Compare Britannia Inds. with Similar Stocks

Dashboard

High Management Efficiency with a high ROCE of 57.15%

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 0.67 times

Poor long term growth as Net Sales has grown by an annual rate of 7.82% and Operating profit at 7.04% over the last 5 years

Flat results in Sep 25

With ROCE of 60.5, it has a Expensive valuation with a 28.5 Enterprise value to Capital Employed

High Institutional Holdings at 34.48%

Total Returns (Price + Dividend)

Latest dividend: 75 per share ex-dividend date: Aug-04-2025

Risk Adjusted Returns v/s

Returns Beta

News

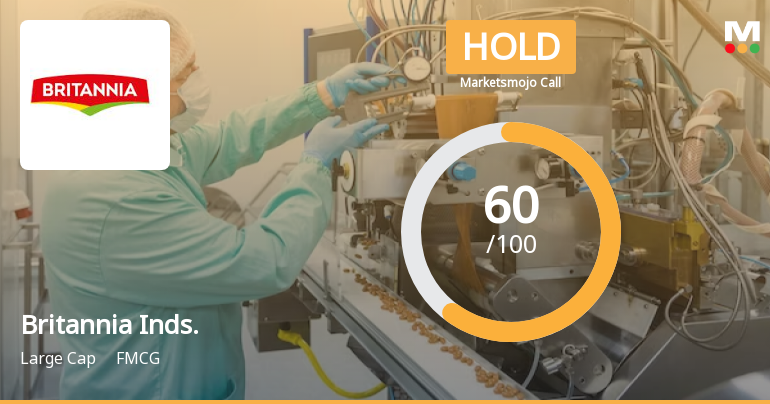

Britannia Industries Ltd is Rated Hold

Britannia Industries Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 28 April 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 31 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

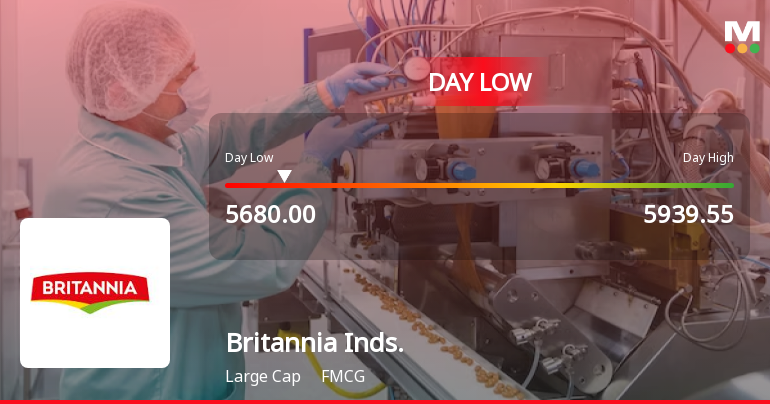

Britannia Industries Ltd Hits Intraday Low Amid Price Pressure

Britannia Industries Ltd experienced a notable decline today, touching an intraday low of Rs 5,680, reflecting a 3.45% drop as the stock faced significant price pressure amid broader market dynamics and sector underperformance.

Read full news article

Britannia Industries Ltd is Rated Hold

Britannia Industries Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 28 April 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 20 January 2026, providing investors with an up-to-date perspective on the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Change in Management

30-Jan-2026 | Source : BSEPursuant to Regulation 30 read with Clause 7 of Para A of Part A of Schedule III of the SEBI Listing Regulations 2015 this is to inform you that Mr. Annu Gupta Chief Business Officer - International Business has submitted his resignation to pursue an opportunity outside Britannia.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

12-Jan-2026 | Source : BSECertificate under Regulation 74 (5) of the SEBI (Depositories and Participants) Regulations 2018.

Intimation Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015

01-Jan-2026 | Source : BSEPursuant to Regulation 30 read with Clause 20 of Para A of Part A of Schedule III of the SEBI Listing Regulations 2015 this is to inform you that the Company has received an Order from the Office of the Principal Commissioner of CGST & Central Excise Chennai North Commissionerate.

Corporate Actions

No Upcoming Board Meetings

Britannia Industries Ltd has declared 7500% dividend, ex-date: 04 Aug 25

Britannia Industries Ltd has announced 1:2 stock split, ex-date: 29 Nov 18

Britannia Industries Ltd has announced 1:1 bonus issue, ex-date: 25 May 21

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 41 Schemes (10.59%)

Held by 852 FIIs (14.88%)

Associated Biscuits International Limited (44.76%)

Life Insurance Corporation Of India (3.11%)

12.26%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 4.73% vs 4.29% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 25.69% vs -7.01% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 6.11% vs 5.62% in Sep 2024

Growth in half year ended Sep 2025 is 13.32% vs -0.77% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 6.38% vs 3.44% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 1.08% vs -9.16% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 7.00% vs 2.88% in Mar 2024

YoY Growth in year ended Mar 2025 is 1.82% vs -7.84% in Mar 2024