Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -24.28% and Operating profit at -226.87% over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -11.76

Flat results in Sep 25

Risky - Negative EBITDA

Reducing Promoter Confidence

Stock DNA

Software Products

INR 195 Cr (Micro Cap)

NA (Loss Making)

36

0.00%

-0.12

-9.83%

2.72

Total Returns (Price + Dividend)

Xelpmoc Design for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Xelpmoc Design and Tech Ltd is Rated Sell

Xelpmoc Design and Tech Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 10 Oct 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 25 December 2025, providing investors with an up-to-date view of its fundamentals, returns, and technical outlook.

Read More

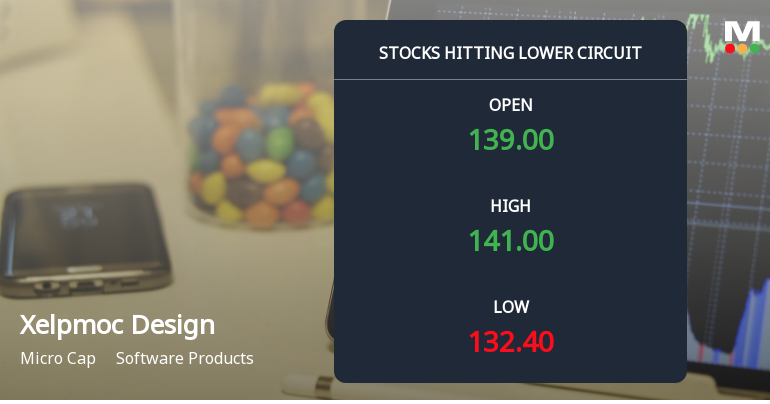

Xelpmoc Design and Tech Hits Lower Circuit Amid Heavy Selling Pressure

Shares of Xelpmoc Design and Tech Ltd, a micro-cap player in the Software Products sector, encountered intense selling pressure on 12 Dec 2025, hitting the lower circuit limit and registering the maximum permissible daily loss. The stock’s sharp decline reflects a sudden shift in market sentiment, with unfilled supply and panic selling dominating trading activity.

Read More

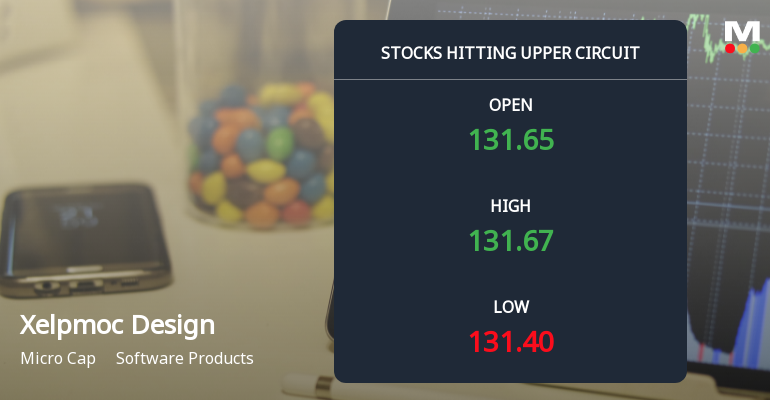

Xelpmoc Design and Tech Hits Upper Circuit Amid Strong Buying Pressure

Shares of Xelpmoc Design and Tech Ltd surged to hit the upper circuit limit on 9 December 2025, reflecting robust buying interest and a maximum permissible daily gain of 5.0%. The stock closed at ₹131.67, marking a significant outperformance relative to its sector and the broader market indices.

Read More Announcements

Xelpmoc Design And Tech Limited - Other General Purpose

03-Dec-2019 | Source : NSEXelpmoc Design And Tech Limited has informed the Exchange regarding a copy of disclosure of Related Party Transactions for the half year ended September 30, 2019 pursuant to Regulation 23(9) of the Listing Regulations.

Xelpmoc Design And Tech Limited - Outcome of Board Meeting

08-Nov-2019 | Source : NSEXelpmoc Design And Tech Limited has informed the Exchange regarding Board meeting held on November 07, 2019.Please find attached herewith scanned copy of outcome of the Board Meeting held today.

Xelpmoc Design And Tech Limited - Analysts/Institutional Investor Meet/Con. Call Updates

05-Nov-2019 | Source : NSEXelpmoc Design And Tech Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates Pursuant to Regulation 30 (6) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (the 'Listing Regulations') read with Part A of Schedule III of the Regulation, we would like to inform that the Company has Scheduled an Earnings Call with the Investors and Shareholders to discuss operational and financial performance in 2nd quarter and half year ended September 30, 2019 on Friday, November 08, 2019 at 5.30 P.M.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 1 FIIs (0.0%)

Sandipan Chattopadhyay (27.64%)

Omprakash Kanayalal Shah (5.02%)

43.3%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -2.56% vs 9.86% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -2.66% vs -1.08% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -34.75% vs -46.61% in Sep 2024

Growth in half year ended Sep 2025 is 25.00% vs 37.21% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -42.52% vs -51.40% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 4.16% vs 39.97% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -39.72% vs -56.11% in Mar 2024

YoY Growth in year ended Mar 2025 is 39.11% vs 15.64% in Mar 2024