Compare Xelpmoc Design with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -24.28% and Operating profit at -226.87% over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -11.76

Flat results in Sep 25

Risky - Negative EBITDA

Reducing Promoter Confidence

Stock DNA

Software Products

INR 207 Cr (Micro Cap)

NA (Loss Making)

34

0.00%

-0.12

-9.83%

2.65

Total Returns (Price + Dividend)

Xelpmoc Design for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

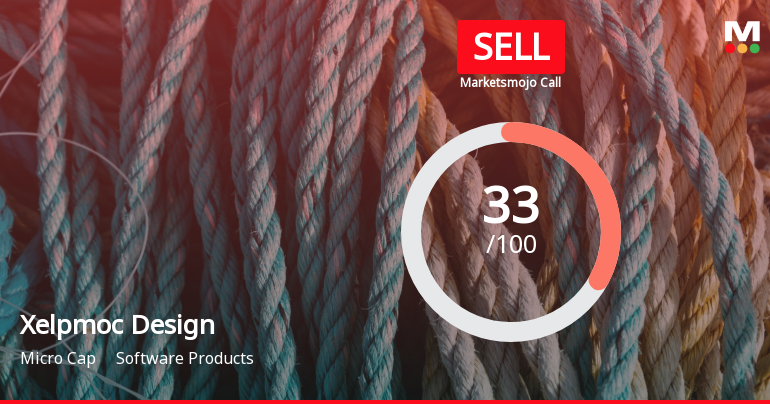

Xelpmoc Design and Tech Ltd is Rated Sell

Xelpmoc Design and Tech Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 10 Oct 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 28 January 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

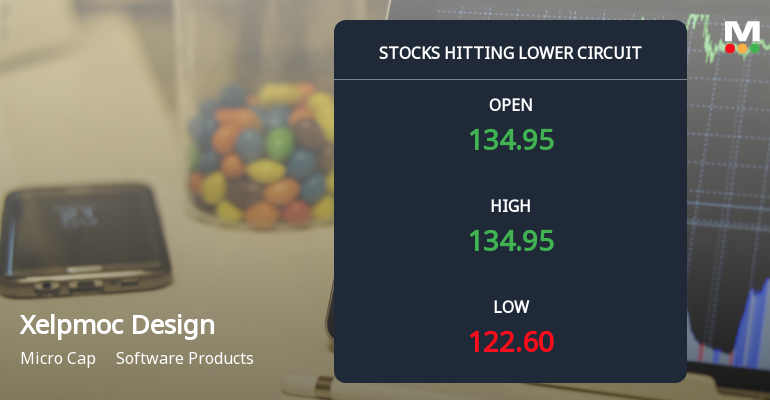

Xelpmoc Design and Tech Ltd Hits Lower Circuit Amid Heavy Selling Pressure

Shares of Xelpmoc Design and Tech Ltd plunged to their lower circuit limit on 9 Jan 2026, succumbing to intense selling pressure that saw the stock lose 5% intraday. The micro-cap software products company faced panic selling and unfilled supply, reflecting investor concerns amid volatile trading conditions and a deteriorating outlook.

Read full news article

Xelpmoc Design and Tech Ltd is Rated Sell

Xelpmoc Design and Tech Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 10 Oct 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 05 January 2026, providing investors with an up-to-date view of the company's fundamentals, returns, and technical outlook.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

16-Jan-2026 | Source : BSECompliance certificate under Regulation 74(5) of SEBI (DP) Regulations 2018

Closure of Trading Window

31-Dec-2025 | Source : BSEClosure of Trading Window

Intimation Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 (SEBI Listing Regulations) - Receipt Of Demand Order

30-Dec-2025 | Source : BSEPlease find enclosed herewith the intimation regarding the receipt of a Demand Order.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Sandipan Chattopadhyay (27.64%)

Omprakash K Shah (5.06%)

45.16%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -2.56% vs 9.86% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -2.66% vs -1.08% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -34.75% vs -46.61% in Sep 2024

Growth in half year ended Sep 2025 is 25.00% vs 37.21% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -42.52% vs -51.40% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 4.16% vs 39.97% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -39.72% vs -56.11% in Mar 2024

YoY Growth in year ended Mar 2025 is 39.11% vs 15.64% in Mar 2024