Compare Heritage Foods with Similar Stocks

Total Returns (Price + Dividend)

Latest dividend: 2.5 per share ex-dividend date: Jul-23-2025

Risk Adjusted Returns v/s

Returns Beta

News

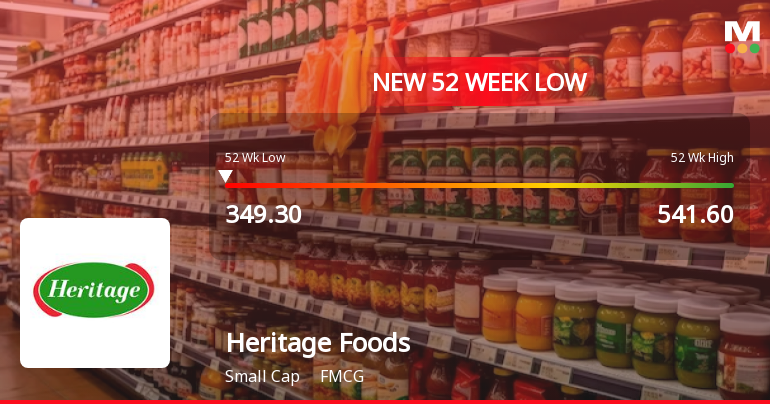

Heritage Foods Ltd Stock Falls to 52-Week Low of Rs.339.15

Heritage Foods Ltd, a key player in the FMCG sector, touched a fresh 52-week low of Rs.339.15 today, marking a significant decline in its stock price amid ongoing challenges reflected in its financial performance and market positioning.

Read full news article

Heritage Foods Ltd Stock Falls to 52-Week Low of Rs.349.35

Heritage Foods Ltd has reached a new 52-week low of Rs.349.35 today, marking a significant decline amid a sustained negative trend. The stock has underperformed its sector and broader market indices, reflecting ongoing pressures on its financial performance and valuation metrics.

Read full news article

Heritage Foods Ltd Valuation Turns Very Attractive Amid Market Downturn

Heritage Foods Ltd has seen a marked shift in its valuation parameters, moving from an attractive to a very attractive rating, despite recent share price declines. This change reflects a significant reappraisal of the company’s price-to-earnings and price-to-book value metrics relative to its historical averages and peer group, signalling potential value opportunities for discerning investors.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

31-Jan-2026 | Source : BSETranscript of Conference Call held on January 29 2026

Announcement under Regulation 30 (LODR)-Newspaper Publication

29-Jan-2026 | Source : BSENewspaper advertisement for Un-audited Financial Results (Standalone & Consolidated) for the quarter ended December 31 2025

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

29-Jan-2026 | Source : BSEAudio Link - Investor Meeting held on January 29 2026

Corporate Actions

No Upcoming Board Meetings

Heritage Foods Ltd has declared 50% dividend, ex-date: 23 Jul 25

Heritage Foods Ltd has announced 5:10 stock split, ex-date: 10 Oct 17

Heritage Foods Ltd has announced 1:1 bonus issue, ex-date: 26 Jul 13

Heritage Foods Ltd has announced 1:1 rights issue, ex-date: 20 Jan 23

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 8 Schemes (3.95%)

Held by 84 FIIs (3.96%)

Bhuvaneswari Nara (24.37%)

Nirvana Holdings Private Limited (11.76%)

30.6%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 8.24% vs 9.87% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -19.63% vs 60.04% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 9.60% vs 7.88% in Sep 2024

Growth in half year ended Sep 2025 is -14.50% vs 173.46% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 9.15% vs 8.54% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -15.97% vs 127.27% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 8.98% vs 17.07% in Mar 2024

YoY Growth in year ended Mar 2025 is 76.71% vs 83.77% in Mar 2024