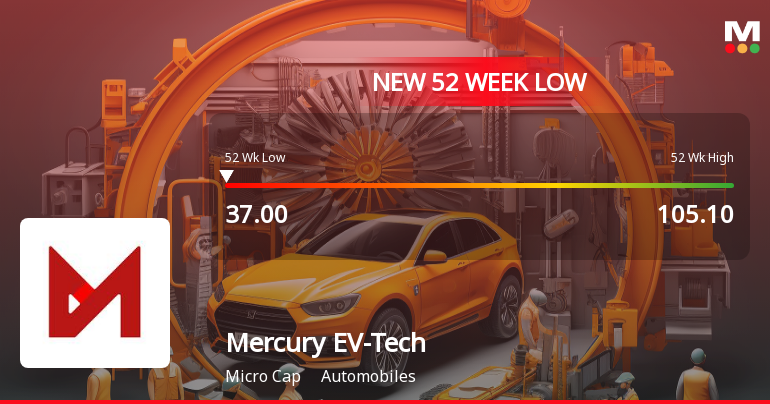

Intraday Performance and Volatility

Mercury EV-Tech’s stock demonstrated considerable intraday volatility, with a price range spanning ₹6.9 and an intraday volatility of 8.49%. The stock reached an intraday high of ₹44.1, marking a 19.22% increase from previous levels. Despite this strong upward movement, the weighted average price indicates that a larger volume of shares traded closer to the lower end of the day’s price spectrum. This suggests that while there was enthusiasm pushing prices higher, some selling pressure persisted near the lows.

Comparison with Benchmarks and Sector

The stock outperformed its sector by 12.44% on the day, a remarkable feat given the broader market context. Over the past week, Mercury EV-Tech has gained 7.05%, cont...

Read More