Compare Yash Mgmt & Sat. with Similar Stocks

Stock DNA

Trading & Distributors

INR 14 Cr (Micro Cap)

NA (Loss Making)

21

0.00%

0.15

-15.78%

0.62

Total Returns (Price + Dividend)

Yash Mgmt & Sat. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Yash Management & Satelite Ltd Falls to 52-Week Low Amid Continued Underperformance

Yash Management & Satelite Ltd’s share price declined to a fresh 52-week low of Rs.7.02 on 3 Feb 2026, marking a significant downturn amid persistent underperformance relative to its sector and benchmark indices.

Read full news article

Yash Management & Satelite Ltd Falls to 52-Week Low Amidst Continued Underperformance

Yash Management & Satelite Ltd, a player in the Trading & Distributors sector, touched a new 52-week low of Rs.7.02 today, marking a significant decline in its stock price amid persistent underperformance and subdued financial metrics.

Read full news article

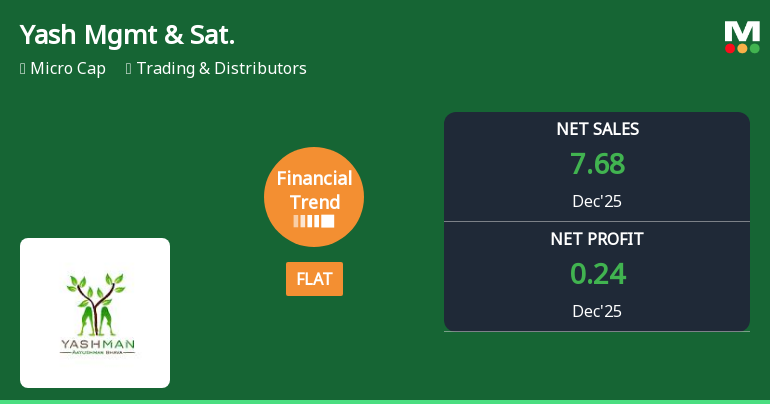

Yash Management & Satelite Ltd Reports Flat Quarterly Performance Amid Mixed Financial Trends

Yash Management & Satelite Ltd has posted a flat financial performance for the quarter ended December 2025, signalling a stabilisation after a period of negative trends. While quarterly net sales surged impressively, the company’s half-year figures reveal ongoing challenges, reflecting a complex financial landscape for this Trading & Distributors sector player.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

24-Jan-2026 | Source : BSENewspaper publication of Unaudited Standalone and Consolidated Financial Results of the company for the Quarter ended 31.12.2025.

Board Meeting Outcome for The BOD Of The Company At Their Meeting Held On Today I.E. 23.01.2026 Inter Alia Considered And Approved The Consolidated And Standalone Unaudited Financial Results Of The Company For The Quarter Ended 31St December 2025

23-Jan-2026 | Source : BSEOutcome Of BM Held On 23rd January 2026 Pursuant to the SEBI LODR Regulations 2015 The Board of the Directors of the Company at their meeting held on today i.e. 23.01.2026 inter alia considered and approved the Consolidated and Standalone Unaudited Financial Results of the Company for the Quarter ended 31st December along with limited review report thereon (attached)

The Board Of The Directors Of The Company At Their Meeting Held On Today I.E. 23.01.2026 Inter Alia Considered And Approved The Consolidated And Standalone Unaudited Financial Results Of The Company For The Quarter Ended 31St December 2025

23-Jan-2026 | Source : BSEThe Board of Director at its BM held on 23.01.2026 considered and approved the unaudited Standalone and Consolidated Financial Result for the quarter ended 31.12.2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Anurag Hargovind Gupta (22.35%)

Golechha Global Finance Limited (2.35%)

32.28%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 120.69% vs -22.84% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 128.24% vs -547.37% in Sep 2025

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -30.47% vs 26.21% in Mar 2024

YoY Growth in year ended Mar 2025 is -12.12% vs 6.78% in Mar 2024