the quarter and nine month ended on 31.12.2025 approved in its Board meeting held on 02.20.2026. enclosed herewith is Investor Presentation Kindly take on record

Corporate Actions

No Upcoming Board Meetings

Vidhi Specialty Food Ingredients Ltd has declared 150% dividend, ex-date: 14 Nov 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 1 Schemes (0.0%)

Held by 10 FIIs (0.1%)

Pravinamanekfamilyprivatetrust(trusteesbipinmadhavjimanekpravinabipinmanekandmihirbipinmanek) (26.03%)

Mukul Mahavir Agrawal (1.6%)

27.01%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 25.95% vs -14.69% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 17.61% vs -16.85% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -6.52% vs 9.04% in Sep 2024

Growth in half year ended Sep 2025 is 23.92% vs 8.00% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is -5.66% vs 22.44% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 13.27% vs 21.29% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 28.30% vs -26.24% in Mar 2024

YoY Growth in year ended Mar 2025 is 19.07% vs -3.32% in Mar 2024