Compare Vimta Labs with Similar Stocks

Stock DNA

Healthcare Services

INR 2,001 Cr (Small Cap)

31.00

84

0.22%

-0.05

17.82%

5.96

Total Returns (Price + Dividend)

Latest dividend: 2 per share ex-dividend date: May-30-2025

Risk Adjusted Returns v/s

Returns Beta

News

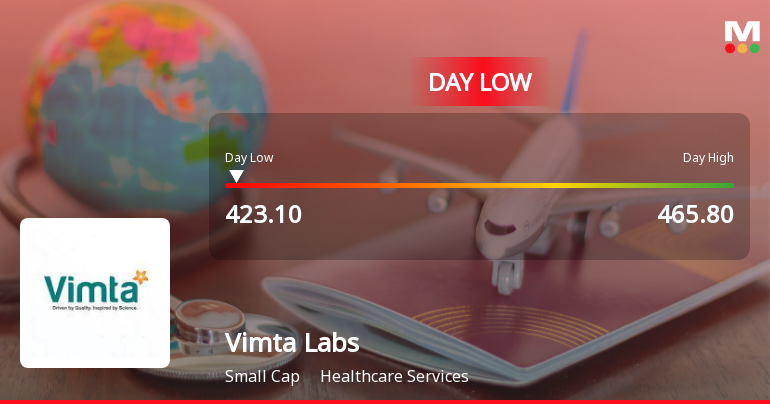

Vimta Labs Ltd Hits Intraday Low Amid Price Pressure on 29 Jan 2026

Vimta Labs Ltd experienced a significant intraday decline, touching a low of Rs 423.55, reflecting a sharp 7.43% drop amid persistent selling pressure and subdued market sentiment. The stock underperformed its sector and broader indices, continuing a multi-day downward trend.

Read full news article

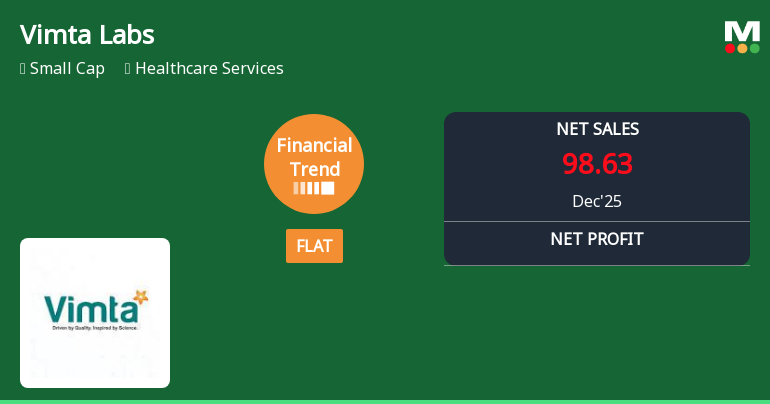

Vimta Labs Ltd Reports Flat Quarterly Performance Amid Margin Pressures

Vimta Labs Ltd, a key player in the Healthcare Services sector, has reported a flat financial performance for the quarter ended December 2025, marking a significant shift from its previously positive growth trajectory. Despite record-high cash reserves and PBDIT, the company’s earnings per share have declined to their lowest quarterly level, prompting a downgrade in its Mojo Grade from Hold to Sell.

Read full news articleAre Vimta Labs Ltd latest results good or bad?

Vimta Labs Ltd's latest financial results for Q3 FY26 reveal a significant year-on-year growth in consolidated net profit, which reached ₹21.50 crores, reflecting a notable increase compared to the previous year. Revenue for the same quarter was reported at ₹89.92 crores, marking a robust year-on-year growth of 20.57%. The operating margin, excluding other income, improved to 36.79%, indicating effective cost management and operational efficiency. The company demonstrated strong operational performance, with the operating profit before depreciation, interest, and tax rising to ₹33.08 crores, showcasing a substantial margin expansion of 479 basis points from the prior year. This operational leverage is further underscored by the return on equity, which stood at 17.82% for the latest financial year, highlighting effective capital utilization. However, the standalone results for the quarter ended December 20...

Read full news article Announcements

Board Meeting Intimation for Considering The Financial Results For The Quarter Ended 31St December 2025.

21-Jan-2026 | Source : BSEVimta Labs Ltd-has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 28/01/2026 inter alia to consider and approve Financial Results for Q3 - FY 2025-26.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

21-Jan-2026 | Source : BSEAnalyst/Investor Conference Call - Q3 Financial Results - FY 2025-26

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Jan-2026 | Source : BSECertificate issued by RTA for the quarter ended 31.12.2025.

Corporate Actions

No Upcoming Board Meetings

Vimta Labs Ltd has declared 100% dividend, ex-date: 30 May 25

Vimta Labs Ltd has announced 2:10 stock split, ex-date: 24 Feb 06

Vimta Labs Ltd has announced 1:1 bonus issue, ex-date: 13 Jun 25

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 2 Schemes (0.0%)

Held by 37 FIIs (4.59%)

Sivalinga Prasad Vasireddi (11.64%)

Eurofins Analytical Services India Pvt Ltd (19.73%)

25.12%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -3.16% vs 4.40% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -11.70% vs 5.45% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 24.93% vs 14.97% in Sep 2024

Growth in half year ended Sep 2025 is 40.97% vs 56.87% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 19.44% vs 17.80% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 15.03% vs 81.53% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 19.19% vs -8.42% in Mar 2024

YoY Growth in year ended Mar 2025 is 64.20% vs -13.30% in Mar 2024