Compare Vivimed Labs. with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength as the company has not declared results in the last 6 months

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 12.57 times

- The company has been able to generate a Return on Equity (avg) of 1.75% signifying low profitability per unit of shareholders funds

Negative results in Jun 23

Risky - No result in last 6 months

Stock DNA

Pharmaceuticals & Drugs

INR 61 Cr (Micro Cap)

NA (Loss Making)

32

0.00%

9.51

-833.41%

1.60

Total Returns (Price + Dividend)

Latest dividend: 0.4 per share ex-dividend date: Sep-19-2018

Risk Adjusted Returns v/s

Returns Beta

News

Vivimed Labs Ltd Hits Lower Circuit Amid Heavy Selling Pressure

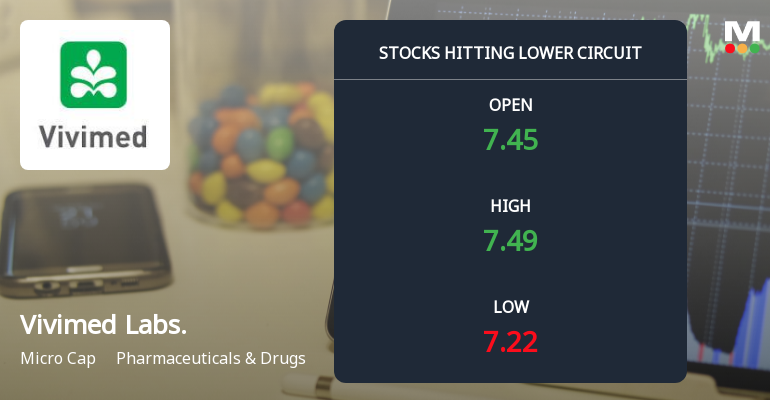

Vivimed Labs Ltd witnessed a sharp decline on 6 Feb 2026, hitting its lower circuit limit of 4.88% as intense selling pressure gripped the stock. The micro-cap pharmaceutical company’s shares closed at ₹7.21, marking a maximum daily loss and continuing a troubling downtrend amid falling investor participation and unfilled supply.

Read full news article

Vivimed Labs Ltd is Rated Strong Sell

Vivimed Labs Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 05 February 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 06 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

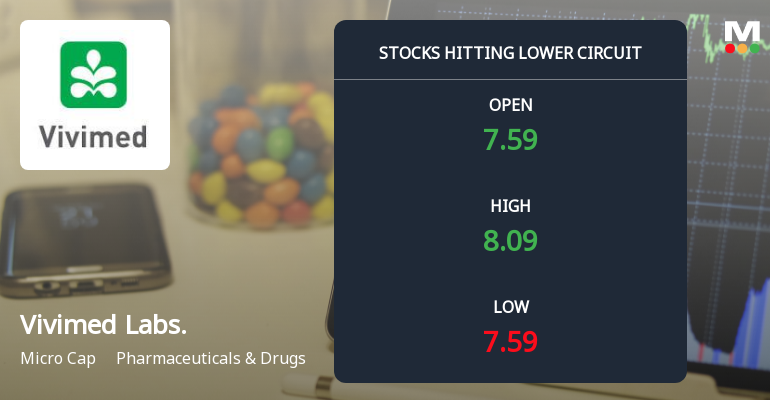

Vivimed Labs Ltd Plunges to Lower Circuit Amid Heavy Selling Pressure

Vivimed Labs Ltd witnessed a sharp decline on 5 Feb 2026, hitting its lower circuit limit of 5%, closing at ₹7.58. The stock faced intense selling pressure, marking its fourth consecutive day of losses and underperforming both its sector and the broader market indices.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Resignation of Chief Financial Officer (CFO)

06-Feb-2026 | Source : BSEResignation of CFO

Updates

03-Feb-2026 | Source : BSEdisclosure under regulation 30

Board Meeting Intimation for 31St December 2025 Results

02-Feb-2026 | Source : BSEVivimed Labs Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 13/02/2026 inter alia to consider and approve 31st december 2025 results

Corporate Actions

13 Feb 2026

Vivimed Labs Ltd has declared 20% dividend, ex-date: 19 Sep 18

Vivimed Labs Ltd has announced 2:10 stock split, ex-date: 06 Apr 16

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

14.799

Held by 0 Schemes

Held by 5 FIIs (1.64%)

Bbr Projects Private Limited (11.45%)

Kitara Piin 1102 (9.37%)

65.18%

Quarterly Results Snapshot (Consolidated) - Jun'23 - QoQ

QoQ Growth in quarter ended Jun 2023 is -4.54% vs -33.57% in Mar 2023

QoQ Growth in quarter ended Jun 2023 is 94.14% vs -1,352.70% in Mar 2023

Half Yearly Results Snapshot (Consolidated) - Sep'22

Growth in half year ended Sep 2022 is -21.15% vs -78.03% in Sep 2021

Growth in half year ended Sep 2022 is -72.57% vs -3,185.90% in Sep 2021

Nine Monthly Results Snapshot (Consolidated) - Dec'22

YoY Growth in nine months ended Dec 2022 is -14.81% vs -78.58% in Dec 2021

YoY Growth in nine months ended Dec 2022 is -26.83% vs 2.03% in Dec 2021

Annual Results Snapshot (Consolidated) - Mar'23

YoY Growth in year ended Mar 2023 is -21.15% vs -72.46% in Mar 2022

YoY Growth in year ended Mar 2023 is -385.63% vs 13.05% in Mar 2022