Compare EFC (I) with Similar Stocks

Dashboard

High Management Efficiency with a high ROCE of 15.14%

High Debt Company with a Debt to Equity ratio (avg) at 1.72 times

Healthy long term growth as Net Sales has grown by an annual rate of 285.97% and Operating profit at 371.03%

With a growth in Net Profit of 21.19%, the company declared Outstanding results in Sep 25

With ROCE of 18.9, it has a Expensive valuation with a 2.8 Enterprise value to Capital Employed

Majority shareholders : Promoters

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

EFC (I) for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

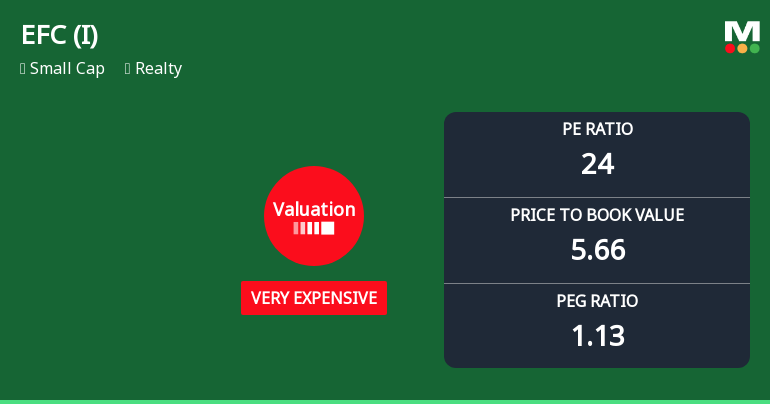

EFC (I) Ltd Valuation Shifts to Very Expensive Amid Market Volatility

EFC (I) Ltd, a key player in the realty sector, has witnessed a marked shift in its valuation parameters, moving from an expensive to a very expensive rating. This change, coupled with a downgrade in its Mojo Grade from Buy to Hold, reflects growing concerns over price attractiveness despite the company’s solid operational metrics. Investors are urged to carefully analyse the evolving valuation landscape as EFC (I) Ltd navigates a challenging market environment.

Read full news article

EFC (I) Ltd is Rated Hold by MarketsMOJO

EFC (I) Ltd is currently rated 'Hold' by MarketsMOJO, with this rating last updated on 18 Nov 2025. While the rating change occurred then, the analysis and financial metrics discussed here reflect the stock's current position as of 27 January 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

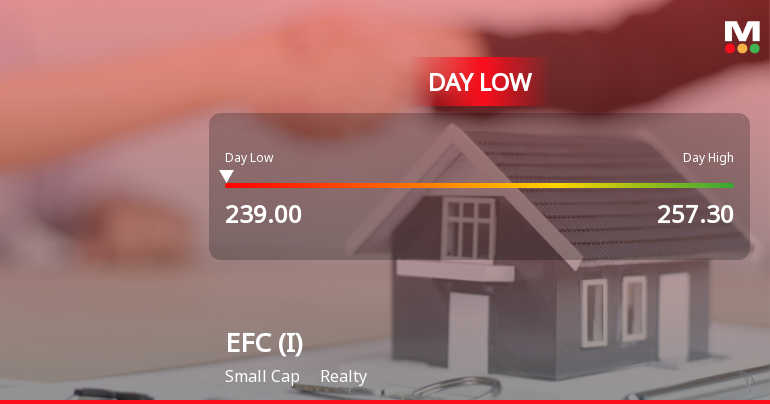

EFC (I) Ltd Hits Intraday Low Amid Price Pressure on 23 Jan 2026

Shares of EFC (I) Ltd, a key player in the realty sector, declined sharply today, touching an intraday low of Rs 239, down 7.15% from the previous close. This underperformance comes amid a broadly negative market environment, with the Sensex falling nearly 0.94% and the NIFTY REALTY index hitting a fresh 52-week low.

Read full news article Announcements

Intimation Regarding Receipt Of No-Objection Letter For Reclassification From Promoter Category To Public Category Under Regulation 31A Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

29-Jan-2026 | Source : BSEThe Detailed Disclosure is attached herewith.

Intimation Regarding Receipt Of Approval For Reclassification From Promoter Category To Public Category Under Regulation 31A Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

29-Jan-2026 | Source : BSEThe Detailed Disclosure is attached herewith.

Announcement under Regulation 30 (LODR)-Acquisition

22-Jan-2026 | Source : BSEDetails as per attached Letter.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

EFC (I) Ltd has announced 2:10 stock split, ex-date: 18 Aug 23

EFC (I) Ltd has announced 1:1 bonus issue, ex-date: 11 Feb 25

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 1 Schemes (1.56%)

Held by 21 FIIs (2.36%)

Umesh Kumar Sahay (38.74%)

Bandhan Small Cap Fund (1.56%)

19.07%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 15.92% vs 4.08% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 29.70% vs 11.68% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 76.62% vs 74.14% in Sep 2024

Growth in half year ended Sep 2025 is 79.35% vs 226.20% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 36.62% vs 689.59% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 173.00% vs 746.20% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 60.06% vs 297.56% in Mar 2024

YoY Growth in year ended Mar 2025 is 94.55% vs 1,386.92% in Mar 2024