Compare Manaksia Alumi. with Similar Stocks

Dashboard

Low ability to service debt as the company has a high Debt to EBITDA ratio of 5.25 times

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 5.25 times

- The company has been able to generate a Return on Equity (avg) of 4.15% signifying low profitability per unit of shareholders funds

Healthy long term growth as Operating profit has grown by an annual rate 49.24%

With ROCE of 9.8, it has a Attractive valuation with a 1.3 Enterprise value to Capital Employed

Majority shareholders : Promoters

Market Beating performance in long term as well as near term

Stock DNA

Non - Ferrous Metals

INR 243 Cr (Micro Cap)

38.00

21

0.18%

1.61

4.67%

1.89

Total Returns (Price + Dividend)

Latest dividend: 0.07 per share ex-dividend date: Sep-08-2025

Risk Adjusted Returns v/s

Returns Beta

News

Manaksia Aluminium Company Ltd is Rated Hold

Manaksia Aluminium Company Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 06 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 03 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

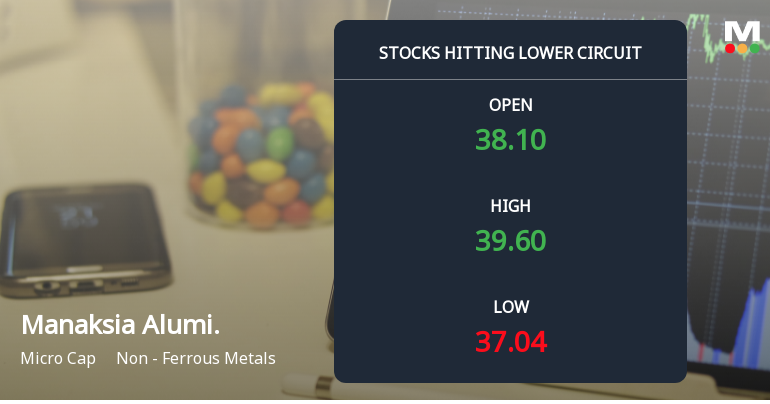

Manaksia Aluminium Company Ltd Hits Lower Circuit Amid Heavy Selling Pressure

Manaksia Aluminium Company Ltd (BE series) plunged to its lower circuit limit on 3 Feb 2026, closing at ₹36.94, down 4.99% on the day. The stock has been under intense selling pressure, marking its 11th consecutive day of decline and accumulating a steep loss of 43.06% over this period. This sharp fall comes amid rising investor participation but persistent panic selling, signalling deep concerns among market participants about the company’s near-term prospects.

Read full news article

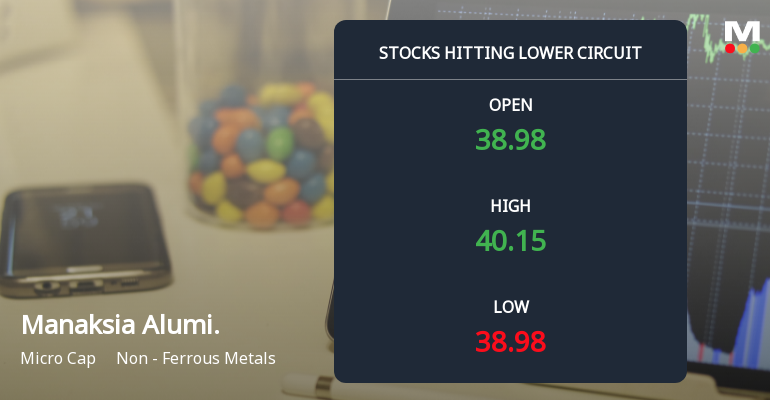

Manaksia Aluminium Company Ltd Plunges to Lower Circuit Amid Heavy Selling Pressure

Manaksia Aluminium Company Ltd (BE series) witnessed a sharp decline on 2 Feb 2026, hitting its lower circuit limit of 5%, closing at ₹38.88. The stock faced intense selling pressure, marking its tenth consecutive day of losses and underperforming its sector by nearly 7%. This sustained downtrend has raised concerns among investors about the company’s near-term prospects amid a challenging market environment.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

13-Jan-2026 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulation 2018 for the Quarter ended 31.12.2025.

Authorization Of Key Managerial Personnel For The Purpose Of Determining Materiality Of An Event Or Information Under Regulation 30(5) Of SEBI LODR 2015

09-Jan-2026 | Source : BSEAuthorization of KMP For the Purpose of determining materiality of an event or information

Appointment of Company Secretary and Compliance Officer

09-Jan-2026 | Source : BSEAppointment of Company secretary and Compliance officer of the Company

Corporate Actions

No Upcoming Board Meetings

Manaksia Aluminium Company Ltd has declared 7% dividend, ex-date: 08 Sep 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Sunil Kumar Agrawal (37.15%)

Monet Securities Private Ltd (3.37%)

14.7%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -2.38% vs -1.94% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -28.85% vs -22.00% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 14.33% vs 21.56% in Sep 2024

Growth in half year ended Sep 2025 is 11.25% vs 5.26% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 26.30% vs -15.58% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 15.38% vs -35.00% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 17.73% vs -10.46% in Mar 2024

YoY Growth in year ended Mar 2025 is 18.86% vs -42.62% in Mar 2024