Compare Noida Tollbridg. with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of 28.80% and Operating profit at 6.41% over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -36.48

Risky - Negative Book Value

Below par performance in long term as well as near term

Stock DNA

Transport Infrastructure

INR 73 Cr (Micro Cap)

3.00

35

0.00%

-0.07

-23.26%

-2.27

Total Returns (Price + Dividend)

Latest dividend: 1.5000 per share ex-dividend date: Sep-21-2016

Risk Adjusted Returns v/s

Returns Beta

News

Are Noida Toll Bridge Company Ltd latest results good or bad?

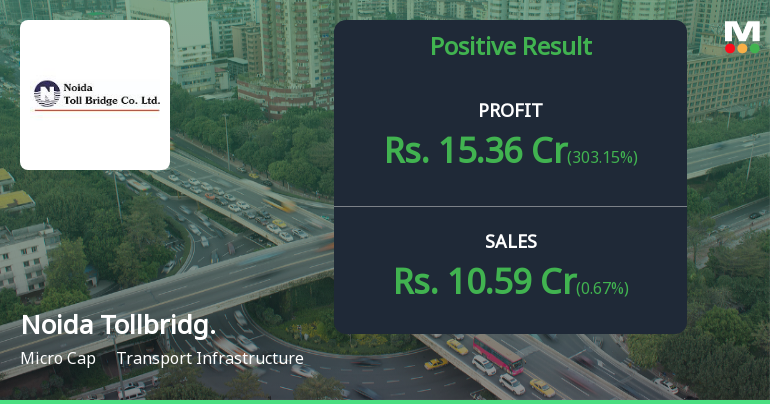

The latest financial results for Noida Toll Bridge Company Ltd for the quarter ended December 2025 reveal a complex operational landscape. The company reported a net profit of ₹15.36 crores, which reflects a significant increase compared to the previous quarter. However, this surge is largely attributed to an extraordinary rise in other income, which constituted 81.71% of profit before tax, raising concerns about the sustainability of these earnings. In terms of revenue, Noida Toll Bridge achieved net sales of ₹10.59 crores, marking a modest growth of 0.67% quarter-on-quarter and 6.86% year-on-year. This indicates limited growth potential, primarily driven by its single-asset toll bridge operation. The operating profit, excluding other income, improved to ₹3.03 crores, with an operating margin of 28.61%, suggesting some enhancement in operational efficiency. Despite these figures, the company's financial ...

Read full news article

Noida Toll Bridge Q3 FY26: Exceptional Profit Surge Masks Underlying Operational Weakness

Noida Toll Bridge Company Ltd. reported a staggering 303.15% quarter-on-quarter surge in consolidated net profit to ₹15.36 crores for Q3 FY26, compared to ₹3.81 crores in Q2 FY26. However, this seemingly impressive performance is almost entirely driven by a massive spike in other income (₹12.69 crores), which constituted 81.71% of profit before tax—raising serious concerns about earnings quality and operational sustainability. The stock declined 4.88% to ₹3.70 following the results announcement, as investors looked beyond the headline numbers to the troubling fundamentals beneath.

Read full news article

Noida Toll Bridge Company Ltd is Rated Strong Sell

Noida Toll Bridge Company Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 02 Jan 2026. However, the analysis and financial metrics presented here reflect the stock's current position as of 30 January 2026, providing investors with an up-to-date view of its fundamentals, valuation, financial trends, and technical outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

01-Feb-2026 | Source : BSEPlease find enclosed newspaper publication on financial results for the quarter/ nine months ended December 31 2025

Announcement under Regulation 30 (LODR)-Press Release / Media Release

30-Jan-2026 | Source : BSEPlease find attached Media Release on Financial Results

Financial Results For The Quarter / Nine Months Ended December 31 2025

30-Jan-2026 | Source : BSEPlease find enclosed un-audited financial results for the quarter / nine months ended December 31 2025

Corporate Actions

No Upcoming Board Meetings

Noida Toll Bridge Company Ltd has declared 15% dividend, ex-date: 21 Sep 16

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Il&fs Transportation Networks Limited (26.37%)

New Okhla Industrial Deveopment Authority (5.37%)

54.5%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 0.67% vs 0.00% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 303.15% vs -8.19% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 5.78% vs 193.36% in Sep 2024

Growth in half year ended Sep 2025 is 171.20% vs 38.10% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 6.14% vs 174.15% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 109.39% vs -843.11% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 93.09% vs -12.14% in Mar 2024

YoY Growth in year ended Mar 2025 is -669.74% vs 9.86% in Mar 2024