Compare Yokowo Co. Ltd. with Similar Stocks

Dashboard

High Management Efficiency with a high ROE of 7.73%

Company's ability to service its debt is strong with a healthy EBIT to Interest (avg) ratio of 47.46

Poor long term growth as Operating profit has grown by an annual rate -2.98% of over the last 5 years

Flat results in Jun 25

With ROE of 4.72%, it has a very attractive valuation with a 0.56 Price to Book Value

Market Beating Performance

Stock DNA

Electronics & Appliances

JPY 54,521 Million (Small Cap)

12.00

NA

0.00%

-0.15

4.95%

1.02

Total Returns (Price + Dividend)

Yokowo Co. Ltd. for the last several years.

Risk Adjusted Returns v/s

News

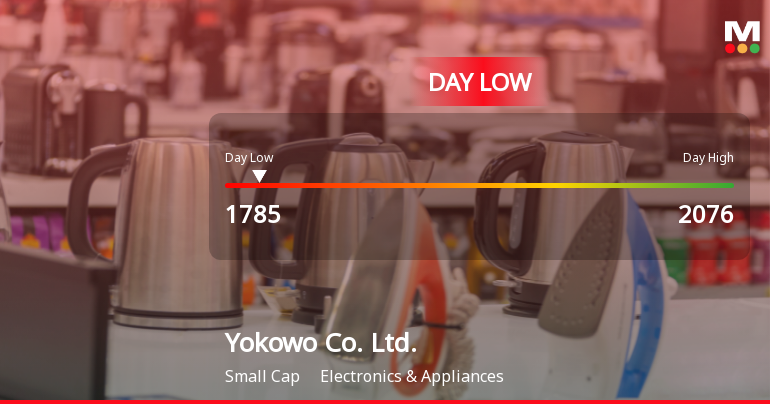

Yokowo Co. Ltd. Hits Day Low of JPY 1,785 Amid Price Pressure

Yokowo Co. has faced notable stock volatility, declining significantly today. While the company shows strong management efficiency and a favorable price-to-book ratio, it has encountered challenges with decreased profits in the latest quarter. Its longer-term performance reflects mixed results, with a modest year-to-date increase and a decline over three years.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot

Shareholding Compare (%holding)

Quarterly Results Snapshot (Consolidated) - Jun'25 - QoQ

QoQ Growth in quarter ended Jun 2025 is -0.24% vs 0.16% in Mar 2025

QoQ Growth in quarter ended Jun 2025 is 198.17% vs -116.51% in Mar 2025

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 7.79% vs -1.37% in Mar 2024

YoY Growth in year ended Mar 2025 is 48.05% vs -52.01% in Mar 2024