Compare Trustedgecapital with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 123 Cr (Micro Cap)

NA (Loss Making)

22

0.00%

0.00

-1.42%

4.37

Total Returns (Price + Dividend)

Trustedgecapital for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Trustedge Capital Ltd Hits New 52-Week High at Rs.138.4

Trustedge Capital Ltd, a Non Banking Financial Company (NBFC), reached a significant milestone today by hitting a new 52-week high of Rs.138.4, marking a remarkable rally over the past year and underscoring its strong momentum in the market.

Read full news article

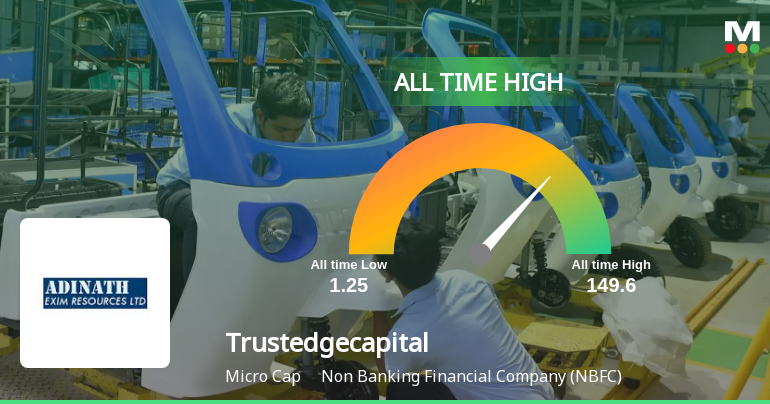

Trustedge Capital Ltd Hits All-Time High at Rs 138.4 on 2 Feb 2026

Trustedge Capital Ltd, a prominent player in the Non Banking Financial Company (NBFC) sector, reached a new all-time high of Rs 138.4 on 2 Feb 2026, underscoring its sustained upward momentum and robust market performance over recent years.

Read full news article

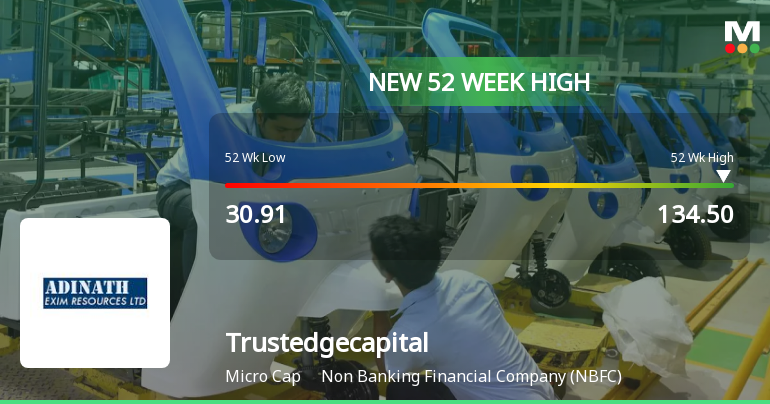

Trustedge Capital Ltd Hits New 52-Week High at Rs.134.5

Trustedge Capital Ltd, a micro-cap player in the Non Banking Financial Company (NBFC) sector, achieved a significant milestone today by reaching a new 52-week high of Rs.134.5. This marks a continuation of the stock’s robust upward momentum, reflecting a remarkable rally over the past year.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

30-Jan-2026 | Source : BSENewspaper publication for the unaudited financial results for the quarter and nine months ended on December 31 2025

Announcement under Regulation 30 (LODR)-Change in Management

28-Jan-2026 | Source : BSERe-appointment of internal auditor of the company for the F.Y. 2025-26

Unaudited Financial Results For The Quarter And Nine Months Ended On December 312025

28-Jan-2026 | Source : BSEUnaudited financial results for the quarter and nine months ended on December 31 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

Trustedge Capital Ltd has announced 49:85 rights issue, ex-date: 01 Oct 25

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Avani Dharen Savla (11.92%)

Jaydeep D Thakkar (1.28%)

22.66%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 42.39% vs 17.95% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 275.00% vs 50.00% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 203.57% vs 7.69% in Sep 2024

Growth in half year ended Sep 2025 is -174.19% vs 10.71% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 262.65% vs 7.79% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -120.00% vs 9.76% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 5.83% vs 3.00% in Mar 2024

YoY Growth in year ended Mar 2025 is -71.43% vs -17.65% in Mar 2024