Compare Windlas Biotech with Similar Stocks

Stock DNA

Pharmaceuticals & Biotechnology

INR 1,752 Cr (Small Cap)

26.00

NA

0.68%

-0.43

12.60%

3.33

Total Returns (Price + Dividend)

Latest dividend: 5.8 per share ex-dividend date: Jul-21-2025

Risk Adjusted Returns v/s

Returns Beta

News

Windlas Biotech Ltd Faces Mixed Technical Signals Amid Mildly Bearish Momentum

Windlas Biotech Ltd, a key player in the Pharmaceuticals & Biotechnology sector, has recently experienced a shift in its technical momentum, moving from a sideways trend to a mildly bearish stance. Despite some bullish weekly indicators, monthly signals suggest caution, reflecting a complex interplay of market forces that investors should carefully consider.

Read full news article

Windlas Biotech Q3 FY26: Steady Growth Marred by Margin Pressure and Weak Profitability

Windlas Biotech Ltd., a small-cap pharmaceutical contract development and manufacturing organisation (CDMO), reported mixed results for Q3 FY26 (October-December 2025), with net sales continuing their upward trajectory but profitability showing minimal sequential improvement. The company posted net profit of ₹17.80 crores for the quarter, representing a modest 0.79% quarter-on-quarter growth but a respectable 13.67% year-on-year increase. With a market capitalisation of ₹1,741 crores, the stock has faced significant headwinds, declining 17.27% over the past year and currently trading at ₹843.00, down 25.90% from its 52-week high of ₹1,137.60.

Read full news article

Windlas Biotech Upgraded to Hold as Technicals Improve Amid Mixed Financial Signals

Windlas Biotech Ltd has seen its investment rating upgraded from Sell to Hold, reflecting a notable shift in its technical outlook and financial performance. The company’s improved technical indicators, steady financial trends, and fair valuation underpin this revised stance, despite some lingering concerns over long-term growth and recent underperformance relative to the broader market.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

29-Jan-2026 | Source : BSESchedule of Conference Call to discuss financial performance for the quarter and nine months ended December 31 2025

Board Meeting Intimation for Notice Of The Board Meeting Scheduled To Be Held On Thursday February 5 2026

28-Jan-2026 | Source : BSEWindlas Biotech Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 05/02/2026 inter alia to consider and approve To inter alia consider and approve the un-audited standalone and consolidated financial results for the quarter and nine months ended December 31 2025.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

22-Jan-2026 | Source : BSEIntimation of Schedule of Analyst / Institutional Investor meetings under the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Windlas Biotech Ltd has declared 116% dividend, ex-date: 21 Jul 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 4 Schemes (6.63%)

Held by 26 FIIs (0.93%)

Akw Wbl Family Private Trust (through Its Trustees Ashok Vimla Trusteeship Services Private Limited) (39.76%)

Icici Prudential Pharma Healthcare And Diaganostics (p.h.d) Fund (5.31%)

21.29%

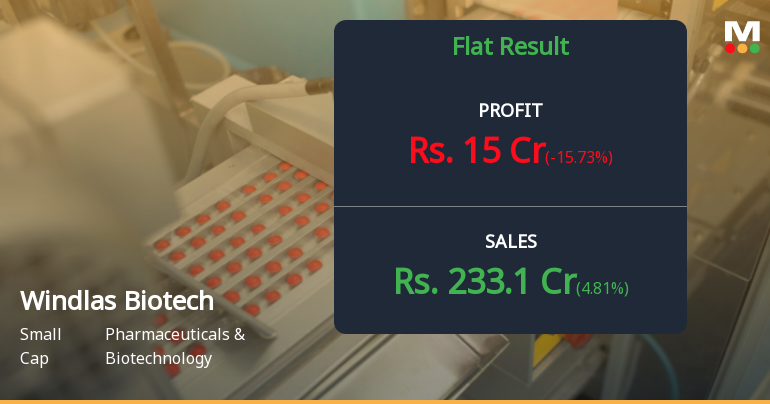

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 4.81% vs 5.86% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -15.73% vs 0.79% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 19.42% vs 21.75% in Sep 2024

Growth in half year ended Sep 2025 is 21.69% vs 11.65% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 19.46% vs 21.21% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 12.84% vs 8.54% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 20.43% vs 22.97% in Mar 2024

YoY Growth in year ended Mar 2025 is 4.81% vs 36.50% in Mar 2024