Compare Global Offshore with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 0%

- Poor long term growth as Net Sales has grown by an annual rate of -21.72% and Operating profit at -242.53% over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of -1.00 times

Negative results in Sep 25

Risky - Negative Operating Profits

Below par performance in long term as well as near term

Stock DNA

Transport Services

INR 141 Cr (Micro Cap)

NA (Loss Making)

10

0.00%

0.39

-8.95%

1.05

Total Returns (Price + Dividend)

Latest dividend: 1.2 per share ex-dividend date: Sep-16-2014

Risk Adjusted Returns v/s

Returns Beta

News

Global Offshore Services Ltd Falls to 52-Week Low Amid Continued Downtrend

Global Offshore Services Ltd has declined to a fresh 52-week low of Rs.43.44, marking a significant downturn amid a broader market environment where the Sensex continues to show resilience. The stock’s recent performance highlights ongoing concerns within the company’s financial and operational metrics, reflecting a challenging period for the transport services firm.

Read full news article

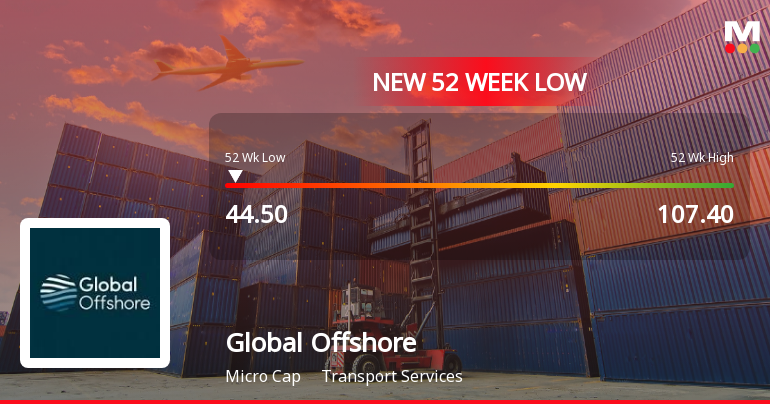

Global Offshore Services Ltd Falls to 52-Week Low of Rs.44.5

Global Offshore Services Ltd has touched a new 52-week low of Rs.44.5 today, marking a significant downturn in its stock performance amid a sustained period of decline and underperformance relative to its sector and broader market indices.

Read full news article

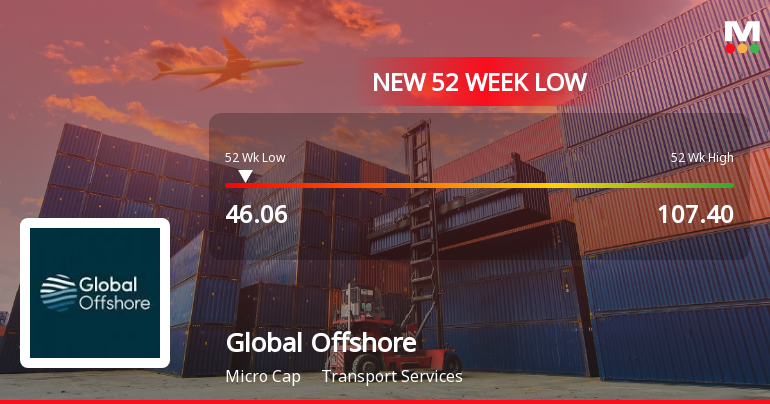

Global Offshore Services Ltd Falls to 52-Week Low of Rs.46.06

Global Offshore Services Ltd’s stock declined to a fresh 52-week low of Rs.46.06 today, marking a significant milestone in its ongoing downward trajectory. The stock’s performance continues to lag behind broader market indices and sector peers, reflecting persistent challenges in its financial and operational metrics.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Change of Company Name

20-Jan-2026 | Source : BSEPursuant to Reg. 30 of SEBI (LODR) Regulations 2015 we hereby intimate that we have received an In-principle approval from BSE Limited for change of name of the Company from Global Offshore Services Ltd to Garware Offshore Services Limited.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

14-Jan-2026 | Source : BSEPursuant to Regulation 75 (5) of SEBI (Depositories and Participants) Regulations 2018 enclosed please find copy of Certificate dated 13.01.2026 issued by our Registrar and Transfer Agents viz. Bigshare Services Pvt Ltd for the quarter ended 31st December 2025

Notice Of Postal Ballot

06-Jan-2026 | Source : BSEPursuant to Provisions of SEBI (Listing Obligation and Disclosure Requirements) Regulations 2015 we enclose herewith a copy of Postal Ballot Notice dated 31.12.2025 dispatched to the Shareholders today for your information and record.

Corporate Actions

No Upcoming Board Meetings

Global Offshore Services Ltd has declared 12% dividend, ex-date: 16 Sep 14

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 4 Schemes (0.1%)

Held by 3 FIIs (0.16%)

Sushma Ashok Garware (7.9%)

Shri Krishna Welfare Trust (2.54%)

46.68%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -7.16% vs -32.47% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 108.65% vs -148.48% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -29.67% vs -33.67% in Sep 2024

Growth in half year ended Sep 2025 is 58.19% vs 47.63% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -24.47% vs -19.53% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 149.95% vs 95.13% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -16.48% vs -23.13% in Mar 2024

YoY Growth in year ended Mar 2025 is -89.81% vs -88.65% in Mar 2024