Compare Mercury EV-Tech with Similar Stocks

Dashboard

With ROE of 3.1, it has a Very Expensive valuation with a 2.6 Price to Book Value

- The stock is trading at a discount compared to its peers' average historical valuations

- Over the past year, while the stock has generated a return of -52.38%, its profits have risen by 209.5% ; the PEG ratio of the company is 0.4

Underperformed the market in the last 1 year

Total Returns (Price + Dividend)

Mercury EV-Tech for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Mercury EV-Tech Ltd is Rated Sell

Mercury EV-Tech Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 20 May 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 24 January 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article

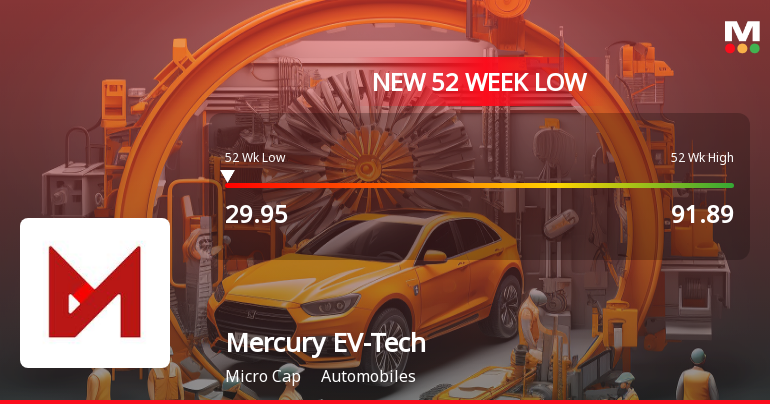

Mercury EV-Tech Ltd Falls to 52-Week Low Amid Market Downturn

Mercury EV-Tech Ltd’s stock price declined to a fresh 52-week low of Rs.29.95 today, marking a significant downturn for the automobile sector company. The stock has underperformed both its sector and the broader market, reflecting ongoing pressures and valuation concerns.

Read full news article

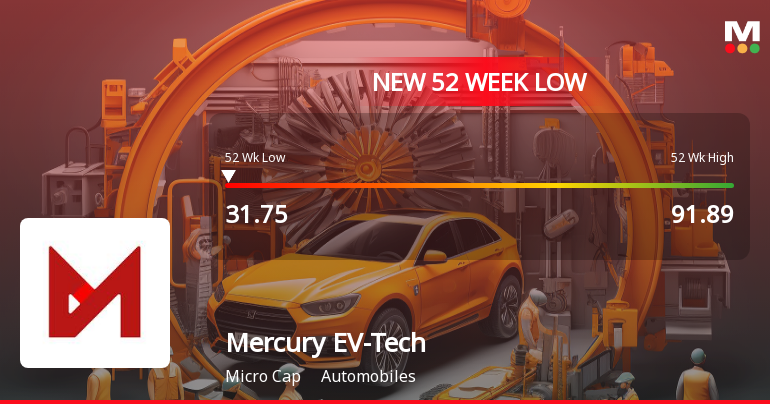

Mercury EV-Tech Ltd Stock Falls to 52-Week Low of Rs.31.75

Mercury EV-Tech Ltd’s shares declined to a fresh 52-week low of Rs.31.75 on 20 Jan 2026, marking a significant milestone in the stock’s recent performance. This new low reflects ongoing pressures on the stock amid broader market weakness and company-specific valuation concerns.

Read full news article Announcements

Clarification Sought On Significant Price Movement

29-Jan-2026 | Source : BSEClarification on Price Movement

Clarification sought from Mercury Ev-Tech Ltd

28-Jan-2026 | Source : BSEThe Exchange has sought clarification from Mercury Ev-Tech Ltd on January 28 2026 with reference to significant movement in price in order to ensure that investors have latest relevant information about the company and to inform the market so that the interest of the investors is safeguarded.

The reply is awaited.

Corrigendum Notice

21-Jan-2026 | Source : BSEIntimation of Corrigendum Notice to Postal Ballot Notice.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

Mercury EV-Tech Ltd has announced 23:1 rights issue, ex-date: 04 Aug 22

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 8 FIIs (2.68%)

Shree Saibaba Exim Private Limited (22.63%)

Forbes Emf (1.58%)

29.87%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 50.69% vs -26.43% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 35.43% vs -18.06% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 142.27% vs 96.71% in Sep 2024

Growth in half year ended Sep 2025 is 43.75% vs 55.22% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 258.36% vs 80.57% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 240.11% vs 70.00% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 307.08% vs 36.77% in Mar 2024

YoY Growth in year ended Mar 2025 is 275.88% vs 43.17% in Mar 2024