Compare KEI Industries with Similar Stocks

Dashboard

Low Debt Company with Strong Long Term Fundamental Strength

- Healthy long term growth as Net Sales has grown by an annual rate of 21.68% and Operating profit at 22.73%

- Company has a low Debt to Equity ratio (avg) at 0.03 times

- The company has been able to generate a Return on Equity (avg) of 16.83% signifying high profitability per unit of shareholders funds

The company has declared Positive results for the last 4 consecutive quarters

High Institutional Holdings at 52.76%

Consistent Returns over the last 3 years

Stock DNA

Cables - Electricals

INR 41,480 Cr (Mid Cap)

46.00

39

0.11%

-0.21

12.78%

6.33

Total Returns (Price + Dividend)

Latest dividend: 4.5 per share ex-dividend date: Jan-28-2026

Risk Adjusted Returns v/s

Returns Beta

News

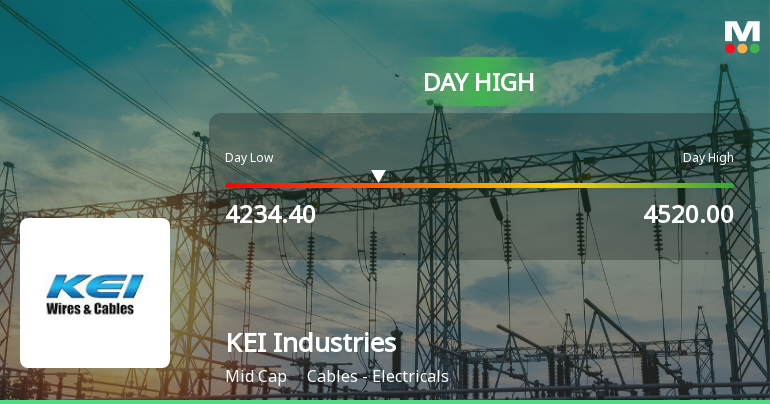

KEI Industries Ltd Hits Intraday High with 8.43% Surge on 3 Feb 2026

KEI Industries Ltd demonstrated robust intraday strength on 3 Feb 2026, surging to an intraday high of Rs 4,451.35, marking a 9.18% gain from the previous close. The stock outperformed its sector and broader market indices, reflecting heightened trading activity and positive momentum within the cables electricals segment.

Read full news article

KEI Industries Ltd Technical Momentum Shifts Signal Mild Bullish Outlook

KEI Industries Ltd has demonstrated a notable shift in price momentum, moving from a mildly bearish to a mildly bullish technical trend, supported by recent gains and an upgrade in its Mojo Grade to Buy. Despite some mixed signals from key technical indicators such as MACD and RSI, the stock’s daily moving averages and Bollinger Bands suggest a cautiously optimistic outlook for investors.

Read full news article

KEI Industries Ltd Technical Momentum Shifts Amid Mixed Market Signals

KEI Industries Ltd has experienced a notable shift in its technical momentum, moving from a mildly bullish stance to a mildly bearish outlook on weekly and monthly charts. Despite a recent downgrade in technical trend sentiment, the stock maintains a strong fundamental rating, reflecting a complex interplay between price action and technical indicators.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

29-Jan-2026 | Source : BSEPursuant to Regulation 30 of the SEBI(LODR) Regulations 2015 given below is the schedule of conference call/meet with the analyst/institutional investors; Date: 09.02..2026 Meeting Organised by: Nuvama Wealth Management Limited Mode of Meeting: Physical Type/Location: One on One and Group Meeting Time: 09.00 AM to 06.00 PM in Mumbai

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

29-Jan-2026 | Source : BSEPursuant to Regulation 30 of the SEBI (LODR) Regulations 2015 we hereby inform the exchanges that the transcript of audio call recording of the Companys Analyst Call held on Thursday 22nd January 2026 to discuss the Un-audited Financial Results (Standalone and Consolidated) for the quarter ended on December 31 2025 is attached herewith. The transcript is also available on the website of the Company.

Report On Transfer Requests Of Physical Shares Re-Lodged Under The Special Window.

24-Jan-2026 | Source : BSEReport on Transfer Requests of Physical Shares re-lodged under the special window

Corporate Actions

No Upcoming Board Meetings

KEI Industries Ltd has declared 225% dividend, ex-date: 28 Jan 26

KEI Industries Ltd has announced 2:10 stock split, ex-date: 21 Dec 06

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 32 Schemes (24.41%)

Held by 291 FIIs (25.48%)

Anil Gupta (11.39%)

Motilal Oswal Bse 1000 Index Fund (4.56%)

10.03%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 19.51% vs 20.05% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 42.50% vs 9.38% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 22.25% vs 16.73% in Sep 2024

Growth in half year ended Sep 2025 is 30.88% vs 16.62% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 21.26% vs 17.91% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 34.96% vs 13.97% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 19.89% vs 17.55% in Mar 2024

YoY Growth in year ended Mar 2025 is 19.92% vs 21.66% in Mar 2024