Compare Vision Cinemas with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -0.07

- The company has been able to generate a Return on Equity (avg) of 4.62% signifying low profitability per unit of shareholders funds

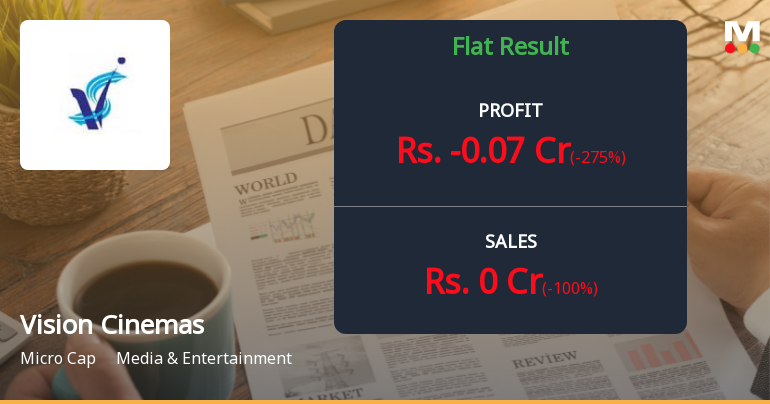

Flat results in Dec 25

Risky - Negative EBITDA

Underperformed the market in the last 1 year

Total Returns (Price + Dividend)

Vision Cinemas for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Are Vision Cinemas Ltd latest results good or bad?

Vision Cinemas Ltd's latest financial results for Q3 FY26 reveal significant operational challenges. The company reported net sales of ₹0.00 crores, marking a complete absence of revenue compared to ₹0.49 crores in the previous quarter (Q2 FY26) and ₹0.79 crores in Q3 FY25. This drastic decline indicates severe operational disruptions or fundamental issues within the business model. Net profit for the same quarter was reported at a loss of ₹0.07 crores, a substantial decline from a profit of ₹0.04 crores in Q2 FY26. The operating margin also fell to 0.0%, down from 10.20% in the previous quarter, reflecting a complete operational failure. The company's Return on Equity (ROE) stands at a low 1.80%, suggesting ongoing difficulties in generating adequate returns on shareholder capital. The financial performance has shown extreme volatility, with the company experiencing zero revenue in multiple quarters and ...

Read full news article

Vision Cinemas Q3 FY26: Revenue Collapse Signals Deepening Operational Crisis

Vision Cinemas Ltd., one of southern India's oldest exhibition and movie processing laboratory companies, reported a complete revenue collapse in Q3 FY26, posting zero net sales for the quarter ended December 2025. The micro-cap company, with a market capitalisation of just ₹9.00 crores, slipped into losses of ₹0.07 crores compared to a marginal profit of ₹0.04 crores in the previous quarter, marking a sequential deterioration of 275.00 per cent.

Read full news article Announcements

Resignation Of Secretarial Auditor

31-Jan-2026 | Source : BSEResignation of Secretarial Auditor

Financial Results For The Quarter Ended 31-December 2025

31-Jan-2026 | Source : BSEFinancial Results for the Quarter Ended-31-12-2025

Board Meeting Intimation for Quarterly Results

22-Jan-2026 | Source : BSEVision Cinemas Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 31/01/2026 inter alia to consider and approve Quarterly Financial Results-31-12-2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Vision Cinemas Ltd has announced 1:10 stock split, ex-date: 30 Mar 09

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 1 FIIs (0.02%)

S I Media Llp (14.12%)

Shahnawaz Najmuddin Kheraj (3.12%)

53.43%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -100.00% vs 0.00% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -275.00% vs 130.77% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -71.68% vs 71.29% in Sep 2024

Growth in half year ended Sep 2025 is 40.00% vs -400.00% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is -80.56% vs 149.50% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 0.00% vs 100.00% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 102.53% vs 295.00% in Mar 2024

YoY Growth in year ended Mar 2025 is 18.18% vs -124.44% in Mar 2024