Compare Vipul Ltd with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 5.28 times

- The company has been able to generate a Return on Capital Employed (avg) of 5.14% signifying low profitability per unit of total capital (equity and debt)

The company has declared Negative results for the last 4 consecutive quarters

Risky - Negative EBITDA

30.71% of Promoter Shares are Pledged

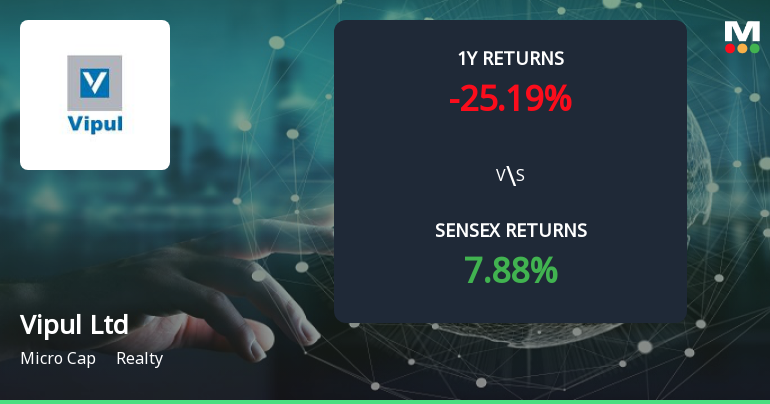

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Realty

INR 162 Cr (Micro Cap)

NA (Loss Making)

35

0.00%

0.10

-7.63%

0.39

Total Returns (Price + Dividend)

Latest dividend: 0.05000000000000001 per share ex-dividend date: Sep-12-2019

Risk Adjusted Returns v/s

Returns Beta

News

Vipul Ltd Forms Golden Cross, Signalling Potential Bullish Breakout

Vipul Ltd, a micro-cap player in the realty sector, has recently formed a Golden Cross, a significant technical indicator where the 50-day moving average crosses above the 200-day moving average. This development often signals a potential bullish breakout and a shift in long-term momentum, suggesting that investors may want to closely monitor the stock for possible trend reversals despite its recent underperformance.

Read full news article

Vipul Ltd is Rated Strong Sell

Vipul Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 06 February 2025. However, the analysis and financial metrics presented here reflect the company’s current position as of 28 January 2026, providing investors with the latest insights into the stock’s performance and fundamentals.

Read full news article

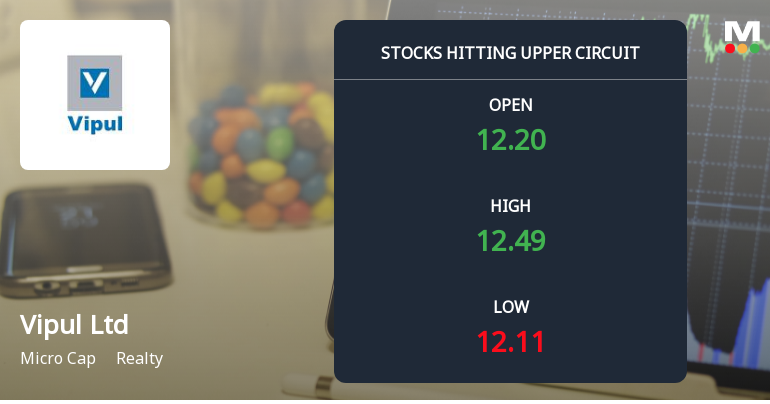

Vipul Ltd Surges to Upper Circuit Amid Strong Buying Pressure

Vipul Ltd, a micro-cap player in the realty sector, surged to hit its upper circuit limit on 14 Jan 2026, registering a maximum daily gain of 4.96% to close at ₹12.49. This sharp rally was driven by robust buying interest, sustained momentum over consecutive sessions, and a notable outperformance relative to its sector and benchmark indices.

Read full news article Announcements

Vipul Limited - Clarification

18-Nov-2019 | Source : NSEVipul Limited has informed the Exchange regarding clarification on Merger of five wholly owned subsidiary companies of Vipul Limited along with the Company.

Vipul Limited - Updates

15-Nov-2019 | Source : NSEVipul Limited has informed the Exchange regarding 'Newspaper Advertisement of Unaudited Financial Results for the Second Quarter and Half Year Ended on September 30, 2019 (Standalone and Consolidated) '.

Vipul Limited - Outcome of Board Meeting

14-Nov-2019 | Source : NSEVipul Limited has informed the Exchange regarding Board meeting held on November 13, 2019.

Corporate Actions

No Upcoming Board Meetings

Vipul Ltd has declared 5% dividend, ex-date: 12 Sep 19

Vipul Ltd has announced 1:2 stock split, ex-date: 04 May 10

Vipul Ltd has announced 1:1 bonus issue, ex-date: 08 Mar 07

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

30.7134

Held by 0 Schemes

Held by 8 FIIs (11.27%)

Punit Beriwala Huf (6.98%)

Moneyplant Gold & Jewellery Trading L.l.c (6.59%)

48.06%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 370.41% vs -96.18% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 609.86% vs 95.94% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -69.46% vs 132.40% in Sep 2024

Growth in half year ended Sep 2025 is 97.29% vs 109.11% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -74.92% vs 155.57% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -78.30% vs 129.50% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -57.83% vs 175.61% in Mar 2024

YoY Growth in year ended Mar 2025 is -112.11% vs 298.99% in Mar 2024